MetLife 2011 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2011 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.At December 31, 2011 and 2010, the amount of the receivable from the unaffiliated financial institution was $241 million and $425 million,

respectively. In June 2011, MetLife, Inc. received $100 million from the unaffiliated financial institution related to an increase in the estimated fair

value of the surplus notes. No payments were made or received by MetLife, Inc. during 2010. During 2009, on a net basis, MetLife, Inc.

received $375 million from the unaffiliated financial institution related to changes in the estimated fair value of the surplus notes.

In addition, at December 31, 2011 and 2010, MetLife, Inc. had pledged collateral with an estimated fair value of $125 million and $49 million,

respectively, to the unaffiliated financial institution.

‰MetLife, Inc., in connection with the collateral financing arrangement associated with MetLife Reinsurance Company of South Carolina’s (“MRSC”)

reinsurance of universal life secondary guarantees, entered into an agreement in 2007 with an unaffiliated financial institution under which MetLife,

Inc. is entitled to the return on the investment portfolio held by trusts established in connection with this collateral financing arrangement in

exchange for the payment of a stated rate of return to the unaffiliated financial institution of three-month LIBOR plus 0.70%, payable quarterly. The

collateral financing agreement may be extended by agreement of MetLife, Inc. and the unaffiliated financial institution on each anniversary of the

closing. MetLife, Inc. may also be required to make payments to the unaffiliated financial institution, for deposit into the trusts, related to any

decline in the estimated fair value of the assets held by the trusts, as well as amounts outstanding upon maturity or early termination of the

collateral financing arrangement. During 2011 and 2010, no payments were made or received by MetLife, Inc. During 2009, MetLife, Inc.

contributed $360 million, as a result of declines in the estimated fair value of the assets in the trusts. Cumulatively, since May 2007, MetLife, Inc.

has contributed a total of $680 million as a result of declines in the estimated fair value of the assets in the trusts, all of which was deposited into

the trusts.

In addition, MetLife, Inc. may be required to pledge collateral to the unaffiliated financial institution under this agreement. At December 31, 2011

and 2010, MetLife, Inc. had pledged $92 million and $63 million under the agreement, respectively.

Remarketing of Junior Subordinated Debt Securities and Settlement of Stock Purchase Contracts. In February 2009, MetLife, Inc. closed the

remarketing of the Series B portion of its junior subordinated debt securities originally issued in 2005. The Series B junior subordinated debt securities

were modified as permitted by their terms to be 7.717% senior debt securities, Series B, due February 15, 2019. MetLife, Inc. did not receive any

proceeds from the remarketing. The subsequent settlement of the stock purchase contracts occurred on February 17, 2009, providing proceeds to

MetLife, Inc. of $1.0 billion in exchange for shares of MetLife, Inc.’s common stock. MetLife, Inc. delivered 24,343,154 shares of its newly issued

common stock to settle the stock purchase contracts.

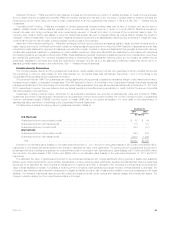

Credit and Committed Facilities. The Company maintains unsecured credit facilities and committed facilities, which aggregated $4.0 billion and

$12.4 billion, respectively, at December 31, 2011. When drawn upon, these facilities bear interest at varying rates in accordance with the respective

agreements.

The unsecured credit facilities are used for general corporate purposes, to support the borrowers’ commercial paper programs and for the issuance

of letters of credit. At December 31, 2011, the Company had outstanding $3.1 billion in letters of credit and no drawdowns against these facilities.

Remaining unused commitments were $916 million at December 31, 2011.

The committed facilities are used for collateral for certain of the Company’s affiliated reinsurance liabilities. At December 31, 2011, the Company had

outstanding $5.4 billion in letters of credit and $2.8 billion in aggregate drawdowns against these facilities. Remaining unused commitments were $4.2

billion at December 31, 2011.

See Note 11 of the Notes to the Consolidated Financial Statements for further discussion of these facilities.

We have no reason to believe that our lending counterparties will be unable to fulfill their respective contractual obligations under these facilities. As

commitments associated with letters of credit and financing arrangements may expire unused, these amounts do not necessarily reflect the Company’s

actual future cash funding requirements.

Covenants. Certain of the Company’s debt instruments, credit facilities and committed facilities contain various administrative, reporting, legal and

financial covenants. The Company believes it was in compliance with all such covenants at December 31, 2011.

Preferred Stock. See “ — The Company — Liquidity and Capital Uses — Dividends” for information on MetLife, Inc.’s Floating Rate

Non-Cumulative Preferred Stock, Series A, and 6.50% Non-Cumulative Preferred Stock, Series B (collectively, the “Preferred Stock”).

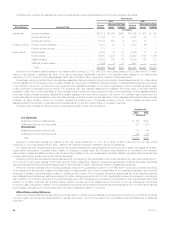

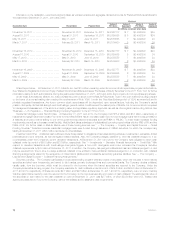

Convertible Preferred Stock. In November 2010, MetLife, Inc. issued to AM Holdings in connection with the financing of the Acquisition

6,857,000 shares of Series B contingent convertible junior participating non-cumulative perpetual preferred stock (the “Convertible Preferred Stock”)

convertible into approximately 68,570,000 shares (valued at $40.90 per share at the time of the Acquisition) of MetLife, Inc.’s common stock (subjectto

anti-dilution adjustments) upon a favorable vote of MetLife, Inc.’s common stockholders. On March 8, 2011, MetLife, Inc. repurchased and canceled all

of the Convertible Preferred Stock. See “— Common Stock” below.

Common Stock. In November 2010, MetLife, Inc. issued to AM Holdings in connection with the financing of the Acquisition 78,239,712 new

shares of its common stock at $40.90 per share. On March 8, 2011, AM Holdings sold the 78,239,712 shares of common stock in a public offering

concurrent with a public offering by MetLife, Inc. of 68,570,000 new shares of its common stock at a price of $43.25 per share for gross proceeds of

$3.0 billion. In connection with the offering of common stock, MetLife, Inc. incurred $16 million of issuance costs which have been recorded as a

reduction of additional paid-in capital. The proceeds were used to repurchase the Convertible Preferred Stock.

In August 2010, in connection with the financing of the Acquisition, MetLife, Inc. issued 86,250,000 new shares of its common stock at a price of

$42.00 per share for gross proceeds of $3.6 billion. In connection with the offering of common stock, MetLife, Inc. incurred $94 million of issuance

costs which have been recorded as a reduction of additional paid-in-capital.

In connection with the remarketing of the junior subordinated debt securities, in February 2009, MetLife, Inc. delivered 24,343,154 shares of its

newly issued common stock to settle the stock purchase contracts. See “— The Company — Liquidity and Capital Sources — Remarketing of Junior

Subordinated Debt Securities and Settlement of Stock Purchase Contracts.”

During the years ended December 31, 2011 and 2010, 3,549,211 and 2,182,174 new shares of common stock were issued for $115 million and

$74 million, respectively, to satisfy various stock option exercises and other stock-based awards. There were no new shares of common stock issued

to satisfy the various stock option exercises and other stock-based awards during the year ended December 31, 2009. There were no shares of

common stock issued from treasury stock during the year ended December 31, 2011. During the years ended December 31, 2010 and 2009,

332,121 shares and 861,586 shares of common stock were issued from treasury stock for $18 million and $46 million, respectively, to satisfy various

stock option exercises and other stock-based awards.

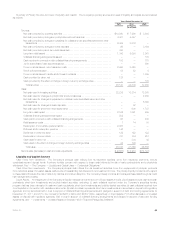

Equity Units. On the Acquisition Date, MetLife, Inc. issued to AM Holdings in connection with the financing of the Acquisition $3.0 billion aggregate

stated amount of Equity Units. On March 8, 2011, concurrently with the public offering of common stock by MetLife, Inc., AM Holdings sold all the

Equity Units in a public offering. The terms and conditions of the Equity Units were unaffected by the resulting transfers of ownership. The Equity Units,

68 MetLife, Inc.