Duke Energy 2012 Annual Report Download - page 191

Download and view the complete annual report

Please find page 191 of the 2012 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

171

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. • CAROLINA POWER & LIGHT COMPANY d/b/a PROGRESS ENERGY

CAROLINAS, INC. • FLORIDA POWER CORPORATION d/b/a PROGRESS ENERY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC

.

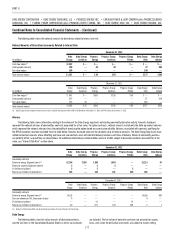

Combined Notes to Consolidated Financial Statements – (Continued)

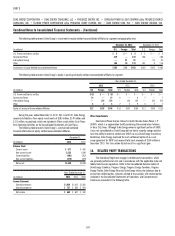

Balance Sheets related to derivative instruments executed with the same

counterparty under the same master netting agreement.

The operations of the USFE&G business segment meet the criteria for

regulatory accounting treatment. Accordingly, for derivatives designated as cash

fl ow hedges within USFE&G, gains and losses are refl ected as a regulatory liability

or asset instead of as a component of AOCI. For derivatives designated as fair

value hedges or left undesignated within USFE&G, gains and losses associated

with the change in fair value of these derivative contracts would be deferred as a

regulatory liability or asset, thus having no immediate earnings impact.

Within the Duke Energy Registrants’ unregulated businesses, for derivative

instruments that qualify for hedge accounting and are designated as cash fl ow

hedges, the effective portion of the gain or loss is reported as a component of

AOCI and reclassifi ed into earnings in the same period or periods during which

the hedged transaction affects earnings. Any gains or losses on the derivative

that represent either hedge ineffectiveness or hedge components excluded

from the assessment of effectiveness are recognized in current earnings. For

derivative instruments that qualify and are designated as a fair value hedge,

the gain or loss on the derivative as well as the offsetting loss or gain on the

hedged item are recognized in earnings in the current period. The Duke Energy

Registrants include the gain or loss on the derivative in the same line item as

the offsetting loss or gain on the hedged item in the Consolidated Statements

of Operations. Additionally, the Duke Energy Registrants enter into derivative

agreements that are economic hedges that either do not qualify for hedge

accounting or have not been designated as a hedge. The changes in fair value of

these undesignated derivative instruments are refl ected in current earnings.

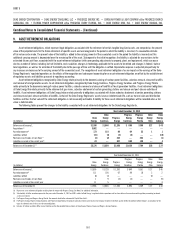

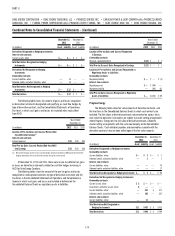

Commodity Price Risk

The Duke Energy Registrants are exposed to the impact of market changes

in the future prices of electricity (energy, capacity and fi nancial transmission

rights), coal, natural gas and emission allowances (SO2, seasonal NOX and

annual NOX) as a result of their energy operations such as electricity generation

and the transportation and sale of natural gas. With respect to commodity

price risks associated with electricity generation, the Duke Energy Registrants

are exposed to changes including, but not limited to, the cost of the coal and

natural gas used to generate electricity, the prices of electricity in wholesale

markets, the cost of capacity and electricity purchased for resale in wholesale

markets and the cost of emission allowances primarily at the Duke Energy

Registrants’ coal fi red power plants. Risks associated with commodity price

changes on future operations are closely monitored and, where appropriate,

various commodity contracts are used to mitigate the effect of such fl uctuations

on operations. Exposure to commodity price risk is infl uenced by a number of

factors, including, but not limited to, the term of the contract, the liquidity of the

market and delivery location.

Commodity Fair Value Hedges.

At December 31, 2012, there were no open commodity derivative

instruments that were designated as fair value hedges.

Commodity Cash Flow Hedges.

At December 31, 2012, there were immaterial open commodity derivative

instruments that were designated as cash fl ow hedges.

