Duke Energy 2012 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2012 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

136

PART II

Combined Notes to Consolidated Financial Statements – (Continued)

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. • CAROLINA POWER & LIGHT COMPANY d/b/a PROGRESS ENERGY

CAROLINAS, INC. • FLORIDA POWER CORPORATION d/b/a PROGRESS ENERY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

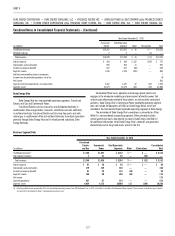

assets on its Consolidated Balance Sheet. These amounts are refl ected in the

Regulatory Assets and Liabilities tables presented previously in this disclosure,

of which $1,592 million is refl ected as Retired generation facilities, $25 million

as Nuclear deferral and $20 million as an offset to Removal costs. Progress

Energy Florida recorded $192 million of impairment and other charges related to

the wholesale portion of Crystal River Unit 3 investments, which are not covered

by the 2012 FSPC Settlement Agreement, and other provisions. The signifi cant

majority of this amount is recorded in Impairment charges on Progress Energy

Florida’s and Progress Energy’s Consolidated Statements of Operations and

Comprehensive Income for the year ended December 31, 2012. This amount is

refl ected as part of the purchase price allocation of the merger with Progress

Energy in Duke Energy’s Consolidated Financial Statements (See Note 2).

In accordance with the 2012 FPSC Settlement Agreement, NEIL proceeds

received allocable to retail customers will be applied fi rst to replacement power

costs incurred after December 31, 2012 through December 31, 2016, with the

remainder used to write down the remaining Crystal River Unit 3 investments.

Progress Energy Florida believes the decision to retire Crystal River Unit 3,

the actions taken and costs incurred in response to the Crystal River Unit 3

delamination have been prudent and, accordingly, considers replacement power

and capital costs not recoverable through insurance to be recoverable through

its fuel cost-recovery clause or base rates. Additional replacement power costs

and exit cost to wind down the operations at the plant and decommission

Crystal River Unit 3 could be material. Retirement of the plant could impact

funding obligations associated with Progress Energy Florida’s nuclear

decommissioning trust fund.

Progress Energy Florida is a party to a master participation agreement

and other related agreements with the joint owners of Crystal River Unit 3 which

convey certain rights and obligations on Progress Energy Florida and the joint

owners. In December 2012, Progress Energy Florida reached an agreement with

one group of joint owners related to all Crystal River Unit 3 matters.

Progress Energy Florida cannot predict the outcome of matters described

above.

Customer Rate Matters.

In conjunction with the 2012 FPSC Settlement Agreement, Progress

Energy Florida will maintain base rates at the current levels through the last

billing cycle of December 2016, except as described as follows. The agreement

provides for a $150 million increase in revenue requirements effective with

the fi rst billing cycle of January 2013, while maintaining the current return on

equity range of 9.5 percent to 11.5 percent. Additionally, costs associated with

Crystal River Unit 3 investments will be removed from retail rate base effective

with the fi rst billing cycle of January 2013. Progress Energy Florida will accrue,

for future rate-setting purposes, a carrying charge on the Crystal River Unit 3

investment until the Crystal River Unit 3 regulatory asset is recovered in base

rates beginning with the fi rst billing cycle of January 2017. If Progress Energy

Florida’s retail base rate earnings fall below the return on equity range, as

reported on a FPSC-adjusted or pro-forma basis on a Progress Energy Florida

monthly earnings surveillance report, Progress Energy Florida may petition the

FPSC to amend its base rates during the term of the agreement. Refer to the

discussion above regarding recovery of Crystal River Unit 3 investments if

the plant is retired.

