MetLife 2011 Annual Report Download - page 154

Download and view the complete annual report

Please find page 154 of the 2011 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

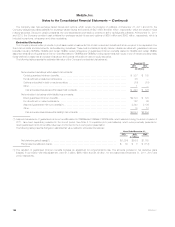

The Company also has exchange-traded futures and options, which require the pledging of collateral. At December 31, 2011 and 2010, the

Company pledged securities collateral for exchange-traded futures and options of $42 million and $40 million, respectively, which is included in fixed

maturity securities. Subject to certain constraints, the counterparties are permitted by contract to sell or repledge this collateral. At December 31, 2011

and 2010, the Company provided cash collateral for exchange-traded futures and options of $680 million and $662 million, respectively, which is

included in premiums, reinsurance and other receivables.

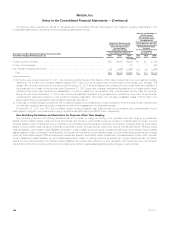

Embedded Derivatives

The Company issues certain products or purchases certain investments that contain embedded derivatives that are required to be separated from

their host contracts and accounted for as freestanding derivatives. These host contracts principally include: variable annuities with guaranteed minimum

benefits, including GMWBs, GMABs and certain GMIBs; ceded reinsurance of guaranteed minimum benefits related to GMABs and certain GMIBs;

assumed reinsurance of guaranteed minimum benefits related to GMWBs and GMABs; funding agreements with equity or bond indexed crediting rates;

funds withheld on assumed and ceded reinsurance; and options embedded in debt or equity securities.

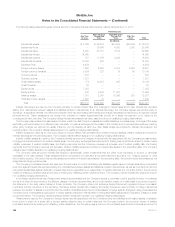

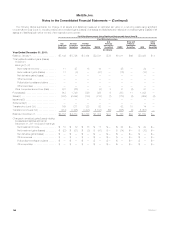

The following table presents the estimated fair value of the Company’s embedded derivatives at:

December 31,

2011 2010

(In millions)

Net embedded derivatives within asset host contracts:

Ceded guaranteed minimum benefits ........................................................ $ 327 $ 185

Funds withheld on assumed reinsurance ..................................................... 35 —

Options embedded in debt or equity securities ................................................ (70) (57)

Other ................................................................................. 1 —

Net embedded derivatives within asset host contracts ......................................... $ 293 $ 128

Net embedded derivatives within liability host contracts:

Direct guaranteed minimum benefits ......................................................... $2,104 $ 370

Funds withheld on ceded reinsurance ....................................................... 122 66

Assumed guaranteed minimum benefits(1) .................................................... 2,340 2,186

Other ................................................................................. 18 12

Net embedded derivatives within liability host contracts ........................................ $4,584 $2,634

(1) Assumed reinsurance of guaranteed minimum benefits related to GMWBs and GMABs of MSI MetLife, which was sold during the second quarter of

2011, have been separately presented in the current period. See Note 2. Comparative prior year balances, which were previously presented in

direct guaranteed minimum benefits, have been conformed to the current period presentation.

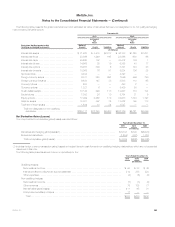

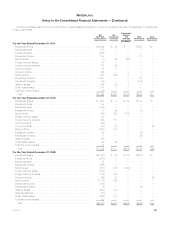

The following table presents changes in estimated fair value related to embedded derivatives:

Years Ended December 31,

2011 2010 2009

(In millions)

Net derivative gains (losses)(1) ...................................................... $(1,284) $(387) $1,758

Policyholder benefits and claims ..................................................... $ 86 $ 8 $ (114)

(1) The valuation of guaranteed minimum benefits includes an adjustment for nonperformance risk. The amounts included in net derivative gains

(losses), in connection with this adjustment, were $1.8 billion, ($96) million and ($1.9) billion, for the years ended December 31, 2011, 2010 and

2009, respectively.

150 MetLife, Inc.