MetLife 2011 Annual Report Download - page 151

Download and view the complete annual report

Please find page 151 of the 2011 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

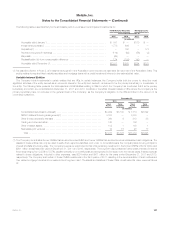

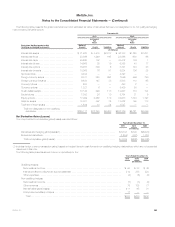

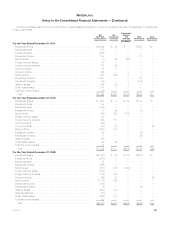

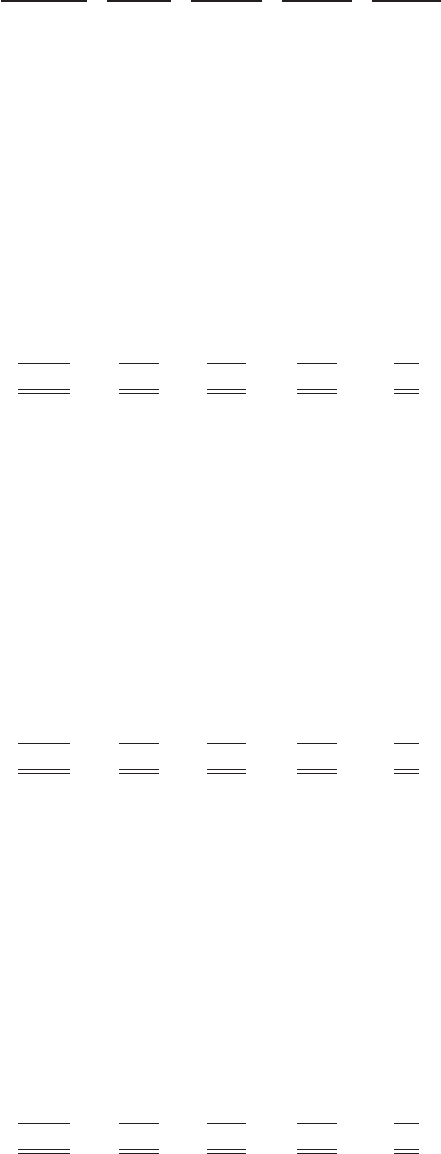

The following tables present the amount and location of gains (losses) recognized in income for derivatives that were not designated or qualifying as

hedging instruments:

Net

Derivative

Gains (Losses)

Net

Investment

Income(1)

Policyholder

Benefits

and

Claims(2) Other

Revenues(3) Other

Expenses(4)

(In millions)

For the Year Ended December 31, 2011:

Interest rate swaps ................................................ $2,544 $ (2) $ — $ 367 $—

Interest rate floors ................................................. 517 — — — —

Interest rate caps ................................................. (228) — — — —

Interest rate futures ................................................ 100 1 — (11) —

Equity futures .................................................... (3) (6) (99) — —

Foreign currency swaps ............................................ 70 — — — —

Foreign currency forwards .......................................... 310 (9) — — —

Currency futures .................................................. 32 — — — —

Currency options ................................................. (69) — — — —

Equity options .................................................... 941 (26) 5 — —

Interest rate options ............................................... 1,021 — — 24 —

Interest rate forwards .............................................. (14) — — (144) —

Variance swaps .................................................. 244 (3) 7 — —

Credit default swaps ............................................... 175 5 — — —

Total rate of return swaps ........................................... (4) — — — —

Total ......................................................... $5,636 $ (40) $ (87) $ 236 $—

For the Year Ended December 31, 2010:

Interest rate swaps ................................................ $ 622 $ 4 $ 39 $172 $—

Interest rate floors ................................................. 144 — — — —

Interest rate caps ................................................. (185) — — — —

Interest rate futures ................................................ 77 (4) — (3) —

Equity futures .................................................... (58) (25) (314) — —

Foreign currency swaps ............................................ 52 — — — —

Foreign currency forwards .......................................... 250 55 — — —

Currency futures .................................................. (23) — — — —

Currency options ................................................. (83) (1) — — (4)

Equity options .................................................... (683) (16) — — —

Interest rate options ............................................... 25 — — (6) —

Interest rate forwards .............................................. 8 — — (74) —

Variance swaps .................................................. (55) — — — —

Credit default swaps ............................................... 34 (2) — — —

Total rate of return swaps ........................................... 14 — — — —

Total ......................................................... $ 139 $ 11 $(275) $ 89 $ (4)

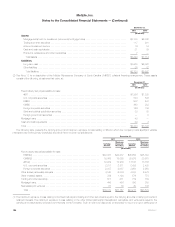

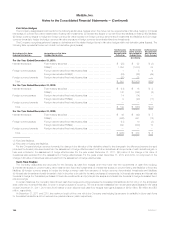

For the Year Ended December 31, 2009:

Interest rate swaps ................................................ $(1,700) $ (5) $ (13) $(161) $—

Interest rate floors ................................................. (907) — — — —

Interest rate caps ................................................. 33 — — — —

Interest rate futures ................................................ (366) 2 — — —

Equity futures .................................................... (681) (38) (363) — —

Foreign currency swaps ............................................ (405) — — — —

Foreign currency forwards .......................................... (102) (24) — — —

Currency options ................................................. (36) (1) — — (3)

Equity options .................................................... (1,713) (68) — — —

Interest rate options ............................................... (379) — — — —

Interest rate forwards .............................................. (7) — — (4) —

Variance swaps .................................................. (276) (13) — — —

Swap spreadlocks ................................................ (38) — — — —

Credit default swaps ............................................... (243) (11) — — —

Total rate of return swaps ........................................... 63 — — — —

Total ......................................................... $(6,757) $(158) $(376) $(165) $ (3)

MetLife, Inc. 147