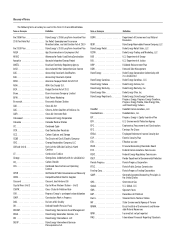

Duke Energy 2012 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2012 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART I

12

earns retail margin on the transmission and distribution of electricity only and not

on the cost of the underlying energy. New rates for Duke Energy Ohio went into

effect for SSO customers on January 1, 2012. The ESP also includes a provision

for a non-bypassable stability charge of $110 million per year to be collected from

January 1, 2012 through December 31, 2014.

On January 18, 2012, the PUCO denied a request for rehearing of its

decision on Duke Energy Ohio’s ESP fi led by Columbus Southern Power and Ohio

Power Company.

For more information on rate matters, see Note 4 to the Consolidated

Financial Statements, “Regulatory Matters — Rate Related Information.”

Federal

The FERC approves USFE&G’s cost-based rates for electric sales

to certain wholesale customers, as well as sales of transmission service.

Regulations of FERC and the state utility commissions govern access to

regulated electric and gas customers and other data by nonregulated entities

and services provided between regulated and nonregulated energy affi liates.

These regulations affect the activities of nonregulated affi liates with USFE&G.

Regional Transmission Organizations (RTO).

PJM Interconnection, LLC (PJM) and Midwest Independent Transmission

System Operator, Inc. (MISO) are the Independent System Operators (ISO)

and the FERC-approved RTOs for the regions in which Duke Energy Ohio and

Duke Energy Indiana operate. PJM is the transmission provider under, and the

administrator of, the PJM Open Access Transmission Tariff (PJM Tariff), operates

the PJM energy, capacity and other markets, and, through central dispatch,

controls the day-to-day operations of the bulk power system for the PJM region.

MISO is the transmission provider under, and the administrator of, the MISO

Open Access Transmission Tariff (MISO Tariff), operates the MISO energy,

capacity and other markets, and, through central dispatch, controls the

day-to-day operations of the bulk power system for the MISO region. Duke

Energy Ohio is a member of PJM and provides regional transmission service

pursuant to the PJM Tariff. Duke Energy Ohio and the other transmission owners

in PJM have turned over control of their transmission facilities to PJM, and their

transmission systems are currently under the dispatch control of PJM. Under the

PJM Tariff, transmission service is provided on a region-wide, open-access basis

using the transmission facilities of the PJM members at rates based on the costs

of transmission service. Duke Energy Indiana is a member of MISO and provides

regional transmission service pursuant to the MISO Tariff. Duke Energy Indiana

and the other transmission owners in MISO have turned over control of their

transmission facilities to MISO, and their transmission systems are currently

under the dispatch control of MISO. Under the MISO Tariff, transmission service

is provided on a region-wide, open-access basis using the transmission facilities

of the MISO members at rates based on the costs of transmission service.

Prior to January 1, 2012, Duke Energy Ohio was a member of MISO. See

Note 4 to the Consolidated Financial Statements, Regulatory Matters, for additional

information related to Duke Energy Ohio’s RTO realignment from MISO to PJM.

Other

Nuclear Matters.

The nuclear power industry faces uncertainties with respect to the cost

and long-term availability of disposal sites for spent nuclear fuel and other

radioactive waste, compliance with changing regulatory requirements, capital

outlays for modifi cations and new plant construction, the technological and

fi nancial aspects of decommissioning plants at the end of their licensed lives,

and requirements relating to nuclear insurance. Nuclear units are periodically

removed from service to accommodate normal refueling and maintenance

outages, repairs, uprates and certain other modifi cations.

USFE&G is subject to the jurisdiction of the NRC for the design,

construction and operation of its nuclear generating facilities. In 2000, the NRC

renewed the operating license for Duke Energy Carolinas’ three Oconee nuclear

units through 2033 for Units 1 and 2 and through 2034 for Unit 3. In 2003,

the NRC renewed the operating licenses for all units at Duke Energy Carolinas’

McGuire Nuclear Station (McGuire) and Catawba Nuclear Station (Catawba).

The two McGuire units are licensed through 2041 and 2043, respectively,

while the two Catawba units are licensed through 2043. The NRC has renewed

the operating licenses for all of Progress Energy Carolinas’ nuclear plants.

The renewed operating licenses for Brunswick Unit 1 and Unit 2, Harris and

Robinson expire in 2036, 2034, 2046 and 2030, respectively.

The NRC issues orders with regard to security at nuclear plants in

response to new or emerging threats. The most recent orders include additional

restrictions on nuclear plant access, increased security measures at nuclear

facilities and closer coordination with our partners in intelligence, military, law

enforcement and emergency response at the federal, state and local levels.

USFE&G is in compliance with the requirements outlined in the orders through

the use of additional security measures until permanent construction projects

are completed in 2013. As the NRC, other governmental entities and the

industry continue to consider security issues, it is possible that more extensive

security plans could be required.

Crystal River Unit 3.

In September 2009, Crystal River Unit 3 began an outage for normal

refueling and maintenance as well as an uprate project to increase its generating

capability and to replace two steam generators. During preparations to replace

the steam generators, workers discovered a delamination (or separation) within

the concrete at the periphery of the containment building, which resulted in

an extension of the outage. After analysis, it was determined that the concrete

delamination at Crystal River Unit 3 was caused by redistribution of stresses in the

containment wall that occurred when an opening was created to accommodate

the replacement of the unit’s steam generators. In March 2011, the work to return

the plant to service was suspended after monitoring equipment identifi ed a new

delamination that occurred in a different section of the outer wall after the repair

work was completed and during the late stages of retensioning the containment

building. Crystal River Unit 3 has remained out of service while Progress Energy

Florida conducted an engineering analysis and review of the new delamination and

evaluated possible repair options.

Subsequent to March 2011, monitoring equipment has detected additional

changes and further damage in the partially tensioned containment building and

additional cracking or delaminations could occur.

Progress Energy Florida developed a repair plan, which would entail

systematically removing and replacing concrete in substantial portions of

the containment structure walls, which had a preliminary cost estimate of

$900 million to $1.3 billion.

In March 2012, Duke Energy commissioned an independent review

team led by Zapata Incorporated (Zapata) to review and assess the Progress

Energy Florida Crystal River Unit 3 repair plan, including the repair scope,

risks, costs and schedule. In its fi nal report in late September, Zapata found

that the proposed repair scope appears to be technically feasible, but there

were signifi cant risks that need to be addressed regarding the approach,

construction methodology, scheduling and licensing. Zapata performed four

separate analyses of the estimated project cost and schedule to repair Crystal

River Unit 3, including; (i) an independent review of the proposed repair scope

(without existing assumptions or data), of which Zapata estimated costs of

$1.49 billion with a project duration of 35 months; (ii) a review of Progress

Energy Florida’s previous bid information, which included cost estimate data

from Progress Energy Florida, of which Zapata estimated costs of $1.55 billion

with a project duration of 31 months; (iii) an expanded scope of work scenario,

that included the Progress Energy Florida scope plus the replacement of the

containment building dome and the removal and replacement of concrete in

the lower building elevations, of which Zapata estimated costs of approximately

$2.44 billion with a project duration of 60 months, and; (iv) a “worst case”

scenario, assuming Progress Energy Florida performed the more limited scope

of work, and at the conclusion of that work, additional damage occurred in

the dome and in the lower elevations, which forced replacement of each,

of which Zapata estimated costs of $3.43 billion with a project duration