Duke Energy 2012 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2012 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

111

PART II

Combined Notes to Consolidated Financial Statements – (Continued)

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. • CAROLINA POWER & LIGHT COMPANY d/b/a PROGRESS ENERGY

CAROLINAS, INC. • FLORIDA POWER CORPORATION d/b/a PROGRESS ENERY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

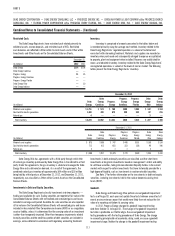

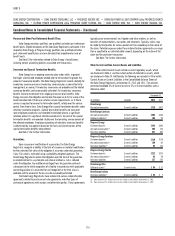

Restricted Cash.

The Duke Energy Registrants have restricted cash related primarily to

collateral assets, escrow deposits, and restricted cash of VIEs. Restricted

cash balances are refl ected in Other within Current Assets and in Other within

Investments and Other Assets on the Consolidated Balance Sheets.

December 31,

(in millions) 2012 2011

Duke Energy $574 $ 104

Duke Energy Carolinas — —

Progress Energy 11 35

Progress Energy Carolinas — —

Progress Energy Florida — —

Duke Energy Ohio — 30

Duke Energy Indiana — —

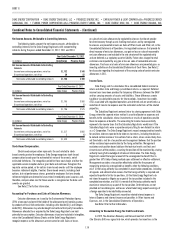

Inventory.

Inventory is comprised of amounts presented in the tables below and

is recorded primarily using the average cost method. Inventory related to the

Duke Energy Registrants’ regulated operations is valued at historical cost

consistent with ratemaking treatment. Materials and supplies are recorded as

inventory when purchased and subsequently charged to expense or capitalized

to property, plant and equipment when installed. Reserves are established for

excess and obsolete inventory. Inventory related to the Duke Energy Registrants’

nonregulated operations is valued at the lower of cost or market. The following

tables present the Duke Energy Registrants’ inventory.

December 31, 2012

(in millions)

Duke

Energy

Duke

Energy

Carolinas

Progress

Energy

Progress

Energy

Carolinas

Progress

Energy

Florida

Duke

Energy

Ohio

Duke

Energy

Indiana

Materials and supplies $1,751 $ 574 $ 768 $499 $269 $ 142 $ 164

Coal held for electric generation 1,468 488 673 329 344 82 216

Natural gas 4 — — — — 3 —

Total inventory $3,223 $1,062 $1,441 $828 $613 $ 227 $ 380

December 31, 2011

(in millions)

Duke

Energy

Duke

Energy

Carolinas

Progress

Energy

Progress

Energy

Carolinas

Progress

Energy

Florida

Duke

Energy

Ohio

Duke

Energy

Indiana

Materials and supplies $ 873 $ 505 $ 747 $446 $301 $ 150 $ 134

Coal held for electric generation 712 412 681 323 358 90 196

Natural gas 3 — 1 1 — 3 —

Total inventory $1,588 $ 917 $1,429 $770 $659 $ 243 $ 330

Duke Energy Ohio has agreements with a third party through which title

of natural gas inventory purchased by Duke Energy Ohio is transferred to a third

party. Under the agreements, the gas inventory is stored and managed for Duke

Energy Ohio and is delivered on demand. As a result of the agreements, the

combined natural gas inventory of approximately $44 million and $50 million

being held by a third party as of December 31, 2012, and December 31, 2011,

respectively, was classifi ed as Other within Current Assets on the Consolidated

Balance Sheets.

Investments in Debt and Equity Securities.

The Duke Energy Registrants classify investments into two categories —

trading and available-for-sale. Trading securities are reported at fair value in the

Consolidated Balance Sheets with net realized and unrealized gains and losses

included in earnings each period. Available-for-sale securities are also reported

at fair value on the Consolidated Balance Sheets with unrealized gains and losses

included in Accumulated Other Comprehensive Income (AOCI) or as a regulatory

asset or liability, unless it is determined that the carrying value of an investment

is other-than-temporarily impaired. Other-than-temporary impairments related

to equity securities and the credit loss portion of debt securities are included in

earnings, unless deferred in accordance with regulatory accounting treatment.

Investments in debt and equity securities are classifi ed as either short-term

investments or long-term investments based on management’s intent and ability

to sell these securities, taking into consideration illiquidity factors in the current

markets with respect to certain investments that have historically provided for a

high degree of liquidity, such as investments in auction rate debt securities.

See Note 17 for further information on the investments in debt and equity

securities, including investments held in the nuclear decommissioning trust

funds (NDTF).

Goodwill.

Duke Energy and Duke Energy Ohio perform annual goodwill impairment

tests as of August 31 each year and update these tests between annual tests if

events or circumstances occur that would more likely than not reduce the fair

value of a reporting unit below its carrying value.

In 2012, Progress Energy changed its goodwill impairment testing

date from October 31 to August 31. The change in the goodwill impairment

test date is preferable as it better aligns the annual goodwill impairment

testing procedures with the testing procedures of Duke Energy. The change

in accounting principle did not accelerate, delay, avoid, or cause a goodwill

impairment charge. Neither the change in the goodwill impairment testing