Duke Energy 2012 Annual Report Download - page 198

Download and view the complete annual report

Please find page 198 of the 2012 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

178

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. • CAROLINA POWER & LIGHT COMPANY d/b/a PROGRESS ENERGY

CAROLINAS, INC. • FLORIDA POWER CORPORATION d/b/a PROGRESS ENERY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

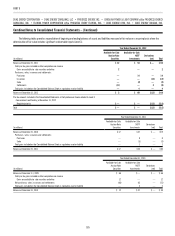

Combined Notes to Consolidated Financial Statements – (Continued)

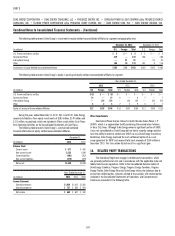

December 31,

2012

December 31,

2011

(in millions) Asset Liability Asset Liability

Derivatives Designated as Hedging Instruments

Interest rate contracts

Current assets: other $ 2 $—$ 3 $—

Investments and other assets: other —— 2 —

Total Derivatives Designated as Hedging Instruments $ 2 $ — $ 5 $—

Derivatives Not Designated as Hedging Instruments

Commodity contracts

Current assets: other $ 31 $ 4 $ 79 $ 39

Investments and other assets: other 81 51 29 18

Current liabilities: other 106 132 136 146

Deferred credits and other liabilities: other — 4 22 33

Interest rate contracts

Current liabilities: other — 1 — 1

Deferred credits and other liabilities: other — 7 — 8

Total Derivatives Not Designated as Hedging

Instruments $ 218 $199 $266 $245

Total Derivatives $220 $199 $271 $245

There were no gains or losses on cash fl ow hedges recorded or

reclassifi ed at Duke Energy Ohio for the years ended December 31, 2012 and

2011, respectively. There was an immaterial amount of losses on cash fl ow

hedges reclassifi ed at Duke Energy Ohio for the year ended December 31, 2010.

At December 31, 2012, there were no pre-tax deferred net gains or losses

on derivative instruments related to cash fl ow hedges remaining in AOCI for

Duke Energy Ohio.

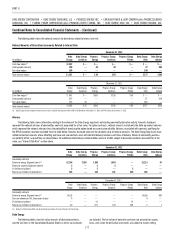

The following tables show the amount of the pre-tax gains and losses

recognized on undesignated contracts by type of derivative instrument, and the

line items in the Consolidated Statements of Operations and Comprehensive

Income in which such gains and losses are included or deferred on the

Consolidated Balance Sheets as regulatory assets or liabilities.

Years Ended

December 31,

(in millions) 2012 2011 2010

Location of Pre-tax Gains and (Losses) Recognized in Earnings

Commodity contracts

Revenue, nonregulated electric, natural gas and other $ 76 $(26) $ (3)

Fuel used in electric generation and purchased power —

nonregulated 2 (1) 9

Interest rate contracts

Interest expense (1) (1) (1)

Total Pre-tax (Losses) Gains Recognized in Earnings $ 77 $(28) $ 5

Location of Pre-tax Gains and (Losses) Recognized as

Regulatory Assets or Liabilities

Commodity contracts

Regulatory asset $ 2 $ 1 $ 5

Regulatory liability (1) ——

Interest rate contracts

Regulatory asset — (4) (1)

Total Pre-tax Gains (Losses) Recognized as Regulatory

Assets of Liabilities $ 1 $ (3) $ 4

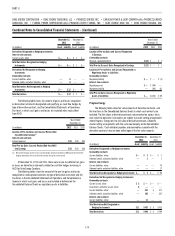

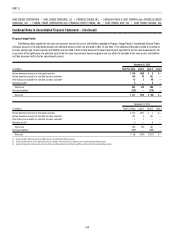

Duke Energy Indiana

The following tables show fair value amounts of derivative contracts,

and the line items in the Consolidated Balance Sheets in which such amounts

are included. The fair values of derivative contracts are presented on a gross

basis, even when the derivative instruments are subject to master netting

arrangements where Duke Energy Indiana nets the fair value of derivative

contracts subject to master netting arrangements with the same counterparty

on the Consolidated Balance Sheets. Cash collateral payables and receivables

associated with the derivative contracts have not been netted against the fair

value amounts.

December 31,

2012

December 31,

2011

(in millions) Asset Liability Asset Liability

Derivatives Not Designated as Hedging Instruments

Commodity contracts

Current assets: other $ 10 $— $ 4 $—

Current liabilities: other ——— 2

Interest rate contracts

Current liabilities: other — 63 ——

Deferred credits and other liabilities: other ——— 66

Total Derivatives Not Designated as

Hedging Instruments $ 10 $ 63 $ 4 $ 68

Total Derivatives $ 10 $ 63 $ 4 $ 68

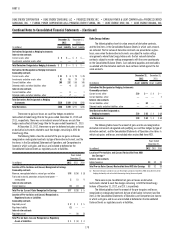

The following table shows the amount of gains and losses recognized on

derivative instruments designated and qualifying as cash fl ow hedges by type of

derivative contract, and the Consolidated Statements of Operations line items in

which such gains and losses are included when reclassifi ed from AOCI.

Years Ended

December 31,

(in millions) 2012 2011 2010

Location of Pre-tax Gains and (Losses) Reclassifi ed from AOCI

into Earnings(a)

Interest rate contracts

Interest expense $3 $2 $3

Total Pre-tax Gains (Losses) Reclassifi ed from AOCI into Earnings $3 $2 $3

(a) Represents the gains and losses on cash fl ow hedges previously recorded in AOCI during the term of the

hedging relationship and reclassifi ed into earnings during the current period.

There were no pre-tax deferred net gains or losses on derivative

instruments related to cash fl ow hedges remaining in AOCI for Duke Energy

Indiana at December 31, 2012, and 2011, respectively.

The following tables show the amount of the pre-tax gains and losses

recognized on undesignated contracts by type of derivative instrument and line

items in the Consolidated Statements of Operations and Comprehensive Income

in which such gains and losses are included or deferred on the Consolidated

Balance Sheets as regulatory assets or liabilities.