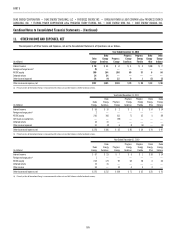

Undesignated Contracts.

The Duke Energy Registrants use derivative contracts as economic hedges to

manage the market risk exposures that arise from providing electricity generation

and capacity to large energy customers, energy aggregators, retail customers

and other wholesale companies. Undesignated contracts may include contracts

not designated as a hedge, contracts that do not qualify for hedge accounting,

derivatives that do not or no longer qualify for the NPNS scope exception, and

de-designated hedge contracts. These contracts expire as late as 2016.

Undesignated contracts also include contracts associated with operations

that Duke Energy continues to wind down or has included as discontinued

operations. As these undesignated contracts expire as late as 2021, Duke

Energy has entered into economic hedges that leave it minimally exposed to

changes in prices over the duration of these contracts.

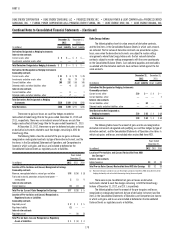

Duke Energy Carolinas and Progress Energy Carolinas use derivative

contracts as economic hedges to manage the market risk exposures that arise

from electricity generation. Duke Energy Carolinas and Progress Energy Carolinas

have also entered into fi rm power sale agreements, which are accounted for as

derivative instruments, as part of the Interim FERC Mitigation in connection with

Duke Energy’s merger with Progress Energy. See Note 2 for further information.

Duke Energy Carolinas’ undesignated contracts as of December 31, 2012, are

primarily associated with forward sales and purchases of power. Progress Energy

Carolinas’ undesignated contracts as of December 31, 2012, are primarily

associated with forward purchases of fuel used in electricity generation.

Progress Energy Florida uses derivative contracts as economic hedges

to manage the market risk exposures that arise from electricity generation.

Undesignated contracts at December 31, 2012, are primarily associated with

forward purchases of fuel used in electricity generation.

Duke Energy Ohio uses derivative contracts as economic hedges

to manage the market risk exposures that arise from providing electricity

generation and capacity to large energy customers, energy aggregators,

retail customers and other wholesale companies. Undesignated contracts at

December 31, 2012 are primarily associated with forward sales and purchases

of power, coal and gas for the Commercial Power segment.

Duke Energy Indiana uses derivative contracts as economic hedges

to manage the market risk exposures that arise from electricity generation.

Undesignated contracts at December 31, 2012, are primarily associated with

forward purchases and sales of power, fi nancial transmission rights and

emission allowances.

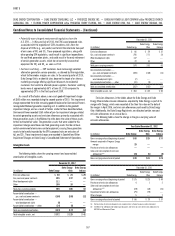

Interest Rate Risk

The Duke Energy Registrants are exposed to risk resulting from changes

in interest rates as a result of their issuance or anticipated issuance of variable

and fi xed-rate debt and commercial paper. Interest rate exposure is managed by

limiting variable-rate exposures to a percentage of total debt and by monitoring

the effects of market changes in interest rates. To manage risk associated

with changes in interest rates, the Duke Energy Registrants may enter into

fi nancial contracts; primarily interest rate swaps and U.S. Treasury lock

agreements. Additionally, in anticipation of certain fi xed-rate debt issuances,

a series of forward starting interest rate swaps may be executed to lock in

components of the market interest rates at the time and terminated prior to or

upon the issuance of the corresponding debt. When these transactions occur

within a business that meets the criteria for regulatory accounting treatment,

these contracts may be treated as undesignated and any pre-tax gain or loss

recognized from inception to termination of the hedges would be recorded as a

regulatory liability or asset and amortized as a component of interest expense

over the life of the debt. Alternatively, these derivatives may be designated

as hedges whereby, any pre-tax gain or loss recognized from inception to

termination of the hedges would be recorded in AOCI and amortized as a

component of interest expense over the life of the debt.