MetLife 2011 Annual Report Download - page 188

Download and view the complete annual report

Please find page 188 of the 2011 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

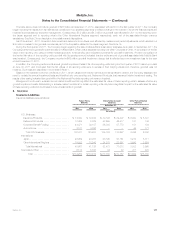

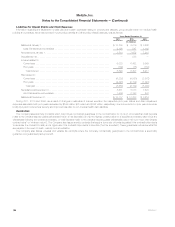

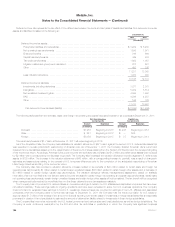

At December 31, 2011, the Company had $13.5 billion of net unaffiliated ceded reinsurance recoverables. Of this total, $10.3 billion, or 76%, were

with the Company’s five largest unaffiliated ceded reinsurers, including $3.2 billion of which were unsecured. At December 31, 2010, the Company had

$13.1 billion of net unaffiliated ceded reinsurance recoverables. Of this total, $10.0 billion, or 76%, were with the Company’s five largest unaffiliated

ceded reinsurers, including $3.6 billion of which were unsecured.

The Company has reinsured with an unaffiliated third-party reinsurer, 49.25% of the closed block through a modified coinsurance agreement. The

Company accounts for this agreement under the deposit method of accounting. The Company, having the right of offset, has offset the modified

coinsurance deposit with the deposit recoverable.

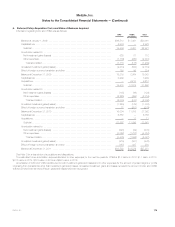

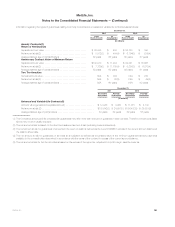

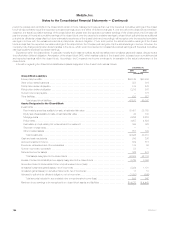

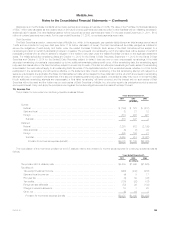

The amounts in the consolidated statements of operations include the impact of reinsurance. Information regarding the effect of reinsurance was as

follows:

Years Ended December 31,

2011 2010 2009

(In millions)

Premiums:

Direct premiums ............................................................. $37,185 $27,596 $27,165

Reinsurance assumed ......................................................... 1,484 1,377 1,313

Reinsurance ceded ........................................................... (2,308) (1,902) (2,321)

Net premiums ........................................................... $36,361 $27,071 $26,157

Universal life and investment-type product policy fees:

Direct universal life and investment-type product policy fees ............................ $ 8,455 $ 6,621 $ 5,784

Reinsurance assumed ......................................................... 154 138 106

Reinsurance ceded ........................................................... (803) (731) (693)

Net universal life and investment-type product policy fees .......................... $ 7,806 $ 6,028 $ 5,197

Other revenues:

Direct other revenues ......................................................... $ 2,468 $ 2,256 $ 2,264

Reinsurance assumed ......................................................... 2 — 1

Reinsurance ceded ........................................................... 62 72 64

Net other revenues ....................................................... $ 2,532 $ 2,328 $ 2,329

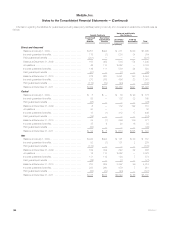

Policyholder benefits and claims:

Direct policyholder benefits and claims ............................................ $37,574 $31,400 $30,029

Reinsurance assumed ......................................................... 1,101 1,275 1,024

Reinsurance ceded ........................................................... (3,218) (3,490) (3,050)

Net policyholder benefits and claims .......................................... $35,457 $29,185 $28,003

Interest credited to policyholder account balances:

Direct interest credited to policyholder account balances .............................. $ 5,600 $ 4,917 $ 4,842

Reinsurance assumed ......................................................... 3 2 3

Reinsurance ceded ........................................................... — — —

Net interest credited to policyholder account balances ............................ $ 5,603 $ 4,919 $ 4,845

Policyholder dividends:

Direct policyholder dividends .................................................... $ 1,446 $ 1,485 $ 1,649

Reinsurance assumed ......................................................... 17 17 13

Reinsurance ceded ........................................................... (17) (17) (13)

Net policyholder dividends .................................................. $ 1,446 $ 1,485 $ 1,649

Other expenses:

Direct other expenses ......................................................... $17,865 $12,870 $10,565

Reinsurance assumed ......................................................... 168 116 100

Reinsurance ceded ........................................................... (303) (222) (144)

Net other expenses ....................................................... $17,730 $12,764 $10,521

184 MetLife, Inc.