MetLife 2011 Annual Report Download - page 70

Download and view the complete annual report

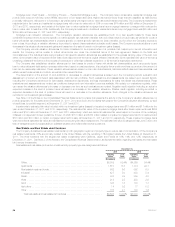

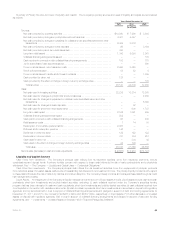

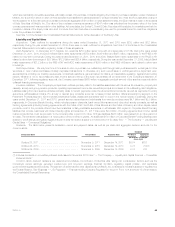

Please find page 70 of the 2011 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Dispositions. Net cash proceeds from dispositions during the years ended December 31, 2011, 2010 and 2009 were $449 million, $0 and $130

million, respectively. See Note 2 of the Notes to the Consolidated Financial Statements for information regarding certain of these dispositions.

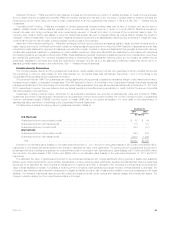

Global Funding Sources. Liquidity is provided by a variety of short-term instruments, including funding agreements, credit facilities and commercial

paper. Capital is provided by a variety of instruments, including short-term and long-term debt, preferred securities, junior subordinated debt securities

and equity and equity-linked securities. The diversity of the Company’s funding sources enhances funding flexibility, limits dependence on any one

market or source of funds and generally lowers the cost of funds. The Company’s global funding sources include:

‰MetLife, Inc. and MetLife Funding, Inc. (“MetLife Funding”) each have commercial paper programs supported by $4.0 billion in general corporate

credit facilities (see “ — The Company — Liquidity and Capital Sources — Credit and Committed Facilities”). MetLife Funding, a subsidiary of

Metropolitan Life Insurance Company (“MLIC”), serves as a centralized finance unit for the Company. MetLife Funding raises cash from its

commercial paper program and uses the proceeds to extend loans, through MetLife Credit Corp., another subsidiary of MLIC, to MetLife, Inc.,

MLIC and other affiliates in order to enhance the financial flexibility and liquidity of these companies. Outstanding balances for the commercial

paper program fluctuate in line with changes to affiliates’ financing arrangements. Pursuant to a support agreement, MLIC has agreed to cause

MetLife Funding to have a tangible net worth of at least one dollar. At both December 31, 2011 and 2010, MetLife Funding had a tangible net

worth of $12 million. At December 31, 2011 and 2010, MetLife Funding had total outstanding liabilities for its commercial paper program,

including accrued interest payable, of $101 million and $102 million, respectively.

‰MetLife Bank is a depository institution that is approved to use the FRB of NY Discount Window borrowing privileges. To utilize these privileges,

MetLife Bank has pledged qualifying loans and investment securities to the FRB of NY as collateral. At both December 31, 2011 and 2010,

MetLife Bank had no liability for advances from the FRB of NY under this facility. For further discussion of MetLife, Inc.’s status as a bank holding

company, see “— MetLife, Inc. — Capital.”

‰MetLife Bank has a cash need to fund residential mortgage loans that it originates and holds generally for a relatively short period before selling to

one of the government-sponsored enterprises such as FNMA or FHLMC. The outstanding volume of residential mortgage originations varies from

month to month and is cyclical within a month. To meet the variable funding requirements from this mortgage activity, as well as to increase overall

liquidity from time to time, MetLife Bank takes advantage of short-term collateralized borrowing opportunities with the Federal Home Loan Bank of

New York (“FHLB of NY”). MetLife Bank has entered into advances agreements with the FHLB of NY whereby MetLife Bank has received cash

advances and under which the FHLB of NY has been granted a blanket lien on certain of MetLife Bank’s residential mortgage loans, mortgage

loans held-for-sale, commercial mortgage loans and mortgage-backed securities to collateralize MetLife Bank’s repayment obligations. Upon any

event of default by MetLife Bank, the FHLB of NY’s recovery is limited to the amount of MetLife Bank’s liability under the advances agreements.

MetLife Bank has received advances from the FHLB of NY on both short-term and long-term bases, with a total liability of $4.8 billion and

$3.8 billion at December 31, 2011 and 2010, respectively. As a result of the recently announced exit from MetLife Bank’s forward mortgage

origination business, MetLife Bank’s cash need to fund residential mortgage loans will be reduced. MetLife Bank also intends to discontinue

entering into advances agreements with the FHLB of NY and intends to effect a transfer of any outstanding advances to MLIC in 2012.

