Duke Energy 2012 Annual Report Download - page 227

Download and view the complete annual report

Please find page 227 of the 2012 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

207

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. • CAROLINA POWER & LIGHT COMPANY d/b/a PROGRESS

ENERGY CAROLINAS, INC. • FLORIDA POWER CORPORATION d/b/a PROGRESS ENERY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

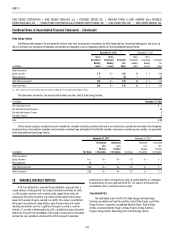

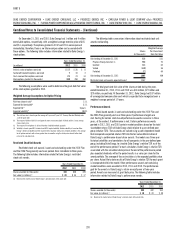

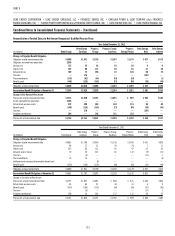

The following table shows preferred stock outstanding at December 31, 2012 and 2011.

(in millions, except share and per share data)

Shares

Authorized

Shares

Outstanding

Redemption

Price Total

Progress Energy Carolinas

Cumulative, no par value $5 Preferred Stock 300,000 236,997 $110.00 $ 24

Cumulative, no par value Serial Preferred Stock 20,000,000

$4.20 Serial Preferred 100,000 102.00 10

$5.44 Serial Preferred 249,850 101.00 25

Cumulative, no par value Preferred Stock A 5,000,000 — — —

No par value Preference Stock 10,000,000 — — —

Total Progress Energy Carolinas 59

Progress Energy Florida

Cumulative, $100 par value Preferred Stock 4,000,000

4.00% Preferred 39,980 104.25 4

4.40% Preferred 75,000 102.00 8

4.58% Preferred 99,990 101.00 10

4.60% Preferred 39,997 103.25 4

4.75% Preferred 80,000 102.00 8

Cumulative, no par value Preferred Stock 5,000,000 — — —

$100 par value Preference Stock 1,000,000 — — —

Total Progress Energy Florida 34

Total preferred stock of subsidiaries $93

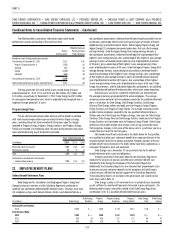

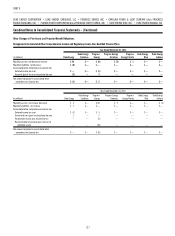

21. SEVERANCE

2011 Severance Plan.

In conjunction with the merger with Progress Energy, in November 2011

Duke Energy and Progress Energy offered a voluntary severance plan to certain

eligible employees. As this was a voluntary severance plan, all severance

benefi ts offered under this plan are considered special termination benefi ts

under U.S. GAAP. Special termination benefi ts are measured upon employee

acceptance and recorded immediately absent any signifi cant retention period. If

a signifi cant retention period exists, the cost of the special termination benefi ts

are recorded ratably over the retention period. Approximately 1,100 employees

from Duke Energy and Progress Energy requested severance during the

voluntary window, which closed on November 30, 2011. The estimated amount

of severance payments associated with this voluntary plan and other severance

benefi ts through 2014, excluding amounts incurred through December 31, 2012,

are expected to range from $30 million to $60 million and most of the costs will

be charged to Duke Energy Carolinas, Progress Energy Carolinas and Progress

Energy Florida.

Additionally, in the third quarter of 2012, a voluntary severance plan was

offered to certain unionized employees of Duke Energy Ohio. Approximately

75 employees accepted the termination benefi ts during the voluntary window,

which closed on October 8, 2012. The expense associated with this plan was

not material.

In conjunction with the retirement of the Crystal River Nuclear Plant

Unit 3, severance benefi ts will be made available to certain eligible impacted

unionized and non-unionized employees, to the extent that those employees do

not fi nd job opportunities at other locations. Approximately 600 employees work

at Crystal River Nuclear Plant Unit 3. Duke Energy is currently determining which

employees will be impacted by the retirement and therefore offered severance

benefi ts. Future severance expense Duke Energy expects to incur at Progress

Energy Florida is currently not estimable as total number of employees impacted

and job classifi cations and functions have not yet been determined.

2010 Severance Plans.

During 2010, the majority of severance charges were related to a voluntary

severance plan whereby eligible employees were provided a window during

which to accept termination benefi ts. As this was a voluntary plan, all severance

benefi ts offered under this plan were also considered special termination

benefi ts under U.S. GAAP and accorded the same accounting treatment as

discussed above. Approximately 900 employees accepted the termination

benefi ts during the voluntary window, which closed March 31, 2010.

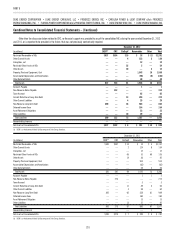

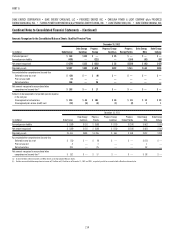

Amounts included in the table below represent direct and allocated

severance and related expense recorded by the Duke Energy Registrants, and

are recorded in Operation, maintenance, and other within Operating Expenses

on the Consolidated Statements of Operations. The Duke Energy Registrants

recorded insignifi cant amounts for severance expense during 2011 for past and

ongoing severance plans.

Years Ended December 31,

(in millions) 2012 2010

Duke Energy(a) $201 $172

Duke Energy Carolinas 63 99

Progress Energy(b) 82 —

Progress Energy Carolinas(b) 55 —

Progress Energy Florida(b) 27 —

Duke Energy Ohio 21 24

Duke Energy Indiana 18 33

(a) Includes $14 million of accelerated stock award expense and $19 million of COBRA and healthcare

reimbursement expenses for 2012.

(b) The Progress Energy Registrants amounts for severance expense during 2010 are not material.