Duke Energy 2012 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2012 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

121

PART II

Combined Notes to Consolidated Financial Statements – (Continued)

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. • CAROLINA POWER & LIGHT COMPANY d/b/a PROGRESS ENERGY

CAROLINAS, INC. • FLORIDA POWER CORPORATION d/b/a PROGRESS ENERY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

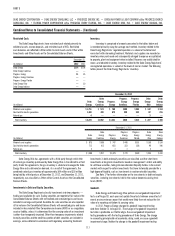

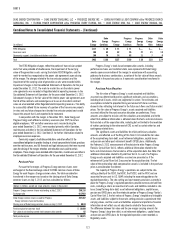

(in millions)

Duke

Energy

Duke

Energy

Carolinas

Progress

Energy

Progress

Energy

Carolinas

Progress

Energy

Florida

Duke

Energy

Ohio

Duke

Energy

Indiana

FERC Mitigation $117 $ 46 $ 71 $ 71 $— $— $—

Severance costs 196 63 82 55 27 21 18

Community support, charitable contributions and other 169 79 74 63 11 7 6

Total $482 $188 $227 $ 189 $ 38 $ 28 $ 24

The FERC Mitigation charges refl ect the portion of transmission project

costs that were probable of disallowance, the impairment of the carrying

value of the generation assets serving the Interim FERC Mitigation, and the

mark-to-market loss recognized on the power sale agreements upon closing

of the merger. The charges related to the transmission projects and the

impairment of the carrying value of generation assets were recorded within

Impairment charges in the Consolidated Statements of Operations for the year

ended December 31, 2012. The mark-to-market loss on the interim power

sale agreements was recorded in Regulated electric operating revenues in the

Consolidated Statements of Operations for the year ended December 31, 2012.

Subsequent changes in the fair value of the interim power sale agreements over

the life of the contracts and realized gains or losses on the interim contract

sales are also recorded within Regulated electric operating revenues. The ability

to successfully defend future recovery of a portion of the transmission projects

in rates and any future changes to estimated transmission project costs could

impact the amount that is not expected to be recovered.

In conjunction with the merger, in November 2011, Duke Energy and

Progress Energy each offered a voluntary severance plan (VSP) to certain

eligible employees. VSP and other severance costs incurred during the

year ended December 31, 2012, were recorded primarily within Operation,

maintenance and other in the Consolidated Statements of Operations for the

year ended December 31, 2012. See Note 21 for further information related to

employee severance expenses.

Community support, charitable contributions and other refl ect (i) the

unconditional obligation to provide funding at a level comparable to historic practices

over the next four years, and (ii) fi nancial and legal advisory costs that were incurred

upon the closing of the merger, retention and relocation costs paid to certain

employees. These charges were recorded within Operation, maintenance and other in

the Consolidated Statements of Operations for the year ended December 31, 2012.

Purchase Price

Pursuant to the merger, all Progress Energy common shares were

exchanged at the fi xed exchange ratio of 0.87083 common shares of Duke

Energy for each Progress Energy common share. The total consideration

transferred in the merger was based on the closing price of Duke Energy

common shares on July 2, 2012, and was calculated as follows:

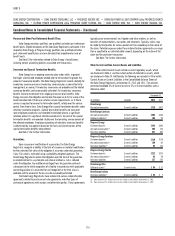

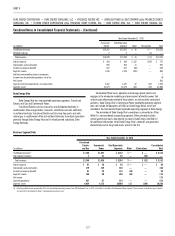

(dollars in millions, except per share amounts; shares in thousands)

Progress Energy common shares outstanding at July 2, 2012 296,116

Exchange ratio 0.87083

Duke Energy common shares issued for Progress

Energy common shares outstanding

257,867

Closing price of Duke Energy common shares on July 2, 2012 $ 69.84

Purchase price for common stock $ 18,009

Fair value of outstanding earned stock compensation awards 62

Total purchase price $ 18,071

Progress Energy’s stock-based compensation awards, including

performance shares and restricted stock, were replaced with Duke Energy

awards upon consummation of the merger. In accordance with accounting

guidance for business combinations, a portion of the fair value of these awards

is included in the purchase price as it represents consideration transferred in

the merger.

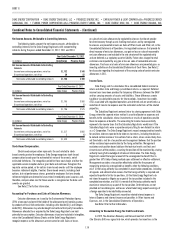

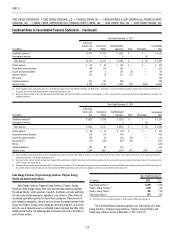

Purchase Price Allocation

The fair value of Progress Energy’s assets acquired and liabilities

assumed was determined based on signifi cant estimates and assumptions,

including level 3 inputs, which are judgmental in nature. The estimates and

assumptions include the projected timing and amount of future cash fl ows;

discount rates refl ecting risk inherent in the future cash fl ows and future market

prices. The fair value of Progress Energy’s assets acquired and liabilities

assumed utilized for the purchase price allocation are preliminary. These

amounts are subject to revision until the valuations are completed, and to the

extent that additional information is obtained about the facts and circumstances

that existed as of the acquisition date, including but not limited to the resolution

of matters pertaining to the retirement of CR3 as well as certain other tax and

contingency related items.

The signifi cant assets and liabilities for which preliminary valuation

amounts are refl ected as of the fi ling of this Form 10-K include the fair value

of the acquired long-term debt, asset retirement obligations, capital leases

and pension and other post-retirement benefi t (OPEB) plans. Additionally

the February 5, 2013 announcement of the decision to retire Progress Energy

Florida’s Crystal River Unit 3, refl ects additional information related to the

facts and circumstances that existed as of the acquisition date. See Note 4 for

additional information related to Crystal River Unit 3. As such, the Progress

Energy assets acquired and liabilities assumed are presented as if the

retirement of Crystal River Unit 3 occurred on the acquisition date. The fair

value of the outstanding stock compensation awards is included in the purchase

price as consideration transferred.

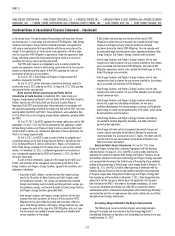

The majority of Progress Energy’s operations are subject to the rate-

setting authority of the FERC, the NCUC, the PSCSC, and the FPSC and are

accounted for pursuant to U.S. GAAP, including the accounting guidance for

regulated operations. The rate-setting and cost recovery provisions currently in

place for Progress Energy’s regulated operations provide revenues derived from

costs, including a return on investment of assets and liabilities included in rate

base. Except for long-term debt, asset retirement obligations, capital leases,

pension and OPEB plans and the wholesale portion of Progress Energy Florida’s

Crystal River Unit 3, the fair values of Progress Energy’s tangible and intangible

assets and liabilities subject to these rate-setting provisions approximate their

carrying values, and the assets and liabilities acquired and pro forma fi nancial

information do not refl ect any net adjustments related to these amounts.

The difference between fair value and the pre-merger carrying amounts for

Progress Energy’s long-term debt, asset retirement obligations, capital leases

and pension and OPEB plans for the regulated operations were recorded as

Regulatory assets.