Additionally, in connection with the MetLife Bank Events and the transfer of the FHLB of NY advances, there may be timing differences in MetLife

Bank’s cash flows giving rise to short-term liquidity needs. Should these needs arise, the Company will provide MetLife Bank with temporary

liquidity support through a possible combination of internally and externally sourced funds. See “ — MetLife, Inc. — Capital.”

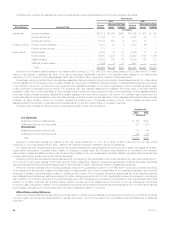

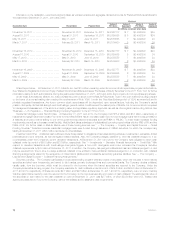

‰The Company issues fixed and floating rate funding agreements, which are denominated in either U.S. dollars or foreign currencies, to certain

special purpose entities (“SPEs”) that have issued either debt securities or commercial paper for which payment of interest and principal is

secured by such funding agreements. During the years ended December 31, 2011, 2010 and 2009, the Company issued $39.9 billion, $34.1

billion and $28.6 billion, respectively, and repaid $41.6 billion, $30.9 billion and $32.0 billion, respectively, of such funding agreements. At

December 31, 2011 and 2010, funding agreements outstanding, which are included in PABs, were $25.5 billion and $27.2 billion, respectively.

See Note 8 of the Notes to the Consolidated Financial Statements.

‰The Company also had obligations under funding agreements with the FHLB of NY of $11.7 billion and $12.6 billion at December 31, 2011 and

2010, respectively, for MLIC, which are included in PABs. During the years ended December 31, 2011, 2010 and 2009, the Company issued

$7.4 billion, $10.8 billion and $16.7 billion, respectively, and repaid $8.3 billion, $11.8 billion and $18.1 billion, respectively, of such funding

agreements. See Note 8 of the Notes to the Consolidated Financial Statements. The liability for outstanding advances agreements entered into by

MetLife Bank is expected to be transferred to MLIC in 2012 under newly executed funding agreements. MetLife Bank will transfer an agreed upon

amount of cash as part of such transfer and the liability will be included in PABs for MLIC.

‰The Company had obligations under funding agreements with the Federal Home Loan Bank of Boston (“FHLB of Boston”) of $450 million and

$100 million at December 31, 2011 and 2010, respectively, for MICC, which are included in PABs. During the years ended December 31, 2011,

2010 and 2009, the Company issued $425 million, $0 and $0, respectively, and repaid $75 million, $225 million and $200 million, respectively,

of such funding agreements. See Note 8 of the Notes to the Consolidated Financial Statements.

‰The Company had obligations under funding agreements with the FHLB of Des Moines of $220 million for MetLife Investors Insurance Company

(“MLIIC”) and $475 million for General American Life Insurance Company (“GALIC”) at December 31, 2011, which are included in PABs. There

were no funding agreements with the FHLB of Des Moines at December 31, 2010. During the year ended December 31, 2011, the Company

issued $295 million and repaid $75 million of such funding agreements for MLIIC. During the year ended December 31, 2011, the Company

issued $700 million and repaid $225 million of such funding agreements for GALIC. See Note 8 of the Notes to the Consolidated Financial

Statements.

‰MLIC and MICC have each issued funding agreements to the Federal Agricultural Mortgage Corporation (“Farmer Mac”) and to certain SPEs that

have issued debt securities for which payment of interest and principal is secured by such funding agreements; such debt securities are also

guaranteed as to payment of interest and principal by Farmer Mac. The obligations under all such funding agreements are secured by a pledge of

certain eligible agricultural real estate mortgage loans and may, under certain circumstances, be secured by other qualified collateral. The amount

of the Company’s liability for funding agreements issued was $2.8 billion at both December 31, 2011 and 2010, respectively, which is included in

PABs. During the years ended December 31, 2011, 2010 and 2009, the Company issued $1.5 billion, $250 million and $0, respectively, and

repaid $1.5 billion, $0 and $0, respectively, of such funding agreements. See Note 8 of the Notes to the Consolidated Financial Statements.

66 MetLife, Inc.