Duke Energy 2012 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2012 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

113

PART II

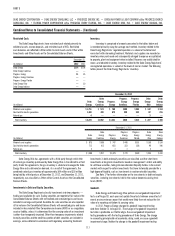

Combined Notes to Consolidated Financial Statements – (Continued)

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. • CAROLINA POWER & LIGHT COMPANY d/b/a PROGRESS ENERGY

CAROLINAS, INC. • FLORIDA POWER CORPORATION d/b/a PROGRESS ENERY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

allowed to recover the remaining net book value and a full return on the asset.

If the Duke Energy Registrants do not expect to recover the full remaining cost

and a full return, the carrying value of the asset is based on the lower of cost

or the present value of the future revenues expected to be provided to recover

the allowable costs discounted at the Duke Energy Registrants’ incremental

borrowing rate. An impairment is recognized if the net book value of the asset

exceeds the present value of the future revenues to be recovered in rates.

When the Duke Energy Registrants sell entire regulated operating units, or

retire or sell nonregulated properties, the original cost is removed from property

and the related accumulated depreciation and amortization balances are

reduced. Any gain or loss is recorded in earnings, unless otherwise required by

the applicable regulatory body.

See Note 10 for further information on the components and estimated

useful lives of Duke Energy’s property, plant and equipment.

Nuclear Fuel.

Nuclear fuel is classifi ed as Property, Plant and Equipment in the

Consolidated Balance Sheets. Nuclear fuel in the front-end fuel processing

phase is considered work in progress and not amortized until placed in service.

Amortization of nuclear fuel is included within Fuel used in electric generation

and purchased power-regulated in the Consolidated Statements of Operations.

The amortization is recorded using the units-of-production method.

AFUDC and Interest Capitalized.

In accordance with applicable regulatory accounting guidance, the Duke

Energy Registrants record AFUDC, which represents the estimated debt and

equity costs of capital funds necessary to fi nance the construction of new

regulated facilities. The equity component of AFUDC is a non-cash amount

within the Consolidated Statements of Operations. AFUDC is capitalized as

a component of the cost of property, plant and equipment, with an offsetting

credit to Other income and expenses, net on the Consolidated Statements

of Operations for the equity component and as an offset to Interest Expense

on the Consolidated Statements of Operations for the debt component. After

construction is completed, the Duke Energy Registrants are permitted to

recover these costs through inclusion in the rate base and the corresponding

depreciation expense or nuclear fuel expense.

AFUDC equity is a permanent difference item for income tax purposes,

thus reducing the Duke Energy Registrants’ effective tax rate during the

construction phase in which AFUDC equity is being recorded. The effective tax

rate is subsequently increased in future periods when the completed property,

plant and equipment are placed in service and depreciation of the AFUDC equity

commences. See Note 24 for information related to the impacts of AFUDC equity

on the Duke Energy Registrants’ effective tax rate.

For nonregulated operations, interest is capitalized during the construction

phase in accordance with the applicable accounting guidance.

Asset Retirement Obligations.

The Duke Energy Registrants recognize asset retirement obligations for

legal obligations associated with the retirement of long-lived assets that result

from the acquisition, construction, development and/or normal use of the

asset, and for conditional asset retirement obligations. The term conditional

asset retirement obligation refers to a legal obligation to perform an asset

retirement activity in which the timing and (or) method of settlement are

conditional on a future event that may or may not be within the control of the

entity. The obligation to perform the asset retirement activity is unconditional

even though uncertainty exists about the timing and (or) method of settlement.

Thus, the timing and (or) method of settlement may be conditional on a future

event. When recording an asset retirement obligation, the present value

of the projected liability is recognized in the period in which it is incurred,

if a reasonable estimate of fair value can be made. The liability is then

accreted over time by applying an interest method of allocation to the liability.

Substantially all accretion is related to regulated operations and is deferred

pursuant to regulatory accounting. The present value of the liability is added to

the carrying amount of the associated asset and this additional carrying amount

is depreciated over the remaining life of the asset.

The present value of the initial obligation and subsequent updates

are based on discounted cash fl ows, which include estimates regarding the

timing of future cash fl ows, the selection of discount rates and cost escalation

rates, among other factors. These underlying assumptions and estimates

are made as of a point in time and are subject to change. The obligations for

nuclear decommissioning are based on site-specifi c cost studies. Duke Energy

Carolinas and Progress Energy Carolinas assume prompt dismantlement of

the nuclear facilities, which refl ects dismantling the site after operations are

ceased. Progress Energy Florida assumes the nuclear facility will be placed into

a safe storage confi guration until the eventual dismantling of the site begins

in approximately 40-60 years. The nuclear decommissioning asset retirement

obligation also assumes Duke Energy Carolinas, Progress Energy Carolinas and

Progress Energy Florida will store spent fuel on site until such time that it can be

transferred to a U.S. Department of Energy (DOE) facility.

See Note 9 for further information.

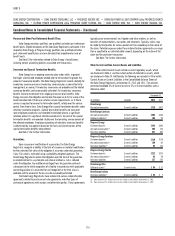

Revenue Recognition and Unbilled Revenue.

Revenues on sales of electricity and gas are recognized when either the

service is provided or the product is delivered. Unbilled retail revenues are

estimated by applying average revenue per kilowatt-hour (kWh) or per thousand

cubic feet (Mcf) for all customer classes to the number of estimated kWh or

Mcf delivered but not billed. Unbilled wholesale energy revenues are calculated

by applying the contractual rate per megawatt-hour (MWh) to the number

of estimated MWh delivered but not yet billed. Unbilled wholesale demand

revenues are calculated by applying the contractual rate per megawatt (MW)

to the MW volume delivered but not yet billed. The amount of unbilled revenues

can vary signifi cantly from period to period as a result of numerous factors,

including seasonality, weather, customer usage patterns and customer mix.

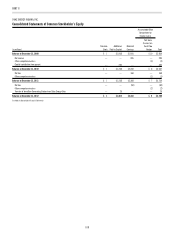

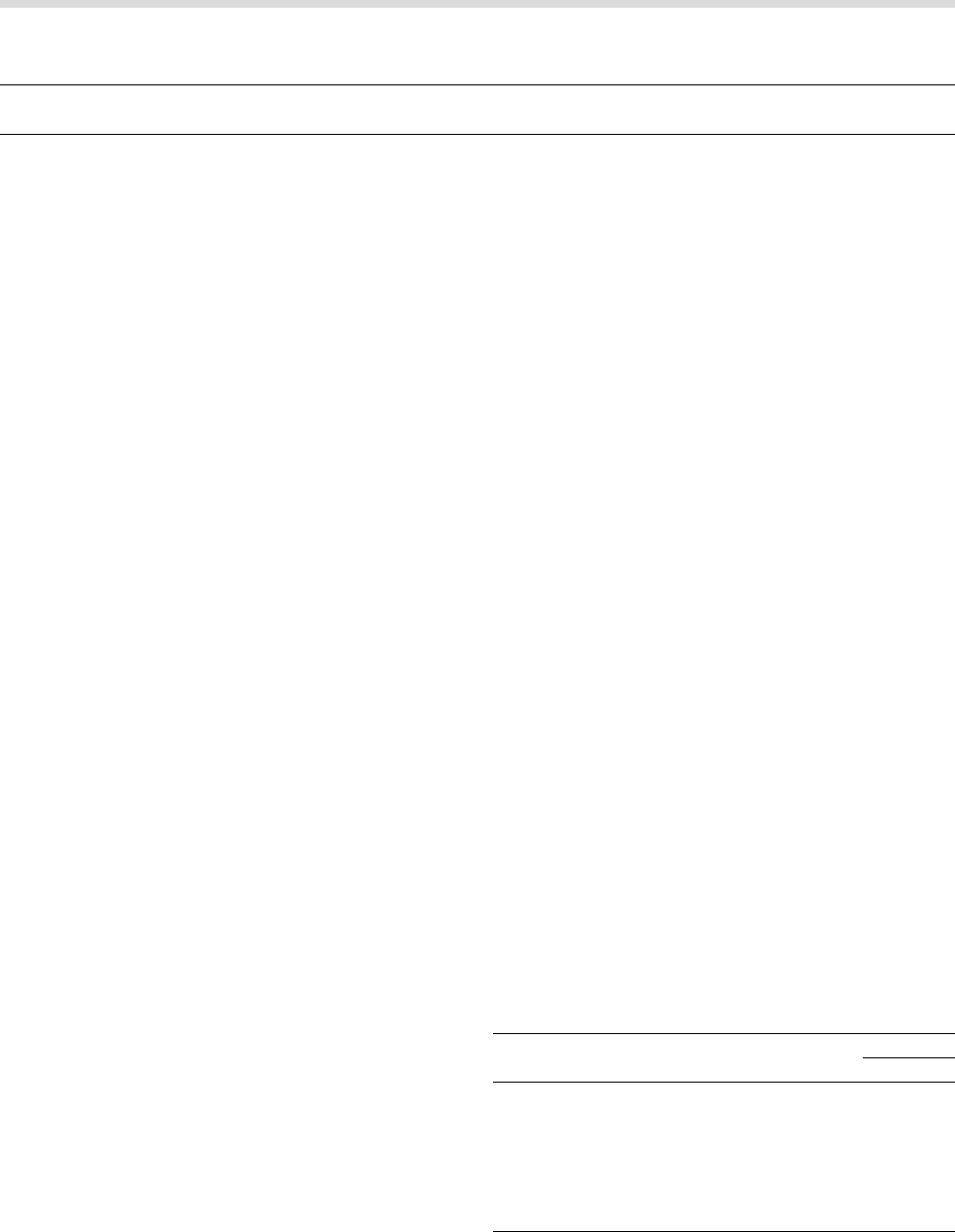

The Duke Energy Registrants had unbilled revenues within Receivables

and within Restricted receivables of variable interest entities on their respective

Consolidated Balance Sheets as shown in the table below.

December 31,

(in millions) 2012 2011

Duke Energy $920 $674

Duke Energy Carolinas 315 293

Progress Energy 187 157

Progress Energy Carolinas 112 102

Progress Energy Florida 74 55

Duke Energy Ohio 47 50

Duke Energy Indiana 32

Additionally, Duke Energy Ohio and Duke Energy Indiana sell, on a

revolving basis, nearly all of their retail and wholesale accounts receivable

to Cinergy Receivables Company, LLC (CRC). These transfers meet sales/