MetLife 2011 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2011 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

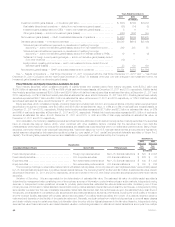

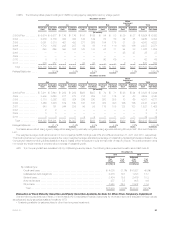

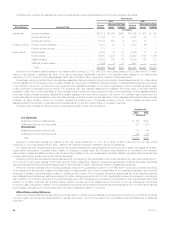

Commercial Mortgage Loans by Geographic Region and Property Type. Commercial mortgage loans are the largest component of the mortgage

loan invested asset class as it represents over 70% of total mortgage loans held-for-investment (excluding the effects of consolidating certain VIEs that

are treated as CSEs) at both December 31, 2011 and 2010. The tables below present the diversification across geographic regions and property types

of commercial mortgage loans held-for-investment at:

December 31,

2011 2010

Amount %of

Total Amount %of

Total

(In millions)

Region(1):

South Atlantic ......................................................... $ 9,022 22.3% $ 7,910 20.9%

Pacific ............................................................... 8,209 20.3 8,616 22.8

Middle Atlantic ......................................................... 6,370 15.8 5,486 14.5

International ........................................................... 4,713 11.7 4,095 10.8

West South Central ..................................................... 3,220 8.0 2,922 7.7

East North Central ...................................................... 2,984 7.3 2,900 7.7

New England .......................................................... 1,563 3.9 1,310 3.5

Mountain ............................................................. 746 1.8 811 2.2

East South Central ..................................................... 487 1.2 461 1.2

West North Central ..................................................... 365 0.9 643 1.7

Multi-Region and Other .................................................. 2,761 6.8 2,664 7.0

Total recorded investment .............................................. 40,440 100.0% 37,818 100.0%

Less: valuation allowances ........................................... 398 562

Carrying value, net of valuation allowances ............................... $40,042 $37,256

Property Type:

Office ............................................................... $18,582 45.9% $16,857 44.6%

Retail ................................................................ 9,524 23.6 9,215 24.3

Apartments ........................................................... 4,011 9.9 3,630 9.6

Hotels ............................................................... 3,114 7.7 3,089 8.2

Industrial ............................................................. 3,102 7.7 2,910 7.7

Other ................................................................ 2,107 5.2 2,117 5.6

Total recorded investment .............................................. 40,440 100.0% 37,818 100.0%

Less: valuation allowances ........................................... 398 562

Carrying value, net of valuation allowances ............................... $40,042 $37,256

(1) Reclassifications have been made to the prior year amounts from various regions to the Multi-Region and Other region to conform to the current year

presentation.

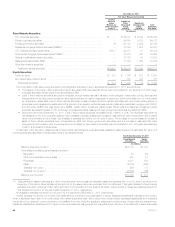

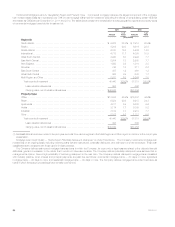

Mortgage Loan Credit Quality — Restructured, Potentially Delinquent, Delinquent or Under Foreclosure. The Company monitors its mortgage loan

investments on an ongoing basis, including reviewing loans that are restructured, potentially delinquent, and delinquent or under foreclosure. These loan

classifications are consistent with those used in industry practice.

The Company defines restructured mortgage loans as loans in which the Company, for economic or legal reasons related to the debtor’s financial

difficulties, grants a concession to the debtor that it would not otherwise consider. The Company defines potentially delinquent loans as loans that,in

management’s opinion, have a high probability of becoming delinquent in the near term. The Company defines delinquent mortgage loans consistent

with industry practice, when interest and principal payments are past due as follows: commercial mortgage loans — 60 days or more; agricultural

mortgage loans — 90 days or more; and residential mortgage loans — 60 days or more. The Company defines mortgage loans under foreclosure as

loans in which foreclosure proceedings have formally commenced.

54 MetLife, Inc.