MetLife 2011 Annual Report Download - page 238

Download and view the complete annual report

Please find page 238 of the 2011 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

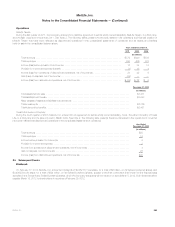

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

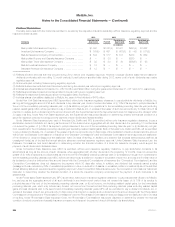

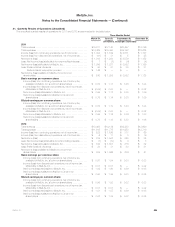

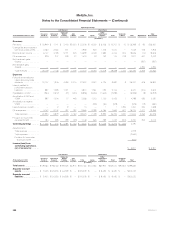

Operating Earnings

Adjustments Total

Consolidated

U.S. Business International

Corporate

& Other TotalYear Ended December 31, 2009 Insurance

Products Retirement

Products

Corporate

Benefit

Funding Auto

& Home Total Japan

Other

International

Regions Total

(In millions)

Revenues

Premiums ........................... $17,168 $ 920 $2,264 $2,902 $23,254 $— $2,884 $2,884 $ 19 $26,157 $ — $26,157

Universal life and investment-type product

policy fees ......................... 2,281 1,543 176 — 4,000 — 1,055 1,055 — 5,055 142 5,197

Net investment income ................. 5,614 3,098 4,527 180 13,419 — 1,111 1,111 70 14,600 141 14,741

Other revenues ....................... 779 173 238 33 1,223 — 14 14 236 1,473 856 2,329

Net investment gains (losses) ............ — — — — — — — — — — (2,901) (2,901)

Net derivative gains (losses) ............. — — — — — — — — — — (4,866) (4,866)

Total revenues ...................... 25,842 5,734 7,205 3,115 41,896 — 5,064 5,064 325 47,285 (6,628) 40,657

Expenses

Policyholder benefits and claims and

policyholder dividends ................ 19,111 1,486 4,245 1,932 26,774 — 2,326 2,326 4 29,104 548 29,652

Interest credited to policyholder account

balances .......................... 952 1,688 1,632 — 4,272 — 577 577 — 4,849 (4) 4,845

Capitalization of DAC ................... (873) (1,067) (14) (435) (2,389) — (587) (587) — (2,976) — (2,976)

Amortization of DAC and VOBA ........... 725 610 15 436 1,786 — 397 397 3 2,186 (897) 1,289

Amortization of negative VOBA ........... — — — — — — — — — — — —

Interest expense on debt ................ 6 — 3 — 9 — 8 8 1,027 1,044 — 1,044

Other expenses ....................... 4,206 2,403 456 764 7,829 — 1,737 1,737 586 10,152 1,012 11,164

Total expenses ..................... 24,127 5,120 6,337 2,697 38,281 — 4,458 4,458 1,620 44,359 659 45,018

Provision for income tax expense (benefit) . . 573 216 288 96 1,173 — 155 155 (756) 572 (2,597) (2,025)

Operating earnings .................. $ 1,142 $ 398 $ 580 $ 322 $ 2,442 $— $ 451 $ 451 $ (539) 2,354

Adjustments to:

Total revenues ...................... (6,628)

Total expenses ..................... (659)

Provision for income tax (expense)

benefit .......................... 2,597

Income (loss) from continuing

operations, net of income tax ....... $ (2,336) $ (2,336)

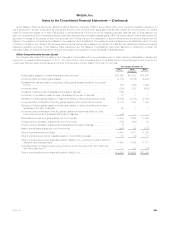

Net investment income is based upon the actual results of each segment’s specifically identifiable asset portfolio adjusted for allocated equity. Other

costs are allocated to each of the segments based upon: (i) a review of the nature of such costs; (ii) time studies analyzing the amount of employee

compensation costs incurred by each segment; and (iii) cost estimates included in the Company’s product pricing.

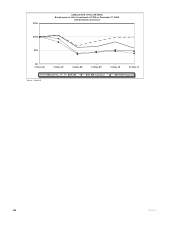

Operating revenues derived from any customer did not exceed 10% of consolidated operating revenues for the years ended December 31, 2011,

2010 and 2009. Operating revenues from U.S. operations were $44.7 billion, $43.7 billion and $41.4 billion for the years ended December 31, 2011,

2010 and 2009, respectively, which represented 68%, 85% and 88%, respectively, of consolidated operating revenues.

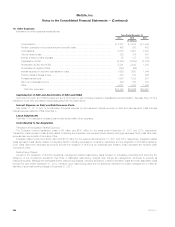

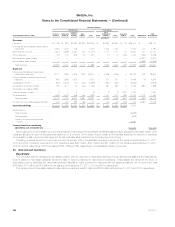

23. Discontinued Operations

Real Estate

The Company actively manages its real estate portfolio with the objective of maximizing earnings through selective acquisitions and dispositions.

Income related to real estate classified as held-for-sale or sold is presented in discontinued operations. These assets are carried at the lower of

depreciated cost or estimated fair value less expected disposition costs. Income from discontinued real estate operations, net of income tax, was

$64 million, $11 million and $19 million for the years ended December 31, 2011, 2010 and 2009, respectively.

The carrying value of real estate related to discontinued operations was $1 million and $184 million at December 31, 2011 and 2010, respectively.

234 MetLife, Inc.