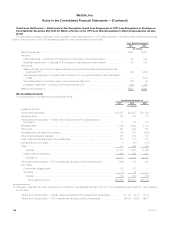

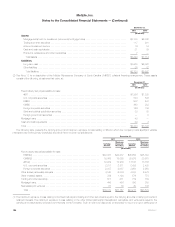

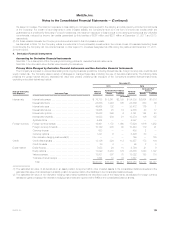

MetLife 2011 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2011 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

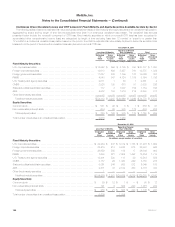

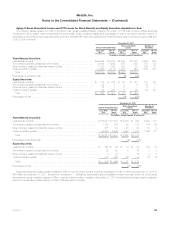

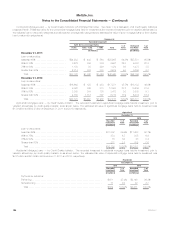

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

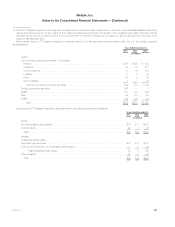

(2) Amounts are presented net of changes in estimated fair value of derivatives related to economic hedges of the Company’s investment in these

equity method international joint venture investments that do not qualify for hedge accounting of ($23) million, $36 million, and ($143) million for the

years ended December 31, 2011, 2010, and 2009, respectively.

See “— Variable Interest Entities” for discussion of CSEs included in the table above.

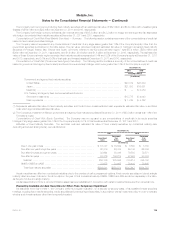

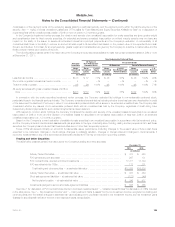

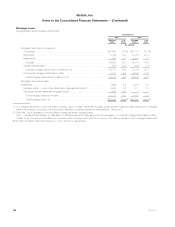

Securities Lending

As described more fully in Note 1, the Company participates in a securities lending program whereby blocks of securities are loaned to third parties.

These transactions are treated as financing arrangements and the associated cash collateral received is recorded as a liability. The Company is

obligated to return the cash collateral received to its counterparties.

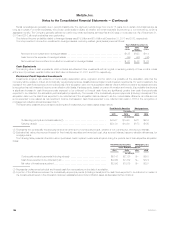

Elements of the securities lending program are presented below at:

December 31,

2011 2010

(In millions)

Securities on loan:(1)

Amortized cost ....................................................................... $20,613 $23,715

Estimated fair value .................................................................... $24,072 $24,230

Cash collateral on deposit from counterparties(2) .............................................. $24,223 $24,647

Security collateral on deposit from counterparties .............................................. $ 371 $ —

Reinvestment portfolio — estimated fair value ................................................. $23,940 $24,177

(1) Included within fixed maturity securities and short-term investments.

(2) Included within payables for collateral under securities loaned and other transactions.

Security collateral on deposit from counterparties in connection with the securities lending transactions may not be sold or repledged, unless the

counterparty is in default, and is not reflected in the consolidated financial statements.

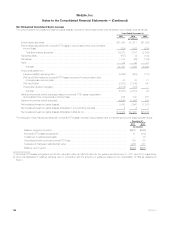

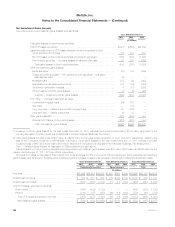

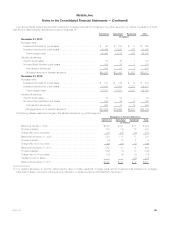

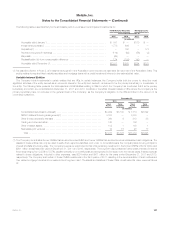

Invested Assets on Deposit, Held in Trust and Pledged as Collateral

Invested assets on deposit, held in trust and pledged as collateral are presented in the table below at estimated fair value for cash and cash

equivalents, short-term investments, fixed maturity securities, equity securities, and trading and other securities and at carrying value for mortgage loans.

December 31,

2011 2010

(In millions)

Invested assets on deposit(1) .............................................................. $ 1,660 $ 2,110

Invested assets held in trust(2) ............................................................. 11,135 8,430

Invested assets pledged as collateral(3) ...................................................... 29,899 29,470

Total invested assets on deposit, held in trust and pledged as collateral ........................... $42,694 $40,010

(1) The Company has invested assets on deposit with regulatory agencies consisting primarily of cash and cash equivalents, short-term investments,

fixed maturity securities and equity securities.

(2) The Company held in trust cash and securities, primarily fixed maturity and equity securities, to satisfy requirements under certain collateral financing

agreements and certain reinsurance agreements.

(3) The Company has pledged fixed maturity securities, mortgage loans and cash and cash equivalents in connection with various agreements and

transactions, including funding and advances agreements (see Notes 8 and 11), collateralized borrowings (see Note 11), collateral financing

arrangements (see Note 12), derivative transactions (see Note 4), and short sale agreements (see “— Trading and Other Securities”).

MetLife, Inc. 129