MetLife 2011 Annual Report Download - page 158

Download and view the complete annual report

Please find page 158 of the 2011 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MetLife, Inc.

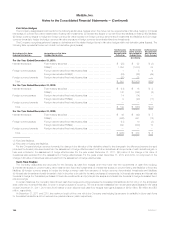

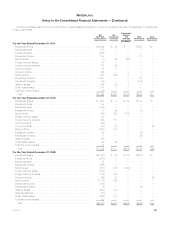

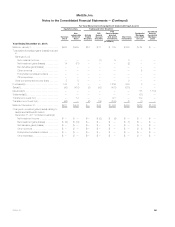

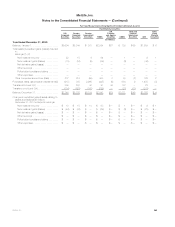

Notes to the Consolidated Financial Statements — (Continued)

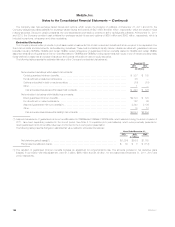

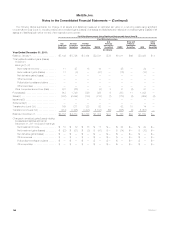

The methods and assumptions used to estimate the fair value of financial instruments are summarized as follows:

Fixed Maturity Securities, Equity Securities, Trading and Other Securities and Short-term Investments

When available, the estimated fair value of the Company’s fixed maturity securities, equity securities, trading and other securities and short-term

investments are based on quoted prices in active markets that are readily and regularly obtainable. Generally, these are the most liquid of the

Company’s securities holdings and valuation of these securities does not involve management’s judgment.

When quoted prices in active markets are not available, the determination of estimated fair value is based on market standard valuation

methodologies, giving priority to observable inputs. The market standard valuation methodologies utilized include: discounted cash flow methodologies,

matrix pricing or other similar techniques. The inputs in applying these market standard valuation methodologies include, but are not limited to: interest

rates, credit standing of the issuer or counterparty, industry sector of the issuer, coupon rate, call provisions, sinking fund requirements, maturity and

management’s assumptions regarding estimated duration, liquidity and estimated future cash flows. Accordingly, the estimated fair values are based on

available market information and management’s judgments about financial instruments.

The significant inputs to the market standard valuation methodologies for certain types of securities with reasonable levels of price transparency are

inputs that are observable in the market or can be derived principally from or corroborated by observable market data. Such observable inputs include

benchmarking prices for similar assets in active markets, quoted prices in markets that are not active and observable yields and spreads in the market.

When observable inputs are not available, the market standard valuation methodologies for determining the estimated fair value of certain types of

securities that trade infrequently, and therefore have little or no price transparency, rely on inputs that are significant to the estimated fair value that are

not observable in the market or cannot be derived principally from or corroborated by observable market data. These unobservable inputs can be based

in large part on management’s judgment or estimation and cannot be supported by reference to market activity. Even though these inputs are

unobservable, management believes they are consistent with what other market participants would use when pricing such securities and are considered

appropriate given the circumstances.

The estimated fair value of FVO securities held by CSEs is determined on a basis consistent with the methodologies described herein for fixed

maturity securities and equity securities. The Company consolidates certain securitization entities that hold securities that have been accounted for

under the FVO and classified within trading and other securities.

The use of different methodologies, assumptions and inputs may have a material effect on the estimated fair values of the Company’s securities

holdings.

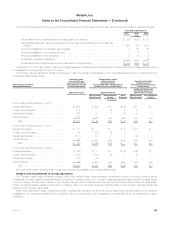

Mortgage Loans

The Company has elected the FVO for commercial mortgage loans held by CSEs, residential mortgage loans held-for-sale and securitized reverse

residential mortgage loans. See Note 1 for a discussion of these mortgage loans. See “— Valuation Techniques and Inputs by Level Within the Three-

Level Fair Value Hierarchy by Major Classes of Assets and Liabilities” below for a discussion of the methods and assumptions used to estimate the fair

value of these financial instruments.

MSRs

Although MSRs are not financial instruments, the Company has included them in the preceding table as a result of its election to carry MSRs at

estimated fair value. See “— Valuation Techniques and Inputs by Level Within the Three-Level Fair Value Hierarchy by Major Classes of Assets and

Liabilities” below for a discussion of the methods and assumptions used to estimate the fair value of these financial instruments.

Other Investments

Other investments is primarily comprised of investment funds. The estimated fair value of these investment funds is determined on a basis consistent

with the methodologies described herein for trading and other securities.

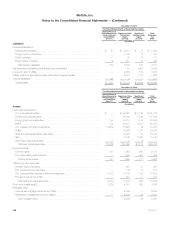

Derivatives

The estimated fair value of derivatives is determined through the use of quoted market prices for exchange-traded derivatives and interest rate

forwards to sell certain to be announced securities, or through the use of pricing models for OTC derivatives. The determination of estimated fair value,

when quoted market values are not available, is based on market standard valuation methodologies and inputs that management believes are

consistent with what other market participants would use when pricing the instruments. Derivative valuations can be affected by changes in interest

rates, foreign currency exchange rates, financial indices, credit spreads, default risk, nonperformance risk, volatility, liquidity and changes in estimates

and assumptions used in the pricing models.

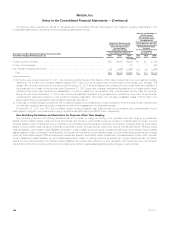

The significant inputs to the pricing models for most OTC derivatives are inputs that are observable in the market or can be derived principally from or

corroborated by observable market data. Significant inputs that are observable generally include: interest rates, foreign currency exchange rates, interest

rate curves, credit curves and volatility. However, certain OTC derivatives may rely on inputs that are significant to the estimated fair value that are not

observable in the market or cannot be derived principally from or corroborated by observable market data. Significant inputs that are unobservable

generally include: independent broker quotes, references to emerging market currencies and inputs that are outside the observable portion of the

interest rate curve, credit curve, volatility or other relevant market measure. These unobservable inputs may involve significant management judgment or

estimation. Even though unobservable, these inputs are based on assumptions deemed appropriate given the circumstances and management

believes they are consistent with what other market participants would use when pricing such instruments.

The credit risk of both the counterparty and the Company are considered in determining the estimated fair value for all OTC derivatives, and any

potential credit adjustment is based on the net exposure by counterparty after taking into account the effects of netting agreements and collateral

arrangements. The Company values its derivative positions using the standard swap curve which includes a spread to the risk free rate. This credit

spread is appropriate for those parties that execute trades at pricing levels consistent with the standard swap curve. As the Company and its significant

derivative counterparties consistently execute trades at such pricing levels, additional credit risk adjustments are not currently required in the valuation

process. The Company’s ability to consistently execute at such pricing levels is in part due to the netting agreements and collateral arrangements that

are in place with all of its significant derivative counterparties. The evaluation of the requirement to make additional credit risk adjustments is performed

by the Company each reporting period.

154 MetLife, Inc.