Duke Energy 2012 Annual Report Download - page 168

Download and view the complete annual report

Please find page 168 of the 2012 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

148

PART II

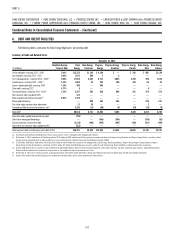

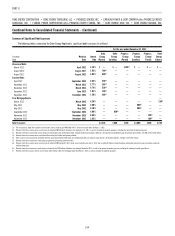

Combined Notes to Consolidated Financial Statements – (Continued)

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. • CAROLINA POWER & LIGHT COMPANY d/b/a PROGRESS ENERGY

CAROLINAS, INC. • FLORIDA POWER CORPORATION d/b/a PROGRESS ENERY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

and unspecifi ed civil penalties in amounts of up to $32,500 per day for each

violation. A number of Duke Energy Carolinas’ plants have been subject to these

allegations. Duke Energy Carolinas asserts that there were no CAA violations

because the applicable regulations do not require permitting in cases where the

projects undertaken are “routine” or otherwise do not result in a net increase

in emissions.

In 2000, the government brought a lawsuit against Duke Energy Carolinas

in the U.S. District Court in Greensboro, North Carolina. The EPA claims that

29 projects performed at 25 of Duke Energy Carolinas’ coal-fi red units violate

these NSR provisions. Three environmental groups have intervened in the case.

In August 2003, the trial court issued a summary judgment opinion adopting

Duke Energy Carolinas’ legal positions on the standard to be used for measuring

an increase in emissions, and granted judgment in favor of Duke Energy

Carolinas. The trial court’s decision was appealed and ultimately reversed and

remanded for trial by the U.S. Supreme Court. At trial, Duke Energy Carolinas

will continue to assert that the projects were routine or not projected to increase

emissions. On February 11, 2011, the trial judge held an initial status conference

and on March 22, 2011, the judge entered an interim scheduling order. The

parties have fi led a stipulation in which the United States and Plaintiff-

Intervenors have dismissed with prejudice 16 claims. In exchange, Duke Energy

Carolinas dismissed certain affi rmative defenses. The parties have fi led motions

for summary judgment on the remaining claims. No trial date has been set, but a

trial is not expected until the second half of 2013, at the earliest.

It is not possible to estimate the damages, if any, that might be incurred

in connection with the unresolved matters related to Duke Energy Carolinas

discussed above. Ultimate resolution of these matters could have a material

effect on the consolidated results of operations, cash fl ows or fi nancial position

of Duke Energy Carolinas. However, the appropriate regulatory treatment will be

pursued for any costs incurred in connection with such resolution.

Asbestos-related Injuries and Damages Claims.

Duke Energy Carolinas has experienced numerous claims for

indemnifi cation and medical cost reimbursement relating to damages for

bodily injuries alleged to have arisen from the exposure to or use of asbestos

in connection with construction and maintenance activities conducted on its

electric generation plants prior to 1985. As of December 31, 2012, there were

111 asserted claims for non-malignant cases with the cumulative relief sought

of up to $27 million, and 49 asserted claims for malignant cases with the

cumulative relief sought of up to $17 million. Based on Duke Energy Carolinas’

experience, it is expected that the ultimate resolution of most of these claims

likely will be less than the amount claimed.

Amounts recognized as asbestos-related reserves related to Duke Energy

Carolinas in the Consolidated Balance Sheets totaled $751 million and $801 million

as of Decembe r 31, 2012 and December 31, 2011, respectively, and are

classifi ed in Other within Deferred Credits and Other Liabilities and Other within

Current Liabilities. These reserves are based upon the minimum amount in

Duke Energy Carolinas’ best estimate of the range of loss for current and future

asbestos claims through 2030. Management believes that it is possible there

will be additional claims fi led against Duke Energy Carolinas after 2030. In light

of the uncertainties inherent in a longer-term forecast, management does not

believe that they can reasonably estimate the indemnity and medical costs that

might be incurred after 2030 related to such potential claims. Asbestos-related

loss estimates incorporate anticipated infl ation, if applicable, and are recorded

on an undiscounted basis. These reserves are based upon current estimates

and are subject to greater uncertainty as the projection period lengthens.

