MetLife 2011 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2011 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

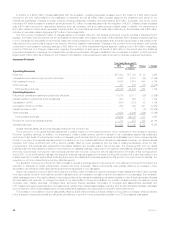

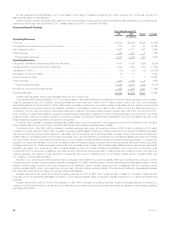

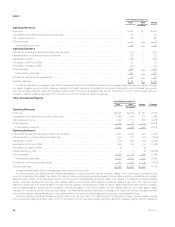

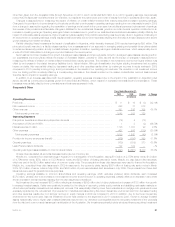

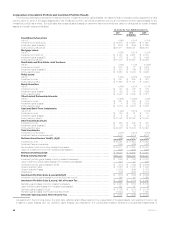

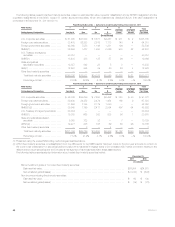

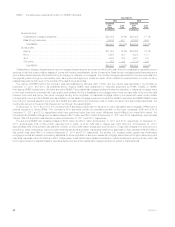

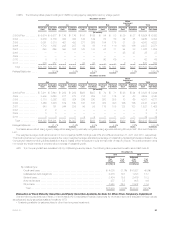

Composition of Investment Portfolio and Investment Portfolio Results

The following yield table presents the investment income, investment portfolio gains (losses), annualized yields on average ending assets and ending

carrying value for each of the asset classes within the investment portfolio, as well as investment income and investment portfolio gains (losses) for the

investment portfolio as a whole. The yield table also presents gains (losses) on derivative instruments which are used to manage risk for certain invested

assets and certain insurance liabilities:

At and for the Years Ended December 31,

2011 2010 2009

(In millions)

Fixed Maturity Securities:

Yield (1) ....................................................................... 4.94% 5.54% 5.75%

Investment income(2),(3),(4) ........................................................ $ 15,016 $ 12,567 $ 11,827

Investment gains (losses)(3) ........................................................ $ (932) $ (255) $ (1,658)

Ending carrying value(2),(3) ........................................................ $351,011 $325,391 $228,070

Mortgage Loans:

Yield(1) ........................................................................ 5.53% 5.51% 5.38%

Investment income(3),(4) .......................................................... $ 3,162 $ 2,821 $ 2,734

Investment gains (losses)(3) ........................................................ $ 175 $ 22 $ (442)

Ending carrying value(3) ........................................................... $ 61,303 $ 55,457 $ 50,824

Real Estate and Real Estate Joint Ventures:

Yield(1) ........................................................................ 3.76% 1.10% (7.47)%

Investment income(3) ............................................................. $ 307 $ 77 $ (541)

Investment gains (losses)(3) ........................................................ $ 230 $ (40) $ (156)

Ending carrying value ............................................................. $ 8,563 $ 8,030 $ 6,896

Policy Loans:

Yield(1) ........................................................................ 5.43% 6.38% 6.49%

Investment income .............................................................. $ 641 $ 649 $ 641

Ending carrying value ............................................................. $ 11,892 $ 11,761 $ 9,932

Equity Securities:

Yield(1) ........................................................................ 4.44% 4.40% 5.12%

Investment income .............................................................. $ 141 $ 128 $ 176

Investment gains (losses) .......................................................... $ (23) $ 104 $ (399)

Ending carrying value ............................................................. $ 3,023 $ 3,602 $ 3,081

Other Limited Partnership Interests:

Yield(1) ........................................................................ 10.58% 14.99% 3.22%

Investment income .............................................................. $ 681 $ 879 $ 174

Investment gains (losses) .......................................................... $ 4 $ (18) $ (356)

Ending carrying value ............................................................. $ 6,378 $ 6,416 $ 5,508

Cash and Short-Term Investments:

Yield(1), (5) ..................................................................... 1.04% 0.61% 0.53%

Investment income .............................................................. $ 155 $ 81 $ 93

Investment gains (losses) .......................................................... $ 2 $ 2 $ 6

Ending carrying value(3) ........................................................... $ 27,750 $ 22,302 $ 18,385

Other Invested Assets:(1)

Investment income .............................................................. $ 454 $ 492 $ 335

Investment gains (losses)(3) ........................................................ $ (9) $ (8) $ (32)

Ending carrying value ............................................................. $ 23,628 $ 15,430 $ 12,697

Total Investments:

Investment income yield(1) ........................................................ 5.01% 5.51% 5.08%

Investment fees and expenses yield ................................................. (0.13) (0.14) (0.14)

Net Investment Income Yield(1), (3),(5) ........................................... 4.88% 5.37% 4.94%

Investment income .............................................................. $ 20,557 $ 17,694 $ 15,439

Investment fees and expenses ..................................................... (546) (465) (432)

Net investment income including divested businesses ................................... $ 20,011 $ 17,229 $ 15,007

Less: net investment income from divested businesses(5) ................................ (335) (349) (407)

Net Investment Income(3) ...................................................... $ 19,676 $ 16,880 $ 14,600

Ending Carrying Value(3) ....................................................... $493,548 $448,389 $335,393

Investment portfolio gains (losses) including divested businesses ........................... $ (553) $ (193) $ (3,037)

Less: investment portfolio gains (losses) from divested businesses(5) ....................... 140 33 129

Investment portfolio gains (losses)(3),(5),(6) ............................................ $ (413) $ (160) $ (2,908)

Gross investment gains ........................................................... $ 1,354 $ 1,180 $ 1,226

Gross investment losses .......................................................... (1,058) (840) (1,393)

Writedowns .................................................................... (709) (500) (2,741)

Investment Portfolio Gains (Losses)(3),(5),(6) ...................................... $ (413) $ (160) $ (2,908)

Investment portfolio gains (losses) income tax (expense) benefit ............................ 148 46 1,068

Investment Portfolio Gains (Losses), Net of Income Tax ............................ $ (265) $ (114) $ (1,840)

Derivative gains (losses) including divested businesses .................................. $ 4,545 $ (614) $ (5,106)

Less: derivative gains (losses) from divested businesses(5) ............................... 163 41 (2)

Derivative gains (losses)(3),(5),(6) .................................................... $ 4,708 $ (573) $ (5,108)

Derivative gains (losses) income tax (expense) benefit ................................... (1,643) 144 1,804

Derivative Gains (Losses), Net of Income Tax ..................................... $ 3,065 $ (429) $ (3,304)

As described in the footnotes below, the yield table reflects certain differences from the presentation of invested assets, net investment income, net

investment gains (losses) and net derivative gains (losses) as presented in the consolidated balance sheets and consolidated statements of

42 MetLife, Inc.