Duke Energy 2012 Annual Report Download - page 212

Download and view the complete annual report

Please find page 212 of the 2012 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

192

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. • CAROLINA POWER & LIGHT COMPANY d/b/a PROGRESS ENERGY

CAROLINAS, INC. • FLORIDA POWER CORPORATION d/b/a PROGRESS ENERY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

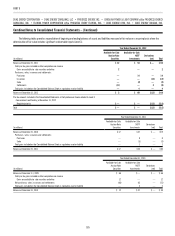

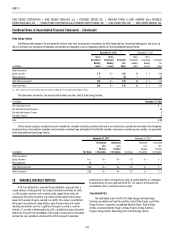

Additional Fair Value Disclosures — Long-term debt, including current maturities:

The fair value of long-term debt, including current maturities, is summarized in the following table. Judgment is required in interpreting market data to develop

the estimates of fair value. Accordingly, the estimates determined are not necessarily indicative of the amounts the Duke Energy Registrants could have settled in

current markets. The fair value of the long-term debt is determined using Level 2 measurements.

As of December 31, 2012 As of December 31, 2011

(in millions) Book Value Fair Value Book Value Fair Value

Duke Energy(a) $39,461 $44,001 $20,573 $23,053

Duke Energy Carolinas(b) $ 8,741 $10,096 $ 9,274 $10,629

Progress Energy $14,428 $16,563 $13,152 $15,518

Progress Energy Carolinas $ 4,840 $ 5,277 $ 4,206 $ 4,735

Progress Energy Florida $ 5,320 $ 6,222 $ 4,681 $ 5,633

Duke Energy Ohio $ 1,997 $ 2,117 $ 2,555 $ 2,688

Duke Energy Indiana $ 3,702 $ 4,268 $ 3,459 $ 4,048

(a) Includes book value of Non-recourse long-term debt of variable interest entities of $852 million and $949 million December 31, 2012 and December 31, 2011, respectively.

(b) Includes book value of Non-recourse long-term debt of variable interest entities of $300 million at both December 31, 2012 and December 31, 2011, respectively.

At both December 31, 2012 and December 31, 2011, the fair value of cash and cash equivalents, accounts and notes receivable, accounts payable, notes

payable and commercial paper and non-recourse notes payable of variable interest entities are not materially different from their carrying amounts because of the

short-term nature of these instruments and/or because the stated rates approximate market rates.

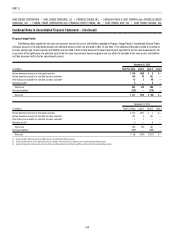

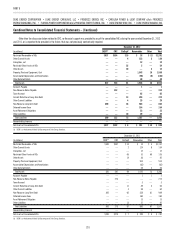

17. INVESTMENTS IN DEBT AND EQUITY SECURITIES

The Duke Energy Registrants classify their investments in debt and equity

securities into two categories — trading and available-for-sale.

Trading Securities. Investments in debt and equity securities held in

grantor trusts associated with certain deferred compensation plans and certain

other investments are classifi ed as trading securities and are reported at fair

value in the Consolidated Balance Sheets with net realized and unrealized

gains and losses included in earnings each period. At December 31, 2012 and

December 31, 2011, the fair value of these investments was $ 33 million and

$32 million, respectively.

Available for Sale Securities. All other investments in debt and equity

securities are classifi ed as available-for-sale securities, which are also reported

at fair value on the Consolidated Balance Sheets with unrealized gains and

losses excluded from earnings and reported either as a regulatory asset or

liability, as discussed further below, or as a component of other comprehensive

income until realized.

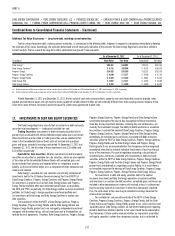

Duke Energy’s available-for-sale securities are primarily comprised of

investments held in the (i) Nuclear Decommissioning Trust Fund (NDTF) at

Duke Energy Carolinas, Progress Energy Carolinas and Progress Energy Florida,

(ii) investments in grantor trusts at both Duke Energy Indiana and Progress

Energy Florida related to other post-retirement benefi t plans as required by

the IURC and FPSC, respectively, (iii) Duke Energy captive insurance investment

portfolio, (iv) Duke Energy’s foreign operations investment portfolio and

(v) investments of Duke Energy and Duke Energy Carolinas in auction rate

debt securities.

The investments within the NDTF at Duke Energy Carolinas, Progress

Energy Carolinas, Progress Energy Florida and the Duke Energy Indiana and

Progress Energy Florida grantor trusts are managed by independent investment

managers with discretion to buy, sell and invest pursuant to the objectives set

forth by the trust agreements. Therefore, Duke Energy Carolinas, Progress Energy,

Progress Energy Carolinas, Progress Energy Florida and Duke Energy Indiana

have limited oversight of the day-to-day management of these investments.

Since day-to-day investment decisions, including buy and sell decisions, are

made by the investment manager, the ability to hold investments in unrealized

loss positions is outside the control of Duke Energy Carolinas, Progress Energy,

Progress Energy Carolinas, Progress Energy Florida and Duke Energy Indiana.

Accordingly, all unrealized gains and losses associated with debt and equity

securities within the NDTF at Duke Energy Carolinas, Progress Energy Carolinas,

Progress Energy Florida and the Duke Energy Indiana and Progress Energy

Florida grantor trusts are considered other-than-temporary and are recognized

immediately when the fair value of individual investments is less than the cost

basis of the investment. Pursuant to regulatory accounting, substantially all

unrealized gains and losses associated with investments in debt and equity

securities within the NDTF at Duke Energy Carolinas, Progress Energy Carolinas,

Progress Energy Florida and the Duke Energy Indiana and Progress Energy Florida

grantor trusts are deferred as a regulatory asset or liability. As a result there is

no immediate impact on the earnings of Duke Energy Carolinas, Progress Energy,

Progress Energy Carolinas, Progress Energy Florida or Duke Energy Indiana.

For investments in debt and equity securities held in the captive

insurance investment portfolio, the foreign operations investment portfolio

and investments in auction rate debt securities, unrealized gains and losses are

included in other comprehensive income until realized, unless it is determined

that the carrying value of an investment is other-than-temporarily impaired.

If so, the write-down to fair value may be included in earnings based on the

criteria discussed below.

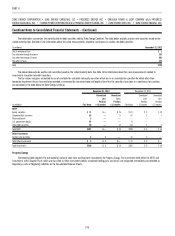

For available-for-sale securities outside of the NDTF at Duke Energy

Carolinas, Progress Energy Carolinas, Progress Energy Florida, and the Duke

Energy Indiana and Progress Energy Florida grantor trusts, which are discussed

separately above, Duke Energy analyzes all investment holdings each reporting

period to determine whether a decline in fair value should be considered other-

than-temporary. Criteria used to evaluate whether an impairment associated

with equity securities is other-than-temporary includes, but is not limited to,