A signifi cant upward or downward trend in the number of claims fi led, the

nature of the alleged injury, and the average cost of resolving each such claim

could change our estimated liability, as could any substantial or favorable

verdict at trial. A federal legislative solution, further state tort reform or structured

settlement transactions could also change the estimated liability. Given the

uncertainties associated with projecting matters into the future and numerous other

factors outside our control, management believes that it is possible Duke Energy

Carolinas may incur asbestos liabilities in excess of the recorded reserves.

Duke Energy Carolinas has a third-party insurance policy to cover certain

losses related to asbestos-related injuries and damages above an aggregate

self insured retention of $476 million. Duke Energy Carolinas’ cumulative

payments began to exceed the self insurance retention on its insurance policy

in 2008. Future payments up to the policy limit will be reimbursed by Duke

Energy Carolinas’ third -party insurance carrier. The insurance policy limit for

potential future insurance recoveries for indemnifi cation and medical cost claim

payments is $935 million in excess of t he self insured retention. Insurance

recoveries of $781 million and $813 million related to this policy are classifi ed

in the respective Consolidated Balance Sheets in Other within Investments and

Other Assets and Receivables as of both December 31, 2012 and December 31,

2011, respectively. Duke Energy Carolinas is not aware of any uncertainties

regarding the legal suffi ciency of insurance claims. Management believes

the insurance recovery asset is probable of recovery as the insurance carrier

continues to have a strong fi nancial strength rating.

Progress Energy

Synthetic Fuels Matters. In October 2009, a jury delivered a verdict in a

lawsuit against Progress Energy and a number of its subsidiaries and affi liates

arising out of an Asset Purchase Agreement dated as of October 19, 1999, and

amended as of August 23, 2000 (the Asset Purchase Agreement) by and among

U.S. Global, LLC (Global); Earthco synthetic fuels facilities (Earthco); certain

affi liates of Earthco; EFC Synfuel LLC (which was owned indirectly by Progress

Energy) and certain of its affi liates, including Solid Energy LLC; Solid Fuel LLC;

Ceredo Synfuel LLC; Gulf Coast Synfuel LLC (renamed Sandy River Synfuel LLC)

(collectively, the Progress Affi liates), as amended by an amendment to the Asset

Purchase Agreement. In a case fi led in the Circuit Court for Broward County,

Florida. in March 2003 (the Florida Global Case), Global requested an unspecifi ed

amount of compensatory damages, as well as declaratory relief. Global asserted

(i) that pursuant to the Asset Purchase Agreement, it was entitled to an interest

in two synthetic fuels facilities previously owned by the Progress Affi liates and

an option to purchase additional interests in the two synthetic fuels facilities and

(ii) that it was entitled to damages because the Progress Affi liates prohibited

it from procuring purchasers for the synthetic fuels facilities. As a result of the

2007 expiration of the Internal Revenue Code Section 29 tax credit program, all of

Progress Energy’s synthetic fuels businesses were abandoned and the synthetic

fuels businesses were reclassifi ed as discontinued operations.

The jury awarded Global $78 million. In November 2009, the court

assessed $ 55 million in prejudgment interest and entered judgment in favor of

Global in a total amount of $133 million. In December 2009, Progress Energy

appealed the Broward County judgment to the Florida Fourth District Court

of Appeals. Also, in December 2009, Progress Energy made a $ 154 million

payment, which represented payment of the total judgment and a required

premium equivalent to two years of interest, to the Broward County Clerk of

Court bond account. Progress Energy continued to accrue interest related to

this judgment.

On October 3, 2012, the Florida Fourth District Court of Appeals reversed

the lower court ruling and directed a verdict on damages under the Commission

and Services Agreement, which was modifi ed by the court’s December 12,

2012 ruling on Global’s motion for reconsideration. The court held that Global

was entitled to 59 percent of its claim, or approximately $ 90 million of the