Duke Energy 2012 Annual Report Download - page 170

Download and view the complete annual report

Please find page 170 of the 2012 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

150

PART II

Combined Notes to Consolidated Financial Statements – (Continued)

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. • CAROLINA POWER & LIGHT COMPANY d/b/a PROGRESS ENERGY

CAROLINAS, INC. • FLORIDA POWER CORPORATION d/b/a PROGRESS ENERY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

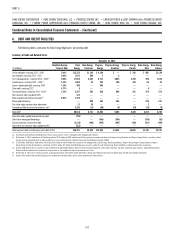

Years Ended December 31,

(in millions) 2012 2011

Reserves for Legal and Other Matters(a)

Duke Energy(b) $846 $ 810

Duke Energy Carolinas(b) 751 801

Progress Energy 79 83

Progress Energy Carolinas 12 11

Progress Energy Florida(c) 47 51

Duke Energy Indiana 8 4

Probable Insurance Recoveries(d)

Duke Energy(e) $781 $ 813

Duke Energy Carolinas(e) 781 813

(a) Reserves are classifi ed in the respective Consolidated Balance Sheets in Other within Deferred Credits

and Other Liabilities and Other within Current Liabilities.

(b) Includes reserves for aforementioned asbestos-related injuries and damages claims.

(c) Includes workers’ compensation claims.

(d) Insurance recoveries are classifi ed in the respective Consolidated Balance Sheets in Other within

Investments and Other Assets and Receivables.

(e) Relates to recoveries associated with aforementioned asbestos-related injuries and damages claims.

Other Commitments and Contingencies

General

As part of its normal business, the Duke Energy Registrants are a party

to various fi nancial guarantees, performance guarantees and other contractual

commitments to extend guarantees of credit and other assistance to various

subsidiaries, investees and other third parties. To varying degrees, these

guarantees involve elements of performance and credit risk, which are not

included on the respective Consolidated Balance Sheets. The possibility of any

of the Duke Energy Registrants having to honor their contingencies is largely

dependent upon future operations of various subsidiaries, investees and other

third parties, or the occurrence of certain future events.

In addition, the Duke Energy Registrants enter into various fi xed-price,

non-cancelable commitments to purchase or sell power (tolling arrangements

or power purchase contracts), take-or-pay arrangements, transportation or

throughput agreements and other contracts that may or may not be recognized

on their respective Consolidated Balance Sheets. Some of these arrangements

may be recognized at fair value on the respective Consolidated Balance Sheets

if such contracts meet the defi nition of a derivative and the NPNS exception

does not apply. In most cases, the Duke Energy Registrants purchase obligation

contracts contain provisions for price adjustments, minimum purchase levels

and other fi nancial commitments. The commitment amounts presented below

are estimates and therefore will likely differ from actual purchase amounts.

Purchase Obligations

The following table presents long-term commitments that are noncancelable or

are cancelable only under certain conditions, have a term of more than one year, and

that third parties have used to secure fi nancing for the facilities that will provide the

contracted goods or services as of December 31, 2012.

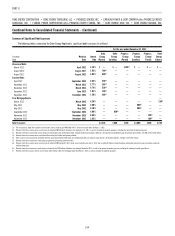

(in millions) 2013 2014 2015 2016 2017 Thereafter Total

Duke Energy(a) $68 $19 $5 $3 $ 2 $18 $115

Progress Energy(a) 68 19 5 3 2 18 115

Progress Energy Florida(a) 68 19 5 3 2 18 115

(a) Represents estimated amounts for Progress Energy Florida’s obligations primarily related to selected

components of long lead time equipment at Levy as discussed under “Other Purchase Obligations.”

Purchases under the above long-term purchase agreements were

$ 29 million, $6 million and $ 23 million in 2012, 2011 and 2010, respectively.

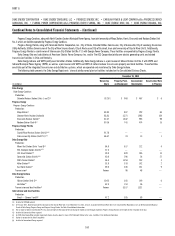

Purchased Power

The Duke Energy Registrants have ongoing purchased power contracts,

including renewable energy contracts, with other utilities, certain co-generators

and qualifi ed facilities (QFs), with expiration dates ranging from 2013 to 2032.

These purchased power contracts generally provide for capacity and energy

payments or bundled capacity and energy payments. In addition, the

Duke Energy Registrants have various contracts to secure transmission rights.

Certain purchased power agreements are classifi ed as leases.

Progress Energy Carolinas has executed certain fi rm contracts for purchased

power with other utilities, including tolling contracts, with expiration dates ranging

from 2017 to 2032 and representing 100 percent of plant net output. Minimum

purchases under these contracts, including those classifi ed as leases, are

approximately $88 million, $90 million, $ 91 million, $92 million and $ 80 million

for 2013 through 2017, respectively, and $578 million payable thereafter.

Progress Energy Florida has executed certain fi rm contracts for purchased

power with other utilities, including tolling contracts, with expiration dates

ranging from 2017 to 2027 and representing between 2 percent and 100 percent

of plant net output. Minimum purchases under these contracts, including

those classifi ed as leases, are approximately $ 102 million, $102 million,

$ 102 million, $71 million and $49 million for 2013 through 2017, respectively,

and $381 million payable thereafter.

Progress Energy Florida has ongoing purchased power contracts with

certain QFs for fi rm capacity with expiration dates ranging from 2013 to

2025. Energy payments are based on the actual power taken under these

contracts. Capacity payments are subject to the QFs meeting certain contract

performance obligations. These contracts account for 100 percent of the net

generating capacity of each of the facilities. All ongoing commitments have

been approved by the FPSC. Minimum expected future capacity payments under

these contracts are $309 million, $ 237 million, $244 million, $ 273 million and

$288 million for 2013 through 2017, respectively, and $ 2,440 million payable

thereafter. The FPSC allows the capacity payments to be recovered through a

capacity cost-recovery clause, which is similar to, and works in conjunction

with, energy payments recovered through the fuel cost-recovery clause.

Duke Energy Ohio has executed certain fi rm contracts for purchased

power with other utilities with expiration dates ranging from 2013 to 2015 and

representing between 1 percent and 24 percent of plant net output. Minimum

purchases under these contracts are approximately $316 million, $252 million

and $80 million for 2013 through 2015, respectively.

Other Purchase Obligations

The long-term commitments related to Levy presented in the previous

table for Duke Energy, Progress Energy and Progress Energy Florida include

only selected components of long lead time equipment. As discussed in Note 4,

Progress Energy Florida identifi ed a schedule shift in the Levy project, and major

construction activities on Levy have been postponed until after the NRC issues

the COL for the plants. Due to the schedule shifts, Progress Energy Florida has

executed amendments to the Levy engineering, procurement and construction

(EPC) agreement. The EPC agreement includes provisions for termination. For

termination without cause, the EPC agreement contains exit provisions with

termination fees, which may be signifi cant, that vary based on the termination

circumstances. Because Progress Energy Florida has executed amendments to

the EPC agreement and anticipates negotiating additional amendments upon

receipt of the COL, Progress Energy Florida cannot currently predict when those

obligations will be satisfi ed or the magnitude of any change. Progress Energy

Florida cannot predict the outcome of this matter.