Duke Energy 2012 Annual Report Download - page 251

Download and view the complete annual report

Please find page 251 of the 2012 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

231

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. • CAROLINA POWER & LIGHT COMPANY d/b/a PROGRESS

ENERGY CAROLINAS, INC. • FLORIDA POWER CORPORATION d/b/a PROGRESS ENERY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

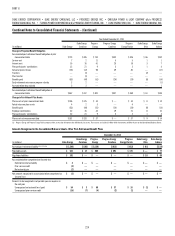

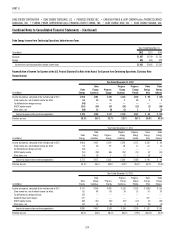

The following table provides a reconciliation of beginning and ending

balances of Master Trust assets measured at fair value on a recurring basis

where the determination of fair value includes signifi cant unobservable inputs

(Level 3).

(in millions) 2012 2011

Duke Energy Master Trust

Balance at January 1 $ 322 $ 185

Purchases, sales, issuances and settlements

Purchases 21 156

Sales (4) (29)

Total gains (losses) and other 13 10

Balance at December 31 $ 352 $ 322

The following table provides a reconciliation of beginning and ending

balances of Progress Trust assets measured at fair value on a recurring basis

where the determination of fair value includes signifi cant unobservable inputs

(Level 3).

(in millions) 2012 2011

Progress Energy Master Trust

Balance at January 1 $311 $160

Purchases, sales, issuances and settlements

Purchases 13 107

Sales (14) (13)

Transfers in and/or out of level 3 (41) —

Total gains (losses) and other 19 57

Balance at December 31 $288 $311

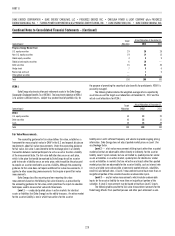

Valuation methods of the primary fair value measurements disclosed

above are as follows:

Investments in equity securities.

Investments in equity securities are typically valued at the closing price in

the principal active market as of the last business day of the quarter. Principal

active markets for equity prices include published exchanges such as NASDAQ

and NYSE. Foreign equity prices are translated from their trading currency using

the currency exchange rate in effect at the close of the principal active market.

Duke Energy has not adjusted prices to refl ect for after-hours market activity.

Most equity security valuations are Level 1 measures. Investments in equity

securities with unpublished prices are valued as Level 2 if they are redeemable

at the measurement date. Investments in equity securities with redemption

restrictions are valued as Level 3.

Investments in corporate bonds and U.S. government securities.

Most debt investments are valued based on a calculation using interest

rate curves and credit spreads applied to the terms of the debt instrument

(maturity and coupon interest rate) and consider the counterparty credit rating.

Most debt valuations are Level 2 measures. If the market for a particular fi xed

income security is relatively inactive or illiquid, the measurement is a Level 3

measurement.

Investments in short-term investment funds.

Investments in short-term investment funds are valued at the net

asset value of units held at year end. Investments in short-term investment

funds with published prices are valued as Level 1. Investments in short-term

investment funds with unpublished prices are valued as Level 2.

Investments in real estate investment trusts.

Investments in real estate investment trusts are valued based upon

property appraisal reports prepared by independent real estate appraisers. The

Chief Real Estate Appraiser of the asset manager is responsible for assuring

that the valuation process provides independent and reasonable property

market value estimates. An external appraisal management fi rm not affi liated

with the asset manager has been appointed to assist the Chief Real Estate

Appraiser in maintaining and monitoring the independence and the accuracy of

the appraisal process.

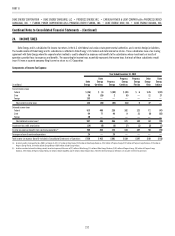

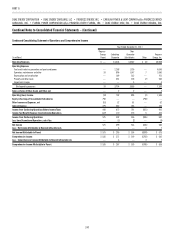

Employee Savings Plans

Duke Energy and Progress Energy sponsor, and the Subsidiary Registrants

participate in, employee savings plans that cover substantially all U.S.

employees. Most employees participate in a matching contribution formula

where Duke Energy provides a matching contribution generally equal to 100%

of employee before-tax and Roth 401(k) contributions, and, as applicable,

after-tax contributions, of up to 6% of eligible pay per pay period. Dividends on

Duke Energy shares held by the savings plans are charged to retained earnings

when declared and shares held in the plans are considered outstanding in the

calculation of basic and diluted earnings per share.

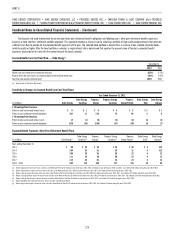

The following table includes pre-tax employer matching contributions

made by Duke Energy and expensed by the Subsidiary Registrants.

(in millions) Duke Energy

Duke Energy

Carolinas

Progress

Energy

Progress Energy

Carolinas

Progress

Energy Florida

Duke Energy

Ohio

Duke Energy

Indiana

For the years ended December 31,

2012 $107 $37 $45 $24 $15 $4 $ 6

2011 86 37 44 23 14 4 8

2010 85 36 43 23 14 4 6