MetLife 2011 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2011 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

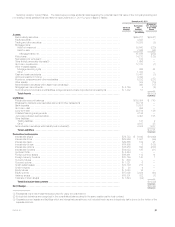

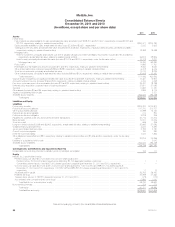

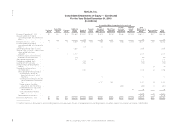

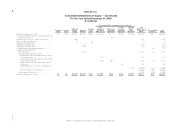

MetLife, Inc.

Consolidated Balance Sheets

December 31, 2011 and 2010

(In millions, except share and per share data)

2011 2010

Assets

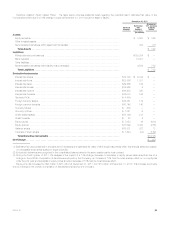

Investments:

Fixed maturity securities available-for-sale, at estimated fair value (amortized cost: $329,811 and $317,617, respectively; includes $3,225 and

$3,330, respectively, relating to variable interest entities) ................................................................... $350,271 $324,797

Equity securities available-for-sale, at estimated fair value (cost: $3,208 and $3,621, respectively) .................................... 3,023 3,602

Trading and other securities, at estimated fair value (includes $473 and $463, respectively, of actively traded securities; and $280 and $387,

respectively, relating to variable interest entities) .......................................................................... 18,268 18,589

Mortgage loans:

Held-for-investment, principally at amortized cost (net of valuation allowances of $481 and $664, respectively; includes $3,187 and $6,840,

respectively, at estimated fair value, relating to variable interest entities) ...................................................... 56,915 58,976

Held-for-sale, principally at estimated fair value (includes $10,716 and $2,510, respectively, under the fair value option) ................. 15,178 3,321

Mortgage loans, net ............................................................................................. 72,093 62,297

Policy loans ....................................................................................................... 11,892 11,761

Real estate and real estate joint ventures (includes $15 and $10, respectively, relating to variable interest entities) ........................ 8,563 8,030

Other limited partnership interests (includes $259 and $298, respectively, relating to variable interest entities) ............................ 6,378 6,416

Short-term investments, principally at estimated fair value .................................................................... 17,310 9,384

Other invested assets, principally at estimated fair value (includes $98 and $104, respectively, relating to variable interest entities) ............ 23,628 15,430

Total investments ............................................................................................... 511,426 460,306

Cash and cash equivalents, principally at estimated fair value (includes $176 and $69, respectively, relating to variable interest entities) ......... 10,461 12,957

Accrued investment income (includes $16 and $34, respectively, relating to variable interest entities) .................................... 4,344 4,328

Premiums, reinsurance and other receivables (includes $12 and $2, respectively, relating to variable interest entities) ........................ 22,481 19,799

Deferred policy acquisition costs and value of business acquired ................................................................ 27,971 27,092

Goodwill ............................................................................................................ 11,935 11,781

Other assets (includes $5 and $6, respectively, relating to variable interest entities) .................................................. 7,984 8,174

Assets of subsidiaries held-for-sale ....................................................................................... — 3,331

Separate account assets ............................................................................................... 203,023 183,138

Total assets ................................................................................................... $799,625 $730,906

Liabilities and Equity

Liabilities

Future policy benefits .................................................................................................. $184,252 $170,912

Policyholder account balances .......................................................................................... 217,700 210,757

Other policy-related balances ........................................................................................... 15,599 15,750

Policyholder dividends payable .......................................................................................... 774 830

Policyholder dividend obligation .......................................................................................... 2,919 876

Payables for collateral under securities loaned and other transactions ............................................................. 33,716 27,272

Bank deposits ....................................................................................................... 10,507 10,316

Short-term debt ...................................................................................................... 686 306

Long-term debt (includes $3,068 and $6,902, respectively, at estimated fair value, relating to variable interest entities) ...................... 23,692 27,586

Collateral financing arrangements ........................................................................................ 4,647 5,297

Junior subordinated debt securities ....................................................................................... 3,192 3,191

Current income tax payable ............................................................................................. 193 297

Deferred income tax liability ............................................................................................. 7,535 1,856

Other liabilities (includes $60 and $93, respectively, relating to variable interest entities; and $7,626 and $0, respectively, under the fair value

option) ........................................................................................................... 30,914 20,366

Liabilities of subsidiaries held-for-sale ..................................................................................... — 3,043

Separate account liabilities .............................................................................................. 203,023 183,138

Total liabilities .................................................................................................. 739,349 681,793

Contingencies, Commitments and Guarantees (Note 16)

Redeemable noncontrolling interests in partially owned consolidated subsidiaries ................................................... 105 117

Equity

MetLife, Inc.’s stockholders’ equity:

Preferred stock, par value $0.01 per share; 200,000,000 shares authorized: .....................................................

Preferred stock, 84,000,000 shares issued and outstanding; $2,100 aggregate liquidation preference ............................... 1 1

Convertible preferred stock, 0 and 6,857,000 shares issued and outstanding at December 31, 2011 and 2010, respectively ............. — —

Common stock, par value $0.01 per share; 3,000,000,000 shares authorized; 1,061,150,915 and 989,031,704 shares issued at

December 31, 2011 and 2010, respectively; 1,057,957,028 and 985,837,817 shares outstanding at December 31, 2011 and 2010,

respectively ..................................................................................................... 11 10

Additional paid-in capital .............................................................................................. 26,782 26,423

Retained earnings .................................................................................................. 27,289 21,363

Treasury stock, at cost; 3,193,887 shares at December 31, 2011 and 2010 ..................................................... (172) (172)

Accumulated other comprehensive income (loss) .......................................................................... 5,886 1,000

Total MetLife, Inc.’s stockholders’ equity ............................................................................. 59,797 48,625

Noncontrolling interests ................................................................................................ 374 371

Total equity .................................................................................................... 60,171 48,996

Total liabilities and equity .......................................................................................... $799,625 $730,906

See accompanying notes to the consolidated financial statements.

88 MetLife, Inc.