MetLife 2011 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2011 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

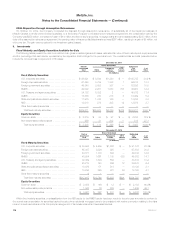

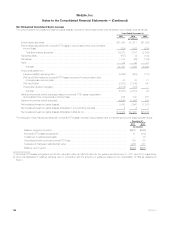

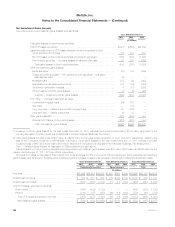

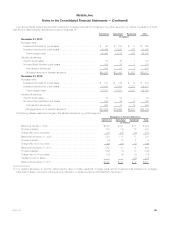

Continuous Gross Unrealized Losses and OTTI Losses for Fixed Maturity and Equity Securities Available-for-Sale by Sector

The following tables present the estimated fair value and gross unrealized losses of fixed maturity and equity securities in an unrealized loss position,

aggregated by sector and by length of time that the securities have been in a continuous unrealized loss position. The unrealized loss amounts

presented below include the noncredit component of OTTI loss. Fixed maturity securities on which a noncredit OTTI loss has been recognized in

accumulated other comprehensive income (loss) are categorized by length of time as being “less than 12 months” or “equal to or greater than

12 months” in a continuous unrealized loss position based on the point in time that the estimated fair value initially declined to below the amortized cost

basis and not the period of time since the unrealized loss was deemed a noncredit OTTI loss.

December 31, 2011

Less than 12 Months Equal to or Greater

than 12 Months Total

Estimated

Fair

Value

Gross

Unrealized

Losses

Estimated

Fair

Value

Gross

Unrealized

Losses

Estimated

Fair

Value

Gross

Unrealized

Losses

(In millions, except number of securities)

Fixed Maturity Securities:

U.S. corporate securities ............................................... $15,642 $ 590 $ 5,135 $ 790 $ 20,777 $ 1,380

Foreign corporate securities ............................................. 12,618 639 5,957 700 18,575 1,339

Foreign government securities ........................................... 11,227 230 1,799 127 13,026 357

RMBS .............................................................. 4,040 547 4,724 1,189 8,764 1,736

U.S. Treasury and agency securities ...................................... 2,611 1 50 1 2,661 2

CMBS .............................................................. 2,825 135 678 91 3,503 226

State and political subdivision securities .................................... 177 2 1,007 154 1,184 156

ABS ............................................................... 4,972 103 1,316 214 6,288 317

Other fixed maturity securities ............................................ — — — — — —

Total fixed maturity securities .......................................... $54,112 $ 2,247 $ 20,666 $ 3,266 $ 74,778 $ 5,513

Equity Securities:

Common stock ....................................................... $ 581 $ 96 $ 5 $ 1 $ 586 $ 97

Non-redeemable preferred stock ......................................... 204 30 370 172 574 202

Total equity securities ................................................ $ 785 $ 126 $ 375 $ 173 $ 1,160 $ 299

Total number of securities in an unrealized loss position ....................... 3,978 1,963

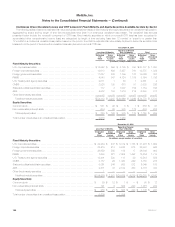

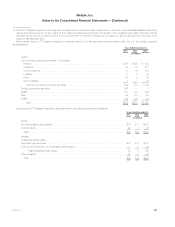

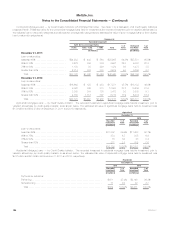

December 31, 2010

Less than 12 Months Equal to or Greater

than 12 Months Total

Estimated

Fair

Value

Gross

Unrealized

Losses

Estimated

Fair

Value

Gross

Unrealized

Losses

Estimated

Fair

Value

Gross

Unrealized

Losses

(In millions, except number of securities)

Fixed Maturity Securities:

U.S. corporate securities ............................................... $ 22,954 $ 447 $ 8,319 $ 1,155 $ 31,273 $ 1,602

Foreign corporate securities ............................................ 22,415 410 3,976 515 26,391 925

Foreign government securities ........................................... 26,659 585 189 17 26,848 602

RMBS ............................................................. 7,630 221 7,624 1,492 15,254 1,713

U.S. Treasury and agency securities ...................................... 13,401 530 118 29 13,519 559

CMBS ............................................................. 3,787 29 1,363 249 5,150 278

State and political subdivision securities ................................... 5,061 246 988 272 6,049 518

ABS............................................................... 2,671 33 2,102 350 4,773 383

Other fixed maturity securities ........................................... 1 — — — 1 —

Total fixed maturity securities .......................................... $104,579 $ 2,501 $ 24,679 $ 4,079 $ 129,258 $ 6,580

Equity Securities:

Common stock ...................................................... $ 89 $ 12 $ 1 $ — $ 90 $ 12

Non-redeemable preferred stock ........................................ 191 9 824 220 1,015 229

Total equity securities ............................................... $ 280 $ 21 $ 825 $ 220 $ 1,105 $ 241

Total number of securities in an unrealized loss position ....................... 5,609 1,704

122 MetLife, Inc.