MetLife 2011 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2011 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

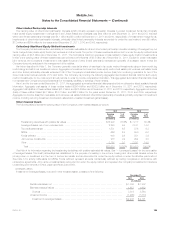

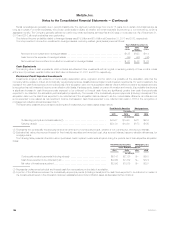

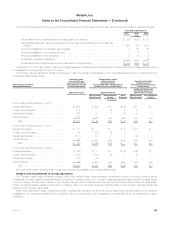

the issuer or investee. The maximum exposure to loss relating to mortgage loans is equal to the carrying amounts plus any unfunded commitments

of the Company. For certain of its investments in other invested assets, the Company’s return is in the form of income tax credits which are

guaranteed by a creditworthy third party. For such investments, the maximum exposure to loss is equal to the carrying amounts plus any unfunded

commitments, reduced by income tax credits guaranteed by third parties of $267 million and $231 million at December 31, 2011 and 2010,

respectively.

(2) For these variable interests, the Company’s involvement is limited to that of a passive investor.

As described in Note 16, the Company makes commitments to fund partnership investments in the normal course of business. Excluding these

commitments, the Company did not provide financial or other support to investees designated as VIEs during the years ended December 31, 2011,

2010 and 2009.

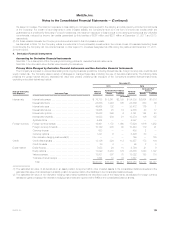

4. Derivative Financial Instruments

Accounting for Derivative Financial Instruments

See Note 1 for a description of the Company’s accounting policies for derivative financial instruments.

See Note 5 for information about the fair value hierarchy for derivatives.

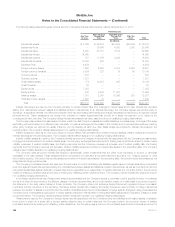

Primary Risks Managed by Derivative Financial Instruments and Non-Derivative Financial Instruments

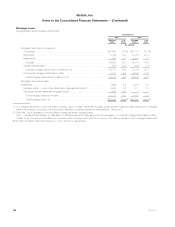

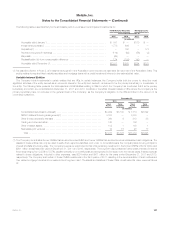

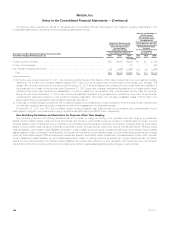

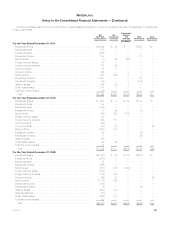

The Company is exposed to various risks relating to its ongoing business operations, including interest rate risk, foreign currency risk, credit risk and

equity market risk. The Company uses a variety of strategies to manage these risks, including the use of derivative instruments. The following table

presents the gross notional amount, estimated fair value and primary underlying risk exposure of the Company’s derivative financial instruments,

excluding embedded derivatives, held at:

December 31,

2011 2010

Primary Underlying

Risk Exposure Instrument Type Notional

Amount

Estimated Fair Value(1) Notional

Amount

Estimated Fair

Value(1)

Assets Liabilities Assets Liabilities

(In millions)

Interest rate Interest rate swaps ................................ $ 79,733 $ 8,241 $2,199 $ 54,803 $2,654 $1,516

Interest rate floors ................................. 23,866 1,246 165 23,866 630 66

Interest rate caps .................................. 49,665 102 — 35,412 176 1

Interest rate futures ................................ 14,965 25 19 9,385 43 17

Interest rate options ................................ 16,988 896 6 8,761 144 23

Interest rate forwards ............................... 14,033 286 91 10,374 106 135

Synthetic GICs ................................... 4,454 — — 4,397 — —

Foreign currency Foreign currency swaps ............................ 16,461 1,172 1,060 17,626 1,616 1,282

Foreign currency forwards ........................... 10,149 200 60 10,443 119 91

Currency futures .................................. 633 — — 493 2 —

Currency options .................................. 1,321 6 — 5,426 50 —

Non-derivative hedging instruments(2) ................. — — — 169 — 185

Credit Credit default swaps ............................... 13,136 326 113 10,957 173 104

Credit forwards ................................... 20 4 — 90 2 3

Equity market Equity futures ..................................... 7,053 26 10 8,794 21 9

Equity options .................................... 17,099 3,263 179 33,688 1,843 1,197

Variance swaps ................................... 18,801 397 75 18,022 198 118

Total rate of return swaps ........................... 1,644 10 34 1,547 — —

Total ......................................... $290,021 $16,200 $4,011 $254,253 $7,777 $4,747

(1) The estimated fair value of all derivatives in an asset position is reported within other invested assets in the consolidated balance sheets and the

estimated fair value of all derivatives in a liability position is reported within other liabilities in the consolidated balance sheets.

(2) The estimated fair value of non-derivative hedging instruments represents the amortized cost of the instruments, as adjusted for foreign currency

transaction gains or losses. Non-derivative hedging instruments are reported within PABs in the consolidated balance sheets.

MetLife, Inc. 139