Duke Energy 2012 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2012 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART I

7

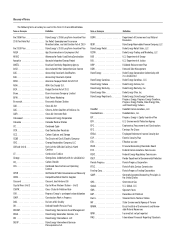

Energy Capacity and Resources

USFE&G owns over 50,000 megawatts of generation capacity. For

additional information on USFE&G’s generation facilities, see “U.S. Franchised

Electric and Gas” in Item 2.“Properties.”

Energy and capacity are also supplied through contracts with other

generators and purchased on the open market. Factors that could cause

USFE&G to purchase power for its customers include generating plant outages,

extreme weather conditions, generation reliability during the summer, growth,

and price. USFE&G has interconnections and arrangements with its neighboring

utilities to facilitate planning, emergency assistance, sale and purchase of

capacity and energy, and reliability of power supply.

USFE&G’s generation portfolio is a balanced mix of energy resources

having different operating characteristics and fuel sources designed to provide

energy at the lowest possible cost to meet its obligation to serve native-load

customers. All options, including owned generation resources and purchased

power opportunities, are continually evaluated on a real-time basis to select and

dispatch the lowest-cost resources available to meet system load requirements.

The vast majority of Duke Energy Carolinas, Progress Energy Carolinas,

and Duke Energy Indiana’s customer energy needs have historically been met

by large, low-energy-production-cost coal-fi red and nuclear generating units

that operated almost continuously (or at baseload levels). However, recent

commodity pricing trends have resulted in more combined cycle gas-fi red

generation. The vast majority of Progress Energy Florida’s customer energy

needs have historically been met by large, low-energy-production-cost nuclear,

fossil steam and combined cycle gas-fi red generation. However, due to the

extended outage of the Crystal River Nuclear Station Unit 3 (Crystal River Unit 3)

nuclear plant a portion of customer needs have been served with purchased

power for the past 3 years.

CT’s and CC’s are less expensive to build and maintain than either nuclear

or coal, and can be rapidly started or stopped as needed to meet changing

customer loads or operated as base load units depending on commodity prices.

Hydroelectric units produce low-cost energy, but their operations are limited by

the availability of water fl ow.

USFE&G’s pumped-storage hydroelectric facilities in the Carolinas offer

the added fl exibility of using low-cost off-peak energy to pump water that will

be stored for later generation use during times of higher-cost on-peak periods.

These facilities allow USFE&G to maximize the value spreads between different

high- and low-cost generation periods.

Recently Completed Generation Projects.

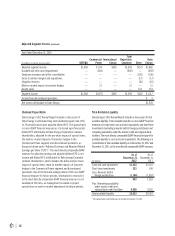

During 2012 and 2011, USFE&G completed construction of and placed

into service a total of 3,585 megawatts (MW) of new generation capacity

including Cliffside Unit 6 and the Buck, Dan River, Lee and Smith combined

cycle natural gas facilities. The total capital cost of this new generation capacity

was $4.8 billion.

Generation Projects Currently Under Construction.

The following information relates to generation projects currently under

construction by USFE&G.

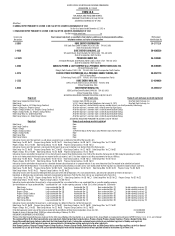

Edwardsport Integrated Gasifi cation Combined Cycle (IGCC) Plant.

Duke Energy Indiana has completed the construction and is conducting

testing of a 618 MW Integrated Gasifi cation Combined Cycle (IGCC) power plant

at its existing Edwardsport Generating Station in Knox County, Indiana.

On December 27, 2012, the IURC approved the settlement agreement

fi nalized in April 2012 between Duke Energy Indiana, the Offi ce of Utility

Consumer Counselor (OUCC), the Duke Energy Indiana Industrial Group

and Nucor Steel Indiana, on the cost increase for the construction of the

Edwardsport IGCC plant. The settlement agreement, as approved, caps costs to

be refl ected in customer rates at $2.595 billion, including estimated allowance

for funds used during construction (AFUDC) through June 30, 2012. Duke Energy

Indiana was allowed to recover AFUDC after June 30, 2012 until customer rates

are revised, with such recovery decreasing to 85% on AFUDC accrued after

November 30, 2012.

Duke Energy Indiana’s current cost estimate for the Edwardsport IGCC

plant is approximately $3.154 billion, excluding fi nancing costs. Through

December 31, 2012, Duke Energy Indiana has recorded total pre-tax impairment

and other charges of $897 million related to the Edwardsport IGCC plant. If cost

estimates for the plant increase, additional charges to expense, which could be

material, could occur. The Edwardsport IGCC plant is expected to be in service

by mid-2013. See Note 4 to the Consolidated Financial Statements, “Regulatory

Matters” for further information.

L.V. Sutton Combined Cycle Facility.

Progress Energy Carolinas is in the process of constructing an

approximately 625 MW natural gas-fi red generating facility at its existing

L.V. Sutton Steam Station (Sutton) in New Hanover County, North Carolina. The

Sutton project has an expected in-service date of December 2013. Based on

updated cost estimates, total costs (including AFUDC) for the Sutton project is

estimated to be approximately $600 million.

Potential New Construction.

The following information relates to major generation projects currently

being evaluated for construction by USFE&G.

Shearon Harris Nuclear Station Expansion.

In 2006, Progress Energy Carolinas selected a site at its existing

Shearon Harris Nuclear Station (Harris) to evaluate for possible future nuclear

expansion. On February 19, 2008, Progress Energy Carolinas fi led its combined

Construction and Operating License (COL) application with the Nuclear

Regulatory Commission (NRC) for two Westinghouse Electric Advanced Passive

(AP) 1000 reactors at Harris, which the NRC docketed on April 17, 2008. No

petitions to intervene have been admitted in the Harris COL application.

Levy Nuclear Station.

On July 30, 2008, Progress Energy Florida fi led its COL application with

the NRC for two Westinghouse AP1000 reactors at its proposed Levy Nuclear

Station (Levy), which the NRC docketed on October 6, 2008. Various parties

fi led a joint petition to intervene in the Levy COL application. On October 31,

2012 and November 1, 2012, the Atomic Safety and Licensing Board held

an evidentiary hearing on portions of the intervention petitions. A decision is

expected in March 2013. In 2008, the FPSC granted Progress Energy Florida’s

petition for an affi rmative Determination of Need and related orders requesting

cost recovery under Florida’s nuclear cost-recovery rule for Levy, together with

the associated facilities, including transmission lines and substation facilities.

On April 30, 2012, as part of its annual nuclear cost recovery fi ling,

Progress Energy Florida updated the Levy project schedule and cost. Due to

lower-than-projected customer demand, the lingering economic slowdown,

uncertainty regarding potential carbon regulation and current low natural gas

prices, Progress Energy Florida has shifted the in-service date for the fi rst

Levy unit to 2024, with the second unit following 18 months later. The revised

schedule is consistent with the recovery approach included in the 2012 FPSC

Settlement Agreement. Although the scope and overnight cost for Levy, including

land acquisition, related transmission work and other required investments,

remain essentially unchanged, the shift in schedule will increase escalation and

carrying costs and raise the total estimated project cost to between $19 billion

and $24 billion.

Along with the FPSC’s annual prudence reviews, Progress Energy Florida

will continue to evaluate the project on an ongoing basis based on certain

criteria, including, but not limited to, cost; potential carbon regulation; fossil

fuel prices; the benefi ts of fuel diversifi cation; public, regulatory and political