MetLife 2011 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2011 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

The Company held non-income producing fixed maturity securities with an estimated fair value of $62 million and $130 million with unrealized gains

(losses) of ($19) million and ($23) million at December 31, 2011 and 2010, respectively.

The Company held foreign currency derivatives with notional amounts of $15.3 billion and $12.2 billion to hedge the exchange rate risk associated

with foreign denominated fixed maturity securities at December 31, 2011 and 2010, respectively.

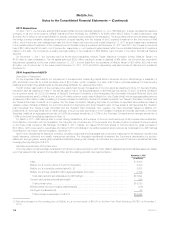

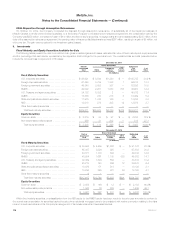

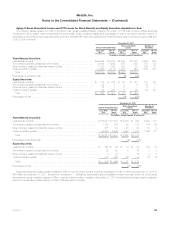

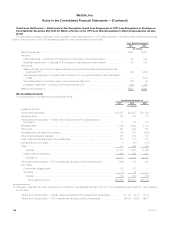

Concentrations of Credit Risk (Fixed Maturity Securities) — Summary. The following section contains a summary of the concentrations of credit risk

related to fixed maturity securities holdings.

The Company was not exposed to any concentrations of credit risk of any single issuer greater than 10% of the Company’s equity, other than the

government securities summarized in the table below. The par value, amortized cost and estimated fair value of holdings in sovereign fixed maturity

securities of Portugal, Ireland, Italy, Greece and Spain, commonly referred to as “Europe’s perimeter region,” was $874 million, $254 million and

$264 million at December 31, 2011, respectively, and $1.9 billion, $1.6 billion and $1.6 billion at December 31, 2010, respectively. The estimated fair

value of these Europe perimeter region sovereign fixed maturity securities represented 0.4% and 3.2% of the Company’s equity at December 31, 2011

and 2010, respectively, and 0.1% and 0.3% of total cash and invested assets at December 31, 2011 and 2010, respectively.

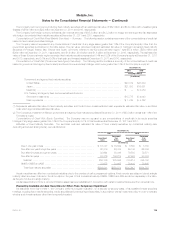

Concentrations of Credit Risk (Government and Agency Securities). The following section contains a summary of the concentrations of credit risk

related to government and agency fixed maturity and fixed-income securities holdings, which were greater than 10% of the Company’s equity at:

December 31,

2011 2010

Carrying Value(1)

(In millions)

Government and agency fixed maturity securities:

United States ................................................................... $40,012 $33,304

Japan ......................................................................... $21,003 $15,591

Mexico(2) ...................................................................... $ — $ 5,050

U.S. Treasury and agency fixed-income securities included in:

Short-term investments ........................................................... $15,775 $ 4,048

Cash equivalents ................................................................ $ 1,748 $ 5,762

(1) Represents estimated fair value for fixed maturity securities, and for short-term investments and cash equivalents, estimated fair value or amortized

cost, which approximates estimated fair value.

(2) The Company’s investment in Mexico government and agency fixed maturity securities at December 31, 2011 of $5.0 billion is less than 10% of the

Company’s equity.

Concentrations of Credit Risk (Equity Securities). The Company was not exposed to any concentrations of credit risk in its equity securities

holdings of any single issuer greater than 10% of the Company’s equity or 1% of total investments at December 31, 2011 and 2010.

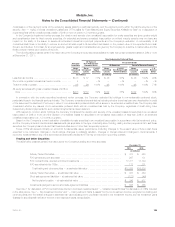

Maturities of Fixed Maturity Securities. The amortized cost and estimated fair value of fixed maturity securities, by contractual maturity date

(excluding scheduled sinking funds), were as follows at:

December 31,

2011 2010

Amortized

Cost

Estimated

Fair

Value Amortized

Cost

Estimated

Fair

Value

(In millions)

Due in one year or less ......................................... $ 16,747 $ 16,862 $ 8,580 $ 8,702

Due after one year through five years ............................... 62,819 64,414 65,143 66,796

Due after five years through ten years .............................. 82,694 88,036 76,508 79,571

Due after ten years ............................................. 93,876 106,274 87,983 90,033

Subtotal ................................................... 256,136 275,586 238,214 245,102

RMBS, CMBS and ABS ......................................... 73,675 74,685 79,403 79,695

Total fixed maturity securities ................................... $329,811 $350,271 $317,617 $324,797

Actual maturities may differ from contractual maturities due to the exercise of call or prepayment options. Fixed maturity securities not due at a single

maturity date have been included in the above table in the year of final contractual maturity. RMBS, CMBS and ABS are shown separately in the table,

as they are not due at a single maturity.

As discussed further in Note 2, an indemnification asset has been established in connection with certain investments acquired from American Life.

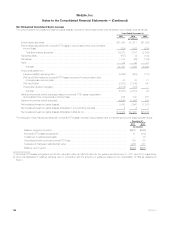

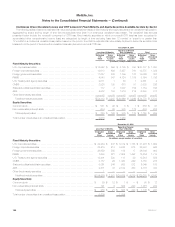

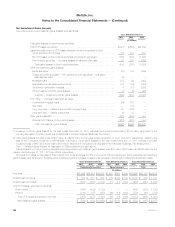

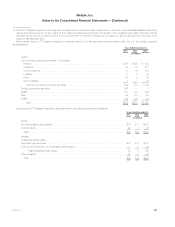

Evaluating Available-for-Sale Securities for Other-Than-Temporary Impairment

As described more fully in Note 1, the Company performs a regular evaluation, on a security-by-security basis, of its available-for-sale securities

holdings, including fixed maturity securities, equity securities and perpetual hybrid securities, in accordance with its impairment policy in order to evaluate

whether such investments are other-than-temporarily impaired.

MetLife, Inc. 119