Duke Energy 2012 Annual Report Download - page 166

Download and view the complete annual report

Please find page 166 of the 2012 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

146

PART II

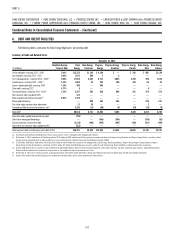

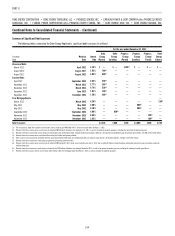

Combined Notes to Consolidated Financial Statements – (Continued)

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. • CAROLINA POWER & LIGHT COMPANY d/b/a PROGRESS ENERGY

CAROLINAS, INC. • FLORIDA POWER CORPORATION d/b/a PROGRESS ENERY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

regulations. The Duke Energy Registrants intend to seek regulatory recovery of

amounts incurred associated with regulated operations in complying with these

regulations. Refer to Note 4 for further information regarding potential plant

retirements and regulatory fi lings related to the Duke Energy Registrants.

Litigation

Duke Energy

Progress Energy Merger Shareholder Litigation.

On July 20, 2012, Duke Energy was served with a shareholder Derivative

Complaint fi led in the Delaware Chancery Court (Rupp v. Rogers, et al.). The

lawsuit names as defendants James E. Rogers and the ten other members of

the Duke Energy Board of Directors who were also members of the pre-merger

Duke Energy Board of Directors (Legacy Duke Directors). Duke Energy is named

as a nominal defendant. Raul v. Rogers, also fi led in Delaware Chancery

Court was consolidated with the Rupp case on September 24, 2012. Two

shareholders, each of whom previously made separate Section 220 demands to

inspect various Duke Energy books and records, fi led derivative cases against

James E. Rogers and the Legacy Duke Directors. The Gerber v Rogers, et al.

lawsuit was fi led on December 5, 2012, and the Reilly v. Rogers, et al. lawsuit

was fi led on January 8, 2013. Each of the lawsuits alleges claims for breach

of fi duciary duties of loyalty and care by the defendants in connection with the

post-merger change in CEO, as discussed in Note 4.

On August 3, 2012, Duke Energy was served with a shareholder

Derivative Complaint, which has been transferred to the North Carolina

Business Court (Krieger v. Johnson, et al.). The lawsuit names as defendants,

William D. Johnson, James E. Rogers and the Legacy Duke Directors. Duke

Energy is named as a nominal defendant. The lawsuit alleges claims for breach

of fi duciary duty in granting excessive compensation to Mr. Johnson. A hearing

on the defendants’ motion to dismiss was held on January 22, 2013. A decision

on the motion made by the defendants remains pending.

Duke Energy has been served with two shareholder Derivative Complaints,

fi led in federal district court in Delaware. The plaintiffs in Tansey v. Rogers,

et al., served on August 17, 2012, and Pinchuck v. Rogers, et al., served

on October 31, 2012, allege claims for breach of fi duciary duty and waste

of corporate assets, as well as claims under Section 14(a) and 20(a) of the

Exchange Act against the Legacy Duke Directors. Duke Energy is named as a

nominal defendant. On December 18, 2012, the defendants fi led a motion to

stay the case.

Duke Energy was also served in July 2012 with three purported securities

class action lawsuits. These three cases (Craig v. Duke Energy Corporation,

et al.; Nieman v. Duke Energy Corporation, et al.; and Sunner v. Duke Energy

Corporation, et al.), have been consolidated in the United States District

Court for the Western District of North Carolina. The plaintiff fi led a Corrected

Consolidated Complaint on January 28, 2013, alleging federal Securities Act

and Exchange Act claims based on allegedly materially false and misleading

representations and omissions made in the Registration Statement fi led on

July 7, 2011, and subsequently incorporated into other documents, all in

connection with the post merger change in CEO. The Corrected Consolidated

Complaint names as defendants the Legacy Duke Directors and certain offi cers

of the company. The claims are purportedly brought on behalf of a class of all

persons who purchased or otherwise acquired Duke Energy securities between

June 11, 2012 and July 9, 2012.

It is not possible to predict whether Duke Energy will incur any liability or

to estimate the damages, if any, that Duke Energy might incur in connection with

these lawsuits. Additional lawsuits may be fi led.

Alaskan Global Warming Lawsuit.

On February 26, 2008, plaintiffs, the governing bodies of an Inupiat

village in Alaska, fi led suit in the U.S. Federal Court for the Northern District of

California against Peabody Coal and various oil and power company defendants,

including Duke Energy and certain of its subsidiaries. Plaintiffs brought the

action on their own behalf and on behalf of the village’s 400 residents. The

lawsuit alleges that defendants’ emissions of CO2 contributed to global warming

and constitute a private and public nuisance. Plaintiffs also allege that certain

defendants, including Duke Energy, conspired to mislead the public with respect

to global warming. The plaintiffs in the case have requested damages in the

range of $95 million to $400 million related to the cost of relocating the Village

of Kivalina. On June 30, 2008, the defendants fi led a motion to dismiss on

jurisdictional grounds, together with a motion to dismiss the conspiracy claims.

On October 15, 2009, the District Court granted defendants’ motion to dismiss.

The plaintiffs fi led a notice of appeal and the U.S. Court of Appeals for the Ninth

Circuit held argument in the case on November 28, 2011. On September 21,

2012, the Court of Appeals ruled that the case could not proceed, affi rming

the District Court’s motion to dismiss. The Plaintiffs have fi led a motion for

rehearing en banc by the Court of Appeals, which was denied on November 27,

2012. A Petition for Certiorari to the U.S. Supreme Court, if fi led, was due on

February 25, 2013. Although Duke Energy believes the likelihood of loss is

remote based on current case law, it is not possible to predict the ultimate

outcome of this matter.

Price Reporting Cases.

A total of fi ve lawsuits were fi led against Duke Energy affi liates and other

energy companies and remain pending in a consolidated, single federal court

proceeding in Nevada.

In November 2009, the judge granted defendants’ motion for

reconsideration of the denial of defendants’ summary judgment motion in

two of the remaining fi ve cases to which Duke Energy affi liates are a party. A

hearing on that motion occurred on July 15, 2011, and on July 19, 2011, the

judge granted the motion for summary judgment. Plaintiffs have fi led a notice of

appeal to the U.S. Court of Appeals for the Ninth Circuit, which held argument on

October 19, 2012.

Each of these cases contains similar claims, that the respective plaintiffs,

and the classes they claim to represent, were harmed by the defendants’ alleged

manipulation of the natural gas markets by various means, including providing

false information to natural gas trade publications and entering into unlawful

arrangements and agreements in violation of the antitrust laws of the respective

states. Plaintiffs seek damages in unspecifi ed amounts. It is not possible to predict

whether Duke Energy will incur any liability or to estimate the damages, if any, that

Duke Energy might incur in connection with the remaining matters. However, based

on Duke Energy’s past experiences with similar cases of this nature, it does not

believe its exposure under these remaining matters is material.

Duke Energy International Paranapanema Lawsuit.

On July 16, 2008, Duke Energy International Geracao Paranapanema S.A.

(DEIGP) fi led a lawsuit in the Brazilian federal court challenging transmission