MetLife 2011 Annual Report Download - page 9

Download and view the complete annual report

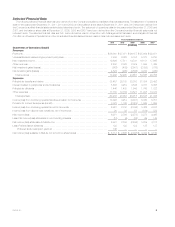

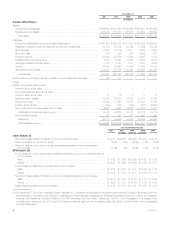

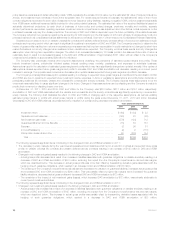

Please find page 9 of the 2011 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(2) At December 31, 2011, general account assets, long-term debt and other liabilities include amounts relating to variable interest entities of

$7.3 billion, $3.1 billion and $60 million, respectively. At December 31, 2010, general account assets, long-term debt and other liabilities include

amounts relating to variable interest entities of $11.1 billion, $6.9 billion and $93 million, respectively.

(3) Policyholder liabilities and other policy-related balances include future policy benefits, policyholder account balances, other policy-related balances,

policyholder dividends payable and the policyholder dividend obligation.

(4) Return on MetLife, Inc.’s common equity is defined as net income (loss) available to MetLife, Inc.’s common shareholders divided by MetLife, Inc.’s

average common stockholders’ equity.

(5) For the year ended December 31, 2009, shares related to the assumed exercise or issuance of stock-based awards have been excluded from the

calculation of diluted earnings per common share as these assumed shares are anti-dilutive.

Business

With a more than 140-year history, we have grown to become a leading global provider of insurance, annuities and employee benefit programs,

serving 90 million customers in over 50 countries. Through our subsidiaries and affiliates, we hold leading market positions in the United States, Japan,

Latin America, Asia Pacific, Europe and the Middle East. Over the past several years, we have grown our core businesses, as well as successfully

executed on our growth strategy. This has included completing a number of transactions that have resulted in the acquisition and, in some cases,

divestiture of certain businesses while also further strengthening our balance sheet to position MetLife for continued growth.

MetLife is organized into six segments: Insurance Products, Retirement Products, Corporate Benefit Funding and Auto & Home (collectively, “U.S.

Business”), and Japan and Other International Regions (collectively, “International”). In addition, the Company reports certain of its results of operations in

Corporate & Other, which includes MetLife Bank, National Association (“MetLife Bank”) and other business activities. On November 21, 2011, MetLife,

Inc. announced that it will be reorganizing its business into three broad geographic regions: The Americas; Europe, the Middle East and Africa (“EMEA”);

and Asia, and creating a global employee benefits business to better reflect its global reach. While the Company has initiated certain changes in

response to this announcement, including the appointment of certain executive leadership into some of the roles designed for the reorganized structure,

management continued to evaluate the performance of the operating segments under the existing segment structure as of December 31, 2011. In

addition, management continues to evaluate the Company’s segment performance and allocated resources and may adjust such measurements in the

future to better reflect segment profitability.

In December 2011, MetLife Bank and MetLife, Inc. entered into a definitive agreement to sell most of the depository business of MetLife Bank. The

transaction is expected to close in the second quarter of 2012, subject to certain regulatory approvals and other customary closing conditions.

Additionally, in January 2012, MetLife, Inc. announced it is exiting the business of originating forward residential mortgages (together with MetLife Bank’s

pending actions to exit the depository business, including the aforementioned December 2011 agreement, the “MetLife Bank Events”). Once MetLife

Bank has completely exited its depository business, MetLife, Inc. plans to terminate MetLife Bank’s Federal Deposit Insurance Corporation (“FDIC”)

insurance, putting MetLife, Inc. in a position to be able to deregister as a bank holding company. The Company continues to originate reverse

mortgages and will continue to service its current mortgage customers. See Note 2 of the Notes to the Consolidated Financial Statements.

In November 2011, the Company entered into an agreement to sell its insurance operations in the Caribbean region, Panama and Costa Rica (the

“Caribbean Business”). The sale is expected to close in the second quarter of 2012 subject to regulatory approval and other customary closing

conditions. See Note 2 of the Notes to the Consolidated Financial Statements.

On November 1, 2010 (the “Acquisition Date”), MetLife, Inc. completed the acquisition of American Life Insurance Company (“American Life”) from

AM Holdings LLC (formerly known as ALICO Holdings LLC) (“AM Holdings”), a subsidiary of American International Group, Inc. (“AIG”), and Delaware

American Life Insurance Company (“DelAm”) from AIG (American Life, together with DelAm, collectively, “ALICO”) (the “Acquisition”). ALICO’s fiscal

year-end is November 30. Accordingly, the Company’s consolidated financial statements reflect the assets and liabilities of ALICO as of November 30,

2011 and 2010, and the operating results of ALICO for the year ended November 30, 2011 and the one month ended November 30, 2010. The

assets, liabilities and operating results relating to the Acquisition are included in the Japan and Other International Regions segments. Prior year results

have been adjusted to conform to the current year presentation of segments. See Note 2 of the Notes to the Consolidated Financial Statements.

In the U.S., we provide a variety of insurance and financial services products — including life, dental, disability, auto and homeowners insurance,

guaranteed interest and stable value products, and annuities — through both proprietary and independent retail distribution channels, as well as at the

workplace. This business serves approximately 60,000 group customers, including over 90 of the top one hundred FORTUNE 500®companies, and

provides protection and retirement solutions to millions of individuals. U.S. Business markets our products and services through various distribution

groups. Our life insurance and retirement products targeted to individuals are sold via sales forces, comprised of MetLife employees, in addition to third-

party organizations. Our group life, non-medical health and corporate benefit funding products are sold via sales forces primarily comprised of MetLife

employees. Personal lines property and casualty insurance products are directly marketed to employees at their employer’s worksite. Auto & Home

products are also marketed and sold to individuals by independent agents and property and casualty specialists through a direct response channel and

the individual distribution sales group. MetLife sales employees work with all distribution groups to better reach and service customers, brokers,

consultants and other intermediaries.

Outside the U.S., we operate in Japan and over 50 countries within Latin America, Asia Pacific, Europe and the Middle East. MetLife is the largest

life insurer in Mexico and also holds leading market positions in Japan, Poland, Chile and Korea. This business provides life insurance, accident and

health insurance, credit insurance, annuities, endowment and retirement & savings products to both individuals and groups. We believe our international

operations will grow more quickly than our U.S. Business in the future. International markets its products and services through a multi-distribution

strategy which varies by geographic region. The various distribution channels include: agency, bancassurance, direct marketing (“DM”), brokerage and

e-commerce. In developing countries, agency covers the needs of the emerging middle class with primarily traditional products (e.g., endowment and

accident and health). In more developed and mature markets, agents, while continuing to serve their existing customers to keep pace with their

developing financial needs, also target upper middle class and high net worth customer bases with a more sophisticated product set including more

investment-sensitive products, such as universal life, mutual fund and single premium deposits. In the bancassurance channel, International leverages

partnerships that span all regions. In addition, DM has extensive and far reaching capabilities in all regions. The DM operations deploy both broadcast

marketing approaches (e.g. direct response TV, web-based lead generation) and traditional DM techniques such as telemarketing. Japan represents

our largest DM market.

Operating revenues derived from any customer did not exceed 10% of consolidated operating revenues in any of the last three years. Financial

information, including revenues, expenses, operating earnings, and total assets by segment, is provided in Note 22 of the Notes to the Consolidated

MetLife, Inc. 5