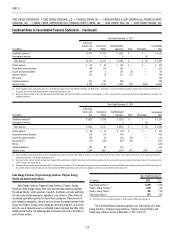

Progress Energy Florida will refund $288 million to retail customers

through its fuel clause. Progress Energy Florida will refund $129 million in each

of 2013 and 2014, and an additional $10 million annually to residential and

small commercial customers in 2014, 2015 and 2016. At December 31, 2011,

a regulatory liability was established for the $288 million to be refunded in

future periods. In 2011, the corresponding charge was recorded as a reduction

of operating revenues in Progress Energy Florida’s and Progress Energy’s

Consolidated Statements of Operations and Comprehensive Income. As discussed

above, Progress Energy Florida also recorded a Regulatory liability of $100 million in

the third quarter of 2012 related to replacement power obligations.

Levy Nuclear Station.

On July 30, 2008, Progress Energy Florida fi led its COL application with

the NRC for two Westinghouse AP1000 reactors at its proposed Levy Nuclear

Station (Levy), which the NRC docketed on October 6, 2008. Various parties

fi led a joint petition to intervene in the Levy COL application. On October 31 and

November 1, 2012, the Atomic Safety and Licensing Board held an evidentiary

hearing on portions of the intervention petitions. A decision is expected in

March 2013. In 2008, the FPSC granted Progress Energy Florida’s petition for an

affi rmative Determination of Need and related orders requesting cost recovery

under Florida’s nuclear cost-recovery rule for Levy, together with the associated

facilities, including transmission lines and substation facilities.

On April 30, 2012, as part of its annual nuclear cost recovery fi ling, Progress

Energy Florida updated the Levy project schedule and cost. Due to lower-than-

projected customer demand, the lingering economic slowdown, uncertainty

regarding potential carbon regulation and current low natural gas prices, Progress

Energy Florida has shifted the in-service date for the fi rst Levy unit to 2024, with

the second unit following 18 months later. The revised schedule is consistent

with the recovery approach included in the 2012 FPSC Settlement Agreement.

Although the scope and overnight cost for Levy, including land acquisition, related

transmission work and other required investments, remain essentially unchanged,

the shift in schedule will increase escalation and carrying costs and raise the total

estimated project cost to between $19 billion and $24 billion.

Along with the FPSC’s annual prudence reviews, Progress Energy Florida

will continue to evaluate the project on an ongoing basis based on certain

criteria, including, but not limited to, cost; potential carbon regulation; fossil

fuel prices; the benefi ts of fuel diversifi cation; public, regulatory and political

support; adequate fi nancial cost-recovery mechanisms; appropriate levels of

joint owner participation; customer rate impacts; project feasibility; DSM and

EE programs; and availability and terms of capital fi nancing. Taking into account

these criteria, Levy is considered to be Progress Energy Florida’s preferred

baseload generation option.

Under the terms of the 2012 FSPC Settlement Agreement, Progress

Energy Florida began residential cost-recovery of its proposed Levy Nuclear

Station effective in the fi rst billing cycle of January 2013 at the fi xed rates

contained in the settlement and continuing for a fi ve-year period, with true-up

of any actual costs not recovered during the 5-year period occurring in the fi nal

year. Progress Energy Florida will not fi le for recovery of any new Levy costs

that were not addressed in the 2012 FSPC Settlement Agreement before March

1, 2017 and will not begin recovering those costs from customers before the

fi rst billing cycle of January, 2018, unless otherwise agreed to by the parties to

the agreement. This amount is intended to recover the estimated retail project

costs to date plus costs necessary to obtain the COL and any engineering,

procurement and construction cancellation costs, if Progress Energy Florida

ultimately chooses to cancel that contract. In addition, the consumer parties

will not oppose Progress Energy Florida continuing to pursue a COL for

Levy. The 2012 FSPC Settlement Agreement also provides that Progress

Energy Florida will treat the allocated wholesale cost of Levy (approximately

$68 million) as a retail regulatory asset and include this asset as a component

of rate base and amortization expense for regulatory reporting. Progress Energy

Florida will have the discretion to accelerate and/or suspend such amortization

in full or in part provided that it amortizes all of the regulatory asset by

December 31, 2016.