Duke Energy 2012 Annual Report Download - page 151

Download and view the complete annual report

Please find page 151 of the 2012 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

131

PART II

Combined Notes to Consolidated Financial Statements – (Continued)

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. • CAROLINA POWER & LIGHT COMPANY d/b/a PROGRESS ENERGY

CAROLINAS, INC. • FLORIDA POWER CORPORATION d/b/a PROGRESS ENERY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

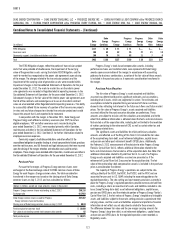

As of December 31, 2011

(in millions) Duke Energy

Duke Energy

Carolinas

Progress

Energy

Progress

Energy

Carolinas

Progress

Energy

Florida

Duke

Energy

Ohio

Duke

Energy

Indiana

Regulatory Liabilities

DSM costs/Energy effi ciency $ 41 $ 41 $ 19 $ — $ 19 $ — $ —

Nuclear deferral — — 15 — 15 — —

Other 46 21 14 2 12 22 3

Total Current Regulatory Liabilities(b) 87 62 48 2 46 22 3

Removal costs 2,586 1,770 2,240 1,529 550 230 590

Accrued pension and post-retirement benefi ts 117 — — — — 19 70

Amount to be refunded to customers — — 288 — 288 — —

Storm reserve — — 135 — 135 — —

Other 216 158 64 14 51 24 23

Total Non-Current Regulatory Liabilities 2,919 1,928 2,727 1,543 1,024 273 683

Total Regulatory Liabilities $3,006 $1,990 $2,775 $1,545 $1,070 $295 $686

(a) Included in Other within Current Assets on the Consolidated Balance Sheets.

(b) Included in Other within Current Liabilities on the Consolidated Balance Sheets.

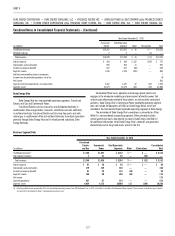

Descriptions of the regulatory assets and liabilities summarized in the

tables above, as well as their recovery and amortization periods are as follows.

Items are excluded from rate base unless otherwise noted.

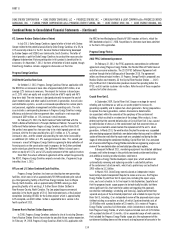

Vacation accrual. Vacation is accrued as it is earned by employees and

generally recovered as it is paid, generally within one year. This includes both

accrued vacation and personal holiday pay.

Nuclear deferral. In 2009, pursuant to the FPSC nuclear cost-recovery

rule, Progress Energy Florida fi led a petition to recover costs, which primarily

consisted of preconstruction and carrying costs incurred or anticipated to be

incurred during 2009 and the projected 2010 costs associated with the Levy

project. In an effort to help mitigate the initial price impact on its customers, as

part of its fi ling, Progress Energy Florida recorded this asset, and it was to be

recovered or amortized, as approved by the FPSC, over a period not exceeding

fi ve years. These costs are projected to be recovered by the end of 2014. This

amount also includes deferred depreciation expense related to Crystal River

Unit 3 as a result of the 2012 FPSC settlement agreement.

DSM Costs/EE. These amounts represent costs recoverable or refundable

under the Duke Energy Registrants’ Demand Side Management programs,

various state Energy Effi ciency programs, SmartGrid, and other peak time

energy management programs. The recovery period varies for these costs, with

some currently unknown. Duke Energy Carolinas and Progress Energy Florida are

required to pay interest on the outstanding liability balance, and Progress Energy

Florida collects interest on the outstanding asset balance.

Deferred fuel costs. Deferred fuel costs represent certain energy costs

that are recoverable or refundable as approved by the applicable regulatory

body. Interest is earned on under-recovered costs and interest is paid on

over-recovered costs to customers.

For Progress Energy Florida, as a result of the 2012 FPSC settlement

agreement, the FPSC approved an agreement between Progress Energy Florida

and consumer advocates in Florida that provides customers a refund through

the fuel clause, relating to the Crystal River Unit 3 delamination and subsequent

outage. The amounts for Progress Energy Florida are reduced by this refund.

Over-distribution of BPM sharing. These costs represent Duke Energy

Carolinas’ BPM sharing requirements by the NCUC. The NCUC requires a

percentage of the profi ts on the wholesale market to be shared with retail

customers. Under the BPM rider, Duke Energy Carolinas is required to true-up

any differences, and as a result, the over-distribution to retail customers is

recorded as a regulatory asset. The recovery period for these costs is generally

one year, and Duke Energy Carolinas earns a return on the balance.

Post-in-service carrying costs and deferred operating expenses.

These costs represent deferred depreciation and operating expenses as well as

carrying costs on the portion of assets of the Duke Energy Registrants’ capital

expenditure programs that are placed in service but not yet refl ected in rates as

plant in service. Duke Energy Carolinas is allowed to earn a return on the North

Carolina portion of the outstanding balance, but does not earn a return on the

South Carolina portion. Duke Energy Ohio and Duke Energy Indiana are allowed

to earn a return on the outstanding balance. Duke Energy Carolinas amounts

are excluded from rate base and Duke Energy Ohio amounts are included in

rate base. At Duke Energy Indiana, some amounts are included in and some are

excluded from rate base. Recovery is over various lives, and the latest recovery

period for these costs is 2067.

Gasifi cation services agreement buyout costs. In 1999, Duke Energy

Indiana entered into a buyout of a gasifi cation services agreement. The IURC

authorized Duke Energy Indiana to recover costs incurred, including carrying

costs on the unrecovered balance, over an 18-year period. Duke Energy Indiana

earns a return on the balance, and the recovery period lasts through 2018.

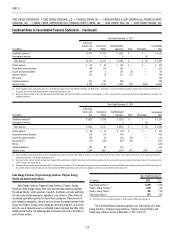

Accrued pension and post-retirement. Accrued pension and other

post-retirement benefi ts represent regulatory assets related to the recognition

of each of the Duke Energy Registrants’ respective shares of the underfunded

status of Duke Energy and Progress Energy’s defi ned benefi t and other post-

retirement plans as a liability on each registrant’s balance sheet. The regulatory

asset is amortized in proportion to the recognition of prior service costs (gains),

transition obligations and actuarial losses attributable to Duke Energy and

Progress Energy’s pension plans and other post-retirement benefi t plans

determined by the cost recognition provisions of the accounting guidance for

pensions and post-retirement benefi ts. See Note 23, Employee Benefi t Plans, for

additional detail.

Retired generation facilities. These amounts represent the net book

value of Duke Energy facilities that have been retired. Duke Energy Indiana

earns a return on the outstanding balances and the costs are included in rate

base. Progress Energy Carolinas anticipates earning a return on the outstanding

balance with the costs excluded from rate base. For Duke Energy Indiana, the