MetLife 2011 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2011 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

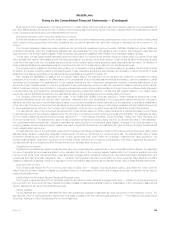

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

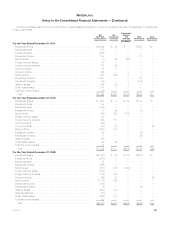

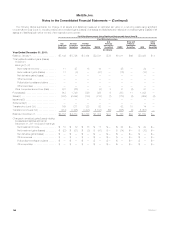

December 31, 2011

Fair Value Measurements at Reporting Date Using

Quoted Prices in

Active Markets for

Identical Assets

and Liabilities

(Level 1)

Significant Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Total

Estimated

Fair

Value

(In millions)

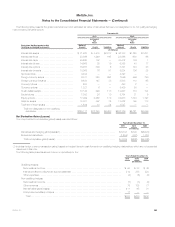

Liabilities:

Derivative liabilities:(3)

Interest rate contracts ..................................................... $ 91 $ 2,351 $ 38 $ 2,480

Foreign currency contracts ................................................. — 1,103 17 1,120

Credit contracts .......................................................... — 85 28 113

Equity market contracts .................................................... 12 211 75 298

Total derivative liabilities .................................................. 103 3,750 158 4,011

Net embedded derivatives within liability host contracts(4) ........................... — 19 4,565 4,584

Long-term debt of CSEs ..................................................... — 2,952 116 3,068

Liability related to securitized reverse residential mortgage loans(6) .................... — 6,451 1,175 7,626

Trading liabilities(6) .......................................................... 124 3 — 127

Total liabilities ............................................................ $ 227 $ 13,175 $ 6,014 $ 19,416

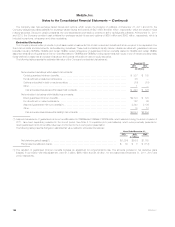

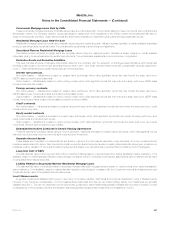

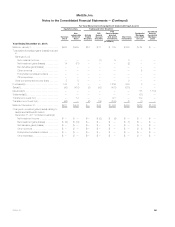

December 31, 2010

Fair Value Measurements at Reporting Date Using

Quoted Prices in

Active Markets for

Identical Assets

and Liabilities

(Level 1)

Significant Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Total

Estimated

Fair

Value

(In millions)

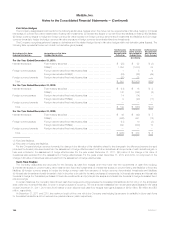

Assets:

Fixed maturity securities:

U.S. corporate securities ................................................... $ — $ 84,623 $ 7,149 $ 91,772

Foreign corporate securities ................................................ — 62,162 5,726 67,888

Foreign government securities ............................................... 149 38,719 3,134 42,002

RMBS ................................................................. 274 43,037 2,541 45,852

U.S. Treasury and agency securities .......................................... 14,602 18,623 79 33,304

CMBS ................................................................. — 19,664 1,011 20,675

State and political subdivision securities ....................................... — 10,083 46 10,129

ABS ................................................................... — 10,142 3,026 13,168

Other fixed maturity securities ............................................... — 3 4 7

Total fixed maturity securities .............................................. 15,025 287,056 22,716 324,797

Equity securities:

Common stock .......................................................... 831 1,094 268 2,193

Non-redeemable preferred stock ............................................. — 504 905 1,409

Total equity securities .................................................... 831 1,598 1,173 3,602

Trading and other securities:

Actively Traded Securities .................................................. — 453 10 463

FVO general account securities .............................................. — 54 77 131

FVO contractholder-directed unit-linked investments ............................. 6,270 10,789 735 17,794

FVO securities held by CSEs ................................................ — 201 — 201

Total trading and other securities ........................................... 6,270 11,497 822 18,589

Short-term investments(1) .................................................... 3,026 4,681 858 8,565

Mortgage loans:

Commercial mortgage loans held by CSEs ..................................... — 6,840 — 6,840

Residential mortgage loans held-for-sale(2) ..................................... — 2,486 24 2,510

Total mortgage loans .................................................... — 9,326 24 9,350

152 MetLife, Inc.