MetLife 2011 Annual Report Download - page 42

Download and view the complete annual report

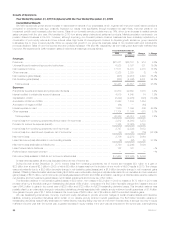

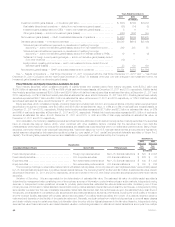

Please find page 42 of the 2011 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.grade corporate fixed maturities, mortgage loans and U.S. Treasury and agency securities. In addition, our investment portfolio includes the excess

capital not allocated to the segments. Accordingly, it includes a higher allocation of certain other invested asset classes to provide additional

diversification and opportunity for long-term yield enhancement, including leveraged leases, other limited partnership interests, real estate, real estate

joint ventures, trading securities and equity securities.

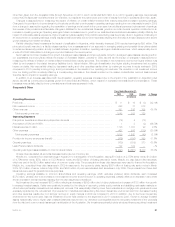

Corporate & Other benefited in 2010 from a $76 million reduction in discretionary spending, such as consulting and postemployment related costs,

a $35 million decrease in real estate-related charges and $15 million of lower legal costs. These savings were partially offset by a $14 million increase in

charitable contributions. The current year also included $44 million of internal resource costs for associates committed to the Acquisition. Additionally,

the resolutions of certain legal matters increased operating earnings by $35 million.

Positive results from our mortgage loan servicing business were driven by a $32 million improvement in hedging results. A larger portfolio resulted in

higher servicing fees of $18 million. This was partially offset by $10 million of additional expenses incurred in response to both the larger portfolio and

increased regulatory oversight.

Interest expense increased $64 million primarily as a result of the debt issuances in 2009 and the senior notes and debt securities issued in

anticipation of the Acquisition, partially offset by the impact of lower interest rates on variable rate collateral financing arrangements.

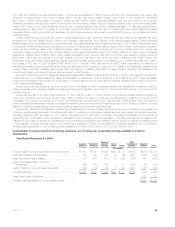

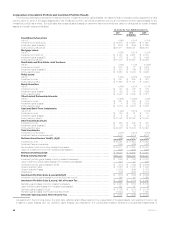

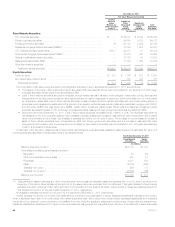

The 2010 period includes $75 million of charges related to the Health Care Act. The Federal government currently provides a Medicare Part D

subsidy. The Health Care Act reduced the tax deductibility of retiree health care costs to the extent of any Medicare Part D subsidy received beginning

in 2013. Because the deductibility of future retiree health care costs is reflected in our financial statements, the entire future impact of this change in law

was required to be recorded as a charge in the period in which the legislation was enacted. As a result, we incurred a $75 million charge in the first

quarter of 2010. The Health Care Act also amended Section 162(m) of the Internal Revenue Code of 1986, as amended, as a result of which MetLife

was initially considered a healthcare provider, as defined, and would be subject to limits on tax deductibility of certain types of compensation. In

December 2010, the Internal Revenue Service issued Notice 2011-2 which clarified that the executive compensation deduction limitation included in the

Health Care Act did not apply to insurers like MetLife selling de minimis amounts of health care coverage. As a result, in the fourth quarter of 2010, we

reversed $18 million of previously recorded taxes for 2010. In 2009, Corporate & Other received a larger benefit of $49 million as compared to 2010

related to the utilization of tax preferenced investments which provide tax credits and deductions.

Effects of Inflation

Management believes that inflation has not had a material effect on its consolidated results of operations, except insofar as inflation may affect

interest rates.

An increase in inflation could affect our business in several ways. During inflationary periods, the value of fixed income investments falls which could

increase realized and unrealized losses. Inflation also increases expenses for labor and other materials, potentially putting pressure on profitability if such

costs cannot be passed through in our product prices. Inflation could also lead to increased costs for losses and loss adjustment expenses in certain of

our businesses, which could require us to adjust our pricing to reflect our expectations for future inflation. Prolonged and elevated inflation could

adversely affect the financial markets and the economy generally, and dispelling it may require governments to pursue a restrictive fiscal and monetary

policy, which could constrain overall economic activity, inhibit revenue growth and reduce the number of attractive investment opportunities.

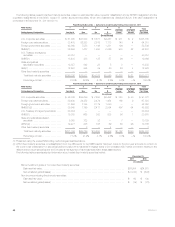

Investments

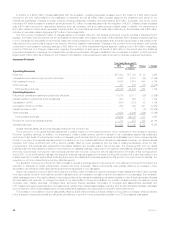

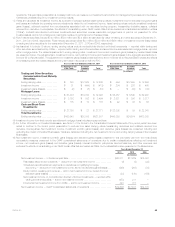

Investment Risks. The Company’s primary investment objective is to optimize, net of income tax, risk-adjusted investment income and risk-

adjusted total return while ensuring that assets and liabilities are managed on a cash flow and duration basis. The Company is exposed to four primary

sources of investment risk:

‰credit risk, relating to the uncertainty associated with the continued ability of a given obligor to make timely payments of principal and interest;

‰interest rate risk, relating to the market price and cash flow variability associated with changes in market interest rates;

‰liquidity risk, relating to the diminished ability to sell certain investments in times of strained market conditions; and

‰market valuation risk, relating to the variability in the estimated fair value of investments associated with changes in market factors such as credit

spreads.

The Company manages risk through in-house fundamental analysis of the underlying obligors, issuers, transaction structures and real estate

properties. The Company also manages credit risk, market valuation risk and liquidity risk through industry and issuer diversification and asset allocation.

For real estate and agricultural assets, the Company manages credit risk and market valuation risk through geographic, property type and product type

diversification and asset allocation. The Company manages interest rate risk as part of its asset and liability management strategies; through product

design, such as the use of market value adjustment features and surrender charges; and through proactive monitoring and management of certain

non-guaranteed elements of its products, such as the resetting of credited interest and dividend rates for policies that permit such adjustments. The

Company also uses certain derivative instruments in the management of credit, interest rate, currency and equity market risks.

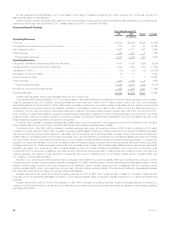

Purchased credit default swaps are utilized by the Company to mitigate credit risk in its investment portfolio. Generally, the Company purchases

credit protection by entering into credit default swaps referencing the issuers of specific assets owned by the Company. In certain cases, basis risk

exists between these credit default swaps and the specific assets owned by the Company. For example, the Company may purchase credit protection

on a macro basis to reduce exposure to specific industries or other portfolio concentrations. In such instances, the referenced entities and obligations

under the credit default swaps may not be identical to the individual obligors or securities in the Company’s investment portfolio. In addition, the

Company’s purchased credit default swaps may have shorter tenors than the underlying investments they are hedging. However, the Company

dynamically hedges this risk through the rebalancing and rollover of its credit default swaps at their most liquid tenors. The Company believes that its

purchased credit default swaps serve as effective legal and economic hedges of its credit exposure.

The Company generally enters into market standard purchased and written credit default swap contracts. Payout under such contracts is triggered

by certain credit events experienced by the referenced entities. For credit default swaps covering North American corporate issuers, credit events

typically include bankruptcy and failure to pay on borrowed money. For European corporate issuers, credit events typically also include involuntary

restructuring. With respect to credit default contracts on Western European sovereign debt, credit events typically include failure to pay debt obligations,

repudiation, moratorium, or involuntary restructuring. In each case, payout on a credit default swap is triggered only after the Credit Derivatives

Determinations Committee of the International Swaps and Derivatives Association deems that a credit event has occurred.

Current Environment

The global economy and markets are still affected by a period of significant stress that began in the second half of 2007. This disruption adversely

affected the financial services sector in particular and global capital markets. The Federal Reserve Board has taken a number of actions in recent years

to spur economic activity by keeping interest rates low and may take further actions to influence interest rates in the future, which may have an impact

38 MetLife, Inc.