MetLife 2011 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2011 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

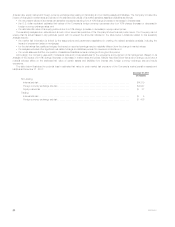

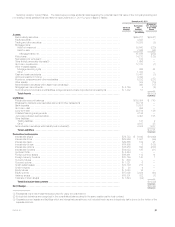

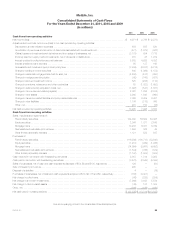

Sensitivity Analysis: Equity Market Prices. The table below provides additional detail regarding the potential loss in estimated fair value of the

Company’s portfolio due to a 10% change in equity at December 31, 2011 by type of asset or liability:

December 31, 2011

Notional

Amount

Estimated

Fair

Value(1)

Assuming a

10% Increase

in Equity

Prices

(In millions)

Assets:

Equity securities .......................................................................... $ 3,023 $ 346

Other invested assets: .....................................................................

Net embedded derivatives within asset host contracts(2) .......................................... 363 (17)

Total Assets ......................................................................... $ 329

Liabilities:

Policyholder account balances .............................................................. $153,304 $ —

Bank deposits ........................................................................... 10,507 —

Other liabilities: ...........................................................................

Net embedded derivatives within liability host contracts(2) ......................................... 4,584 739

Total Liabilities ....................................................................... $ 739

Derivative Instruments:

Interest rate swaps ....................................................................... $79,733 $ 6,042 $ —

Interest rate floors ........................................................................ $23,866 1,081 —

Interest rate caps ......................................................................... $49,665 102 —

Interest rate futures ....................................................................... $14,965 6 —

Interest rate options ....................................................................... $16,988 890 —

Interest rate forwards ...................................................................... $14,033 195 —

Synthetic GICs ........................................................................... $ 4,454 — —

Foreign currency swaps ................................................................... $16,461 112 —

Foreign currency forwards .................................................................. $10,149 140 —

Currency futures ......................................................................... $ 633 — —

Currency options ......................................................................... $ 1,321 6 —

Credit default swaps ...................................................................... $13,136 213 —

Credit forwards .......................................................................... $ 20 4 —

Equity futures ............................................................................ $ 7,053 16 (680)

Equity options ........................................................................... $17,099 3,084 (286)

Variance swaps .......................................................................... $18,801 322 13

Total rate of return swaps .................................................................. $ 1,644 (24) (152)

Total Derivative Instruments ........................................................... $(1,105)

Net Change .............................................................................. $ (37)

(1) Estimated fair value presented in the table above represents the estimated fair value of all financial instruments within this financial statement caption

not necessarily those solely subject to equity price risk.

(2) Embedded derivatives are recognized in the consolidated balance sheet in the same caption as the host contract.

(3) During the fourth quarter of 2011, the analysis of the impact of a 10% change (increase or decrease) in equity prices determined that due to a

change in the portfolio composition of derivatives employed by the Company, an increase of 10% had the most adverse effect on our equity risk

while the prior year end’s analysis of equity prices shows a decrease of 10% had the most adverse effect.

Equity price risk increased by $23 million to $37 million at December 31, 2011 from $14 million at December 31, 2010. This increase is primarily

due to a change in the portfolio composition of derivatives employed by the Company.

MetLife, Inc. 83