MetLife 2011 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2011 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

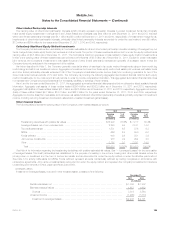

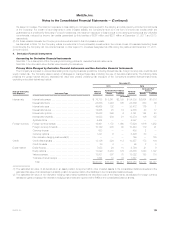

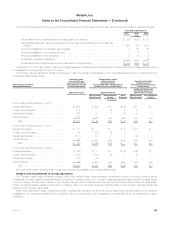

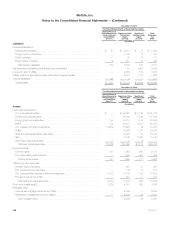

Fair Value Hedges

The Company designates and accounts for the following as fair value hedges when they have met the requirements of fair value hedging: (i) interest

rate swaps to convert fixed rate investments to floating rate investments; (ii) interest rate swaps to convert fixed rate liabilities to floating rate liabilities;

(iii) foreign currency swaps to hedge the foreign currency fair value exposure