MetLife 2011 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2011 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

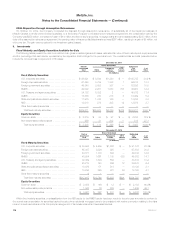

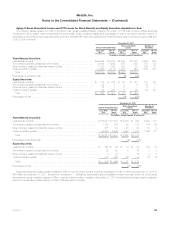

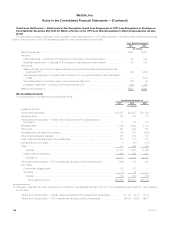

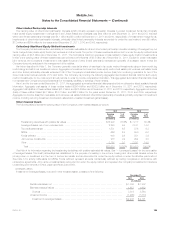

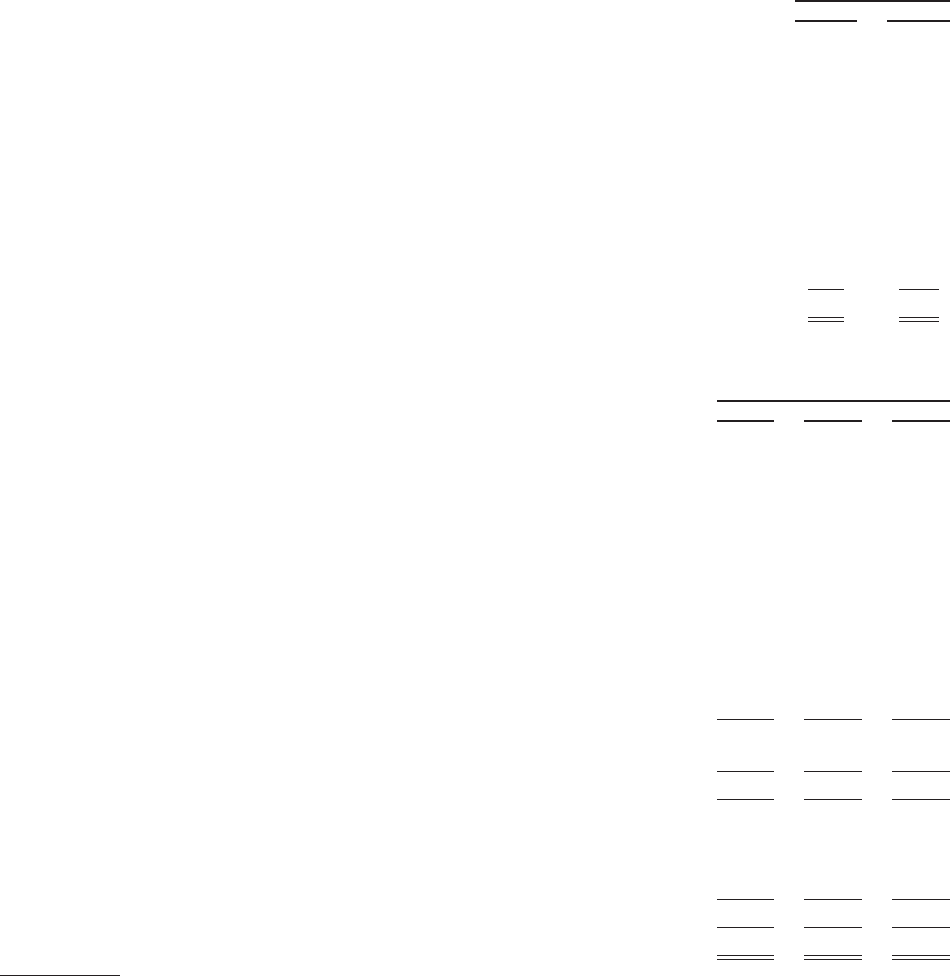

Credit Loss Rollforward — Rollforward of the Cumulative Credit Loss Component of OTTI Loss Recognized in Earnings on

Fixed Maturity Securities Still Held for Which a Portion of the OTTI Loss Was Recognized in Other Comprehensive Income

(Loss)

The table below presents a rollforward of the cumulative credit loss component of OTTI loss recognized in earnings on fixed maturity securities still

held for which a portion of the OTTI loss was recognized in other comprehensive income (loss):

Years Ended December 31,

2011 2010

(In millions)

Balance, at January 1, .................................................................. $443 $ 581

Additions:

Initial impairments — credit loss OTTI recognized on securities not previously impaired .............. 45 109

Additional impairments — credit loss OTTI recognized on securities previously impaired ............. 143 125

Reductions:

Sales (maturities, pay downs or prepayments) during the period of securities previously impaired as

credit loss OTTI .................................................................... (90) (260)

Securities de-recognized in connection with the adoption of new guidance related to the consolidation

of VIEs .......................................................................... — (100)

Securities impaired to net present value of expected future cash flows ........................... (57) (2)

Increases in cash flows — accretion of previous credit loss OTTI ............................... (13) (10)

Balance, at December 31, ............................................................... $471 $ 443

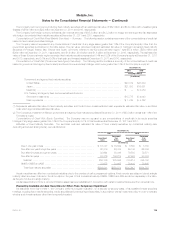

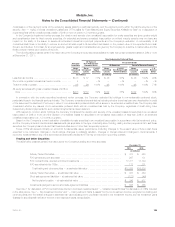

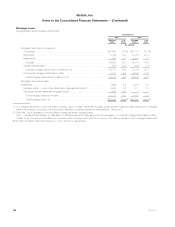

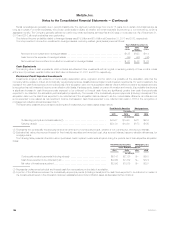

Net Investment Income

The components of net investment income were as follows:

Years Ended December 31,

2011 2010 2009

(In millions)

Investment income:

Fixed maturity securities ........................................................ $15,037 $12,407 $11,545

Equity securities .............................................................. 141 128 178

Trading and other securities — Actively Traded Securities and FVO general account

securities(1) ............................................................... 31 73 116

Mortgage loans .............................................................. 3,164 2,824 2,741

Policy loans ................................................................. 641 649 641

Real estate and real estate joint ventures .......................................... 704 391 (245)

Other limited partnership interests ................................................ 681 879 174

Cash, cash equivalents and short-term investments .................................. 167 101 128

International joint ventures(2) .................................................... 3 (81) (115)

Other ...................................................................... 178 236 205

Subtotal ................................................................ 20,747 17,607 15,368

Less: Investment expenses ................................................... 1,029 894 911

Subtotal, net ............................................................ 19,718 16,713 14,457

Trading and other securities — FVO contractholder-directed unit-linked investments(1) ....... (453) 372 284

FVO CSEs:

Commercial mortgage loans .................................................. 332 411 —

Securities ................................................................. 9 15 —

Subtotal ................................................................ (112) 798 284

Net investment income .................................................. $19,606 $17,511 $14,741

(1) Changes in estimated fair value subsequent to purchase for securities still held as of the end of the respective years included in net investment

income were:

Trading and other securities — Actively Traded Securities and FVO general account securities ........ $ (3) $ 30 $ 34

Trading and other securities — FVO contractholder-directed unit-linked investments ................ $(647) $322 $275

128 MetLife, Inc.