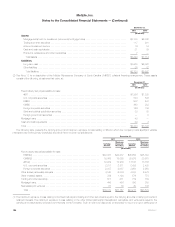

MetLife 2011 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2011 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

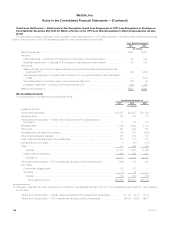

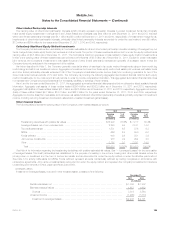

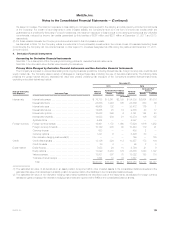

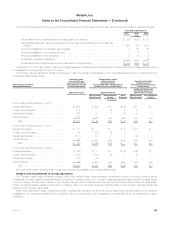

December 31,

2011 2010

(In millions)

Assets:

Mortgage loans held-for-investment (commercial mortgage loans) .................................. $3,138 $6,840

Trading and other securities ............................................................... 117 201

Accrued investment income ............................................................... 16 34

Cash and cash equivalents ................................................................ 21 39

Premiums, reinsurance and other receivables ................................................. 7 —

Total assets .......................................................................... $3,299 $7,114

Liabilities:

Long-term debt ......................................................................... $3,068 $6,820

Other liabilities .......................................................................... 35 72

Total liabilities ........................................................................ $3,103 $6,892

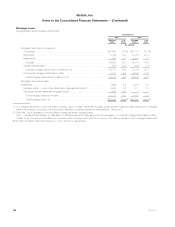

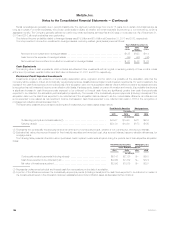

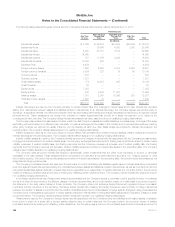

(2) See Note 12 for a description of the MetLife Reinsurance Company of South Carolina (“MRSC”) collateral financing arrangement. These assets

consist of the following, at estimated fair value, at:

December 31,

2011 2010

(In millions)

Fixed maturity securities available-for-sale:

ABS ................................................................................. $1,356 $1,333

U.S. corporate securities ................................................................. 833 893

RMBS ................................................................................ 502 547

CMBS ................................................................................ 369 383

Foreign corporate securities ............................................................... 126 139

State and political subdivision securities ...................................................... 39 30

Foreign government securities ............................................................. — 5

Mortgage loans ........................................................................... 49 —

Cash and cash equivalents ................................................................. 59 3

Total ................................................................................... $3,333 $3,333

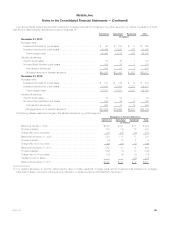

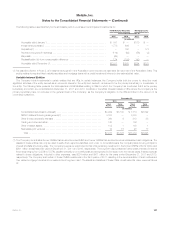

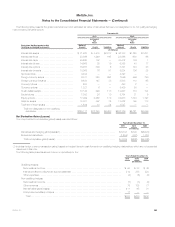

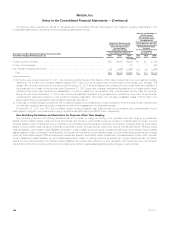

The following table presents the carrying amount and maximum exposure to loss relating to VIEs for which the Company holds significant variable

interests but is not the primary beneficiary and which have not been consolidated at:

December 31,

2011 2010

Carrying

Amount

Maximum

Exposure

to Loss(1) Carrying

Amount

Maximum

Exposure

to Loss(1)

(In millions)

Fixed maturity securities available-for-sale:

RMBS(2) ....................................................... $42,637 $42,637 $45,852 $45,852

CMBS(2) ....................................................... 19,069 19,069 20,675 20,675

ABS(2) ........................................................ 12,979 12,979 13,168 13,168

U.S. corporate securities .......................................... 2,911 2,911 2,435 2,435

Foreign corporate securities ........................................ 2,087 2,087 2,950 2,950

Other limited partnership interests ..................................... 4,340 6,084 4,383 6,479

Other invested assets ............................................... 799 1,194 576 773

Trading and other securities .......................................... 671 671 789 789

Mortgage loans .................................................... 456 456 350 350

Real estate joint ventures ............................................ 61 79 40 108

Total .......................................................... $86,010 $88,167 $91,218 $93,579

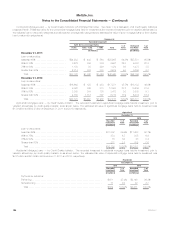

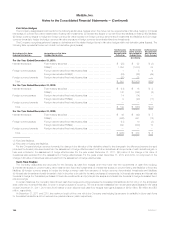

(1) The maximum exposure to loss relating to the fixed maturity and trading and other securities is equal to the carrying amounts or carrying amounts of

retained interests. The maximum exposure to loss relating to the other limited partnership interests and real estate joint ventures is equal to the

carrying amounts plus any unfunded commitments of the Company. Such a maximum loss would be expected to occur only upon bankruptcy of

138 MetLife, Inc.