MetLife 2011 Annual Report Download - page 161

Download and view the complete annual report

Please find page 161 of the 2011 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MetLife, Inc.

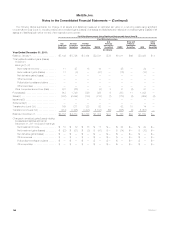

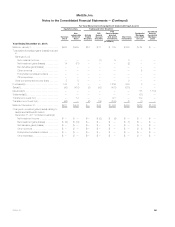

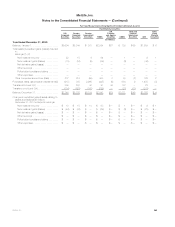

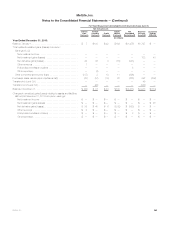

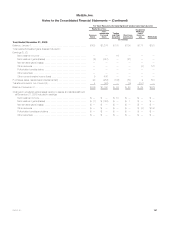

Notes to the Consolidated Financial Statements — (Continued)

Commercial Mortgage Loans Held by CSEs

These commercial mortgage loans are principally valued using the market approach. The principal market for these commercial loan portfolios is the

securitization market. The Company uses the quoted securitization market price of the obligations of the CSEs to determine the estimated fair value of

these commercial loan portfolios. These market prices are determined principally by independent pricing services using observable inputs.

Residential Mortgage Loans Held-For-Sale

Residential mortgage loans held-for-sale are principally valued using the market approach. Valuation is based primarily on readily available observable

pricing for securities backed by similar loans. The unobservable adjustments to such prices are insignificant.

Securitized Reverse Residential Mortgage Loans

Securitized reverse residential mortgage loans are principally valued using the market approach. Valuation is based primarily on readily available

observable pricing for securities backed by similar fixed-rate loans. The unobservable adjustments to such prices are not significant.

Derivative Assets and Derivative Liabilities

This level includes all types of derivative instruments utilized by the Company with the exception of exchange-traded derivatives and interest rate

forwards to sell certain to-be-announced securities included within Level 1 and those derivative instruments with unobservable inputs as describedin

Level 3. These derivatives are principally valued using an income approach.

Interest rate contracts.

Non-option-based — Valuations are based on present value techniques, which utilize significant inputs that may include the swap yield curve,

LIBOR basis curves and repurchase rates.

Option-based — Valuations are based on option pricing models, which utilize significant inputs that may include the swap yield curve, LIBOR basis

curves and interest rate volatility.

Foreign currency contracts.

Non-option-based — Valuations are based on present value techniques, which utilize significant inputs that may include the swap yield curve,

LIBOR basis curves, currency spot rates and cross currency basis curves.

Option-based — Valuations are based on option pricing models, which utilize significant inputs that may include the swap yield curve, LIBOR basis

curves, currency spot rates, cross currency basis curves and currency volatility.

Credit contracts.

Non-option-based — Valuations are based on present value techniques, which utilize significant inputs that may include the swap yield curve, credit

curves and recovery rates.

Equity market contracts.

Non-option-based — Valuations are based on present value techniques, which utilize significant inputs that may include the swap yield curve, spot

equity index levels and dividend yield curves.

Option-based — Valuations are based on option pricing models, which utilize significant inputs that may include the swap yield curve, spot equity

index levels, dividend yield curves and equity volatility.

Embedded Derivatives Contained in Certain Funding Agreements

These derivatives are principally valued using an income approach. Valuations are based on present value techniques, which utilize significant inputs

that may include the swap yield curve and the spot equity and bond index level.

Separate Account Assets

These assets are comprised of investments that are similar in nature to the fixed maturity securities, equity securities, short-term investments and

derivative assets referred to above. Also included are certain mutual funds and hedge funds without readily determinable fair values given prices are not

published publicly. Valuation of the mutual funds and hedge funds is based upon quoted prices or reported NAV provided by the fund managers.

Long-term Debt of CSEs

The estimated fair value of the long-term debt of the Company’s CSEs is based on quoted prices when traded as assets in active markets or, if not

available, based on market standard valuation methodologies, consistent with the Company’s methods and assumptions used to estimate the fair value

of comparable fixed maturity securities.

Liability Related to Securitized Reverse Residential Mortgage Loans

The estimated fair value of the liability related to securitized reverse residential mortgage loans, is based on quoted prices when traded as assets in

active markets or, if not available, based on market standard valuation methodologies, consistent with the Company’s methods and assumptions used

to estimate the fair value of comparable financial instruments.

Level 3 Measurements:

In general, investments classified within Level 3 use many of the same valuation techniques and inputs as described in Level 2 Measurements.

However, if key inputs are unobservable, or if the investments are less liquid and there is very limited trading activity, the investments are generally

classified as Level 3. The use of independent non-binding broker quotations to value investments generally indicates there is a lack of liquidity or a lack

of transparency in the process to develop the valuation estimates generally causing these investments to be classified in Level 3.

MetLife, Inc. 157