MetLife 2011 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2011 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MetLife, Inc.

Notes to the Consolidated Financial Statements

1. Business, Basis of Presentation and Summary of Significant Accounting Policies

Business

“MetLife” or the “Company” refers to MetLife, Inc., a Delaware corporation incorporated in 1999, its subsidiaries and affiliates. MetLife is a leading

global provider of insurance, annuities and employee benefit programs throughout the United States, Japan, Latin America, Asia Pacific, Europe and the

Middle East. Through its subsidiaries and affiliates, MetLife offers life insurance, annuities, auto and homeowners insurance, mortgage and deposit

products and other financial services to individuals, as well as group insurance and retirement & savings products and services to corporations and

other institutions.

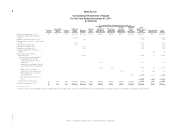

MetLife is organized into six segments: Insurance Products, Retirement Products, Corporate Benefit Funding and Auto & Home (collectively,

“U.S. Business”), and Japan and Other International Regions (collectively, “International”). See Note 22.

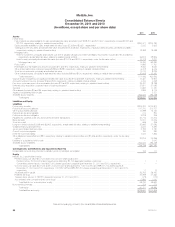

Basis of Presentation

The accompanying consolidated financial statements include the accounts of MetLife, Inc. and its subsidiaries, as well as partnerships and joint

ventures in which the Company has control, and variable interest entities (“VIEs”) for which the Company is the primary beneficiary. See “— Adoption of

New Accounting Pronouncements.” Closed block assets, liabilities, revenues and expenses are combined on a line-by-line basis with the assets,

liabilities, revenues and expenses outside the closed block based on the nature of the particular item. See Note 10. Intercompany accounts and

transactions have been eliminated.

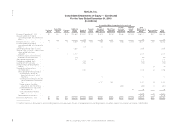

On November 1, 2010 (the “Acquisition Date”), MetLife, Inc. completed the acquisition of American Life Insurance Company (“American Life”) from

AM Holdings LLC (formerly known as ALICO Holdings LLC) (“AM Holdings”), a subsidiary of American International Group, Inc. (“AIG”), and Delaware

American Life Insurance Company (“DelAm”) from AIG (American Life, together with DelAm, collectively, “ALICO”) (the “Acquisition”). The Acquisition was

accounted for using the acquisition method of accounting. ALICO’s fiscal year-end is November 30. Accordingly, the Company’s consolidated financial

statements reflect the assets and liabilities of ALICO as of November 30, 2011 and 2010, and the operating results of ALICO for the year ended

November 30, 2011 and the one month ended November 30, 2010. The accounting policies of ALICO were conformed to those of MetLife upon the

Acquisition. See Note 2.

Certain amounts in the prior years’ consolidated financial statements and related footnotes thereto have been reclassified to conform with the 2011

presentation as discussed throughout the Notes to the Consolidated Financial Statements.

Summary of Significant Accounting Policies and Critical Accounting Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America (“GAAP”) requires

management to adopt accounting policies and make estimates and assumptions that affect amounts reported in the consolidated financial statements.

A description of critical estimates is incorporated within the discussion of the related accounting policies which follows. In applying these policies,

management makes subjective and complex judgments that frequently require estimates about matters that are inherently uncertain. Many of these

policies, estimates and related judgments are common in the insurance and financial services industries; others are specific to the Company’s business

and operations. Actual results could differ from these estimates.

Investments

The accounting policies for the Company’s principal investments are as follows:

Fixed Maturity and Equity Securities. The Company’s fixed maturity and equity securities are classified as available-for-sale and are reported

at their estimated fair value.

Unrealized investment gains and losses on these securities are recorded as a separate component of other comprehensive income (loss),

net of policyholder-related amounts and deferred income taxes. All security transactions are recorded on a trade date basis. Investment gains

and losses on sales of securities are determined on a specific identification basis.

Interest income on fixed maturity securities is recorded when earned using an effective yield method giving effect to amortization of premiums

and accretion of discounts. Dividends on equity securities are recorded when declared. Interest, dividends and prepayment fees are recorded in

net investment income.

Included within fixed maturity securities are structured securities including mortgage-backed and asset-backed securities (“ABS”).

Amortization of the premium or discount considers the estimated timing and amount of prepayments of the underlying loans. Actual prepayment

experience is periodically reviewed and effective yields are recalculated when differences arise between the originally anticipated and the actual

prepayments received and currently anticipated. Prepayment assumptions for single class and multi-class mortgage-backed and ABS are

estimated by management using inputs obtained from third-party specialists, including broker-dealers, and based on management’s knowledge

of the current market. For credit-sensitive mortgage-backed and ABS and certain prepayment-sensitive securities, the effective yield is

recalculated on a prospective basis. For all other mortgage-backed and ABS, the effective yield is recalculated on a retrospective basis.

The Company periodically evaluates fixed maturity and equity securities for impairment. The assessment of whether impairments have

occurred is based on management’s case-by-case evaluation of the underlying reasons for the decline in estimated fair value. The Company’s

review of its fixed maturity and equity securities for impairments includes an analysis of the total gross unrealized losses by three categories of

severity and/or age of the gross unrealized loss, as summarized in Note 3 “— Aging of Gross Unrealized Loss and OTTI Loss for Fixed Maturity

and Equity Securities Available-for-Sale.”

Management considers a wide range of factors about the security issuer and uses its best judgment in evaluating the cause of the decline in

the estimated fair value of the security and in assessing the prospects for near-term recovery. Inherent in management’s evaluation of the security

are assumptions and estimates about the operations of the issuer and its future earnings potential. Considerations used by the Company in the

impairment evaluation process include, but are not limited to: (i) the length of time and the extent to which the estimated fair value has been

below cost or amortized cost; (ii) the potential for impairments of securities when the issuer is experiencing significant financial difficulties; (iii) the

potential for impairments in an entire industry sector or sub-sector; (iv) the potential for impairments in certain economically depressed

geographic locations; (v) the potential for impairments of securities where the issuer, series of issuers or industry has suffered a catastrophic type

of loss or has exhausted natural resources; (vi) with respect to fixed maturity securities, whether the Company has the intent to sell or will more

MetLife, Inc. 95