Duke Energy 2012 Annual Report Download - page 274

Download and view the complete annual report

Please find page 274 of the 2012 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

254

DUKE ENERGY CORPORATION

Schedule I - Condensed Parent Company Notes to Financial Statements – (Continued)

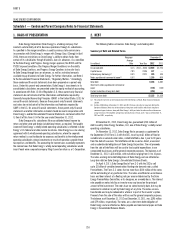

In November 2011, Duke Energy entered into a $6 billion, fi ve-year

master credit facility, expiring in November 2016, with $4 billion available at

closing and the remaining $2 billion became available July 2, 2012, following

the closing of the merger with Progress Energy. In October 2012, the Duke

Energy Registrants reached an agreement with banks representing $5.63 billion

of commitments under the master credit facility to extend the expiration date

by one year to November 2017. Through November 2016, the available credit

under this facility remains at $6 billion. The Duke Energy Registrants each have

borrowing capacity under the master credit facility up to specifi ed sublimits

for each borrower. However, Duke Energy has the unilateral ability at any time

to increase or decrease the borrowing sublimits of each borrower, subject

to a maximum sublimit for each borrower. The amount available under the

master credit facility has been reduced by the use of the master credit facility

to backstop the issuances of commercial paper, certain letters of credit and

variable rate demand tax-exempt bonds that may be put to the Company at the

option of the holder. Borrowing sublimits are also reduced for certain amounts

outstanding under the money pool arrangement.

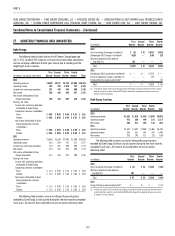

Annual Maturities as of December 31, 2012

(in millions)

2013 $ 706

2014 1,249

2015 449

2016 499

2017 699

Thereafter 2,009

Total long-term debt, including current maturities $ 5,611

3. COMMITMENTS AND CONTINGENCIES

Duke Energy and its subsidiaries are a party to litigation, environmental

and other matters. For further information, see Note 5 to the Consolidated

Financial Statements, “Commitments and Contingencies.”

Duke Energy has various fi nancial and performance guarantees and

indemnifi cations which are issued in the normal course of business. These

contracts include performance guarantees, stand-by letters of credit, debt

guarantees, surety bonds and indemnifi cations. Duke Energy enters into

these arrangements to facilitate commercial transactions with third parties

by enhancing the value of the transaction to the third party. The maximum

potential amount of future payments Duke Energy could have been required to

make under these guarantees as of December 31, 2012 was approximately $6.1

billion. Of this amount, substantially all relates to guarantees of wholly owned

consolidated entities, including debt issued by Duke Energy Carolinas discussed

above, and less than wholly owned consolidated entities. The majority of these

guarantees expire at various times between 2013 and 2039, with the remaining

performance guarantees having no contractual expiration. See Note 7 to the

Consolidated Financial Statements, “Guarantees and Indemnifi cations,” for

further discussion of guarantees issued on behalf of unconsolidated affi liates

and third parties.

4. RELATED PARTY TRANSACTIONS

Duke Energy provides support to certain subsidiaries for their short-term

borrowing needs through participation in a money pool arrangement. Under

this arrangement, certain subsidiaries with short-term funds may provide

short-term loans to affi liates participating under this arrangement. Additionally,

Duke Energy provides loans to subsidiaries through the money pool, but is

not permitted to borrow funds through the money pool arrangement. Duke

Energy had money pool-related receivables of $450 million classifi ed as Notes

receivable from affi liated companies on the Condensed Balance Sheets as of

both December 31, 2012 and 2011.

As of December 31, 2012 and 2011, Duke Energy had an intercompany

loan outstanding with Cinergy of $1,590 million and $608 million, respectively,

which is classifi ed within Notes receivable from affi liated companies on the

Condensed Balance Sheets. The $982 million increase in the intercompany loan

during 2012 and the $264 million decrease during 2011 are refl ected as Notes

receivable from affi liated companies within Net Cash Provided by (Used in)

Investing Activities on the Condensed Statements of Cash Flows.

In conjunction with the money pool arrangement and the intercompany

loan noted above, Duke Energy recorded interest income of approximately

$11 million, $4 million and $7 million in 2012, 2011 and 2010, respectively,

which is included in Other Income and Expenses, net on the Condensed

Statements of Operations and Comprehensive Income.

Duke Energy also provides funding to and sweeps cash from subsidiaries

that do not participate in the money pool. For these subsidiaries, the cash is

used in or generated from their operations, capital expenditures, debt payments

and other activities. Amounts funded or received are carried as open accounts,

as either Investment in consolidated subsidiaries or as Other deferred credits

and other liabilities, and do not bear interest. These amounts are included

within Net Cash (Used in) Provided by Operating Activities on the Condensed

Statements of Cash Flows.

During the years ended December 31, 2012, 2011 and 2010, Duke Energy

received equity distributions of $450 million, $299 million and $350 million,

respectively, from Duke Energy Carolinas. These amounts are refl ected

within Net Cash (Used in) Provided by Investing Activities on the Condensed

Statements of Cash Flows.

During the years ended December 31, 2012 and 2011, Duke Energy

paid advances of $16 million and $15 million, respectively, to Cinergy Corp. for

Green Frontier Windpower LLC PTC funding contributions. During the year ended

December 31, 2010, Duke Energy forgave a $29 million advance to Cinergy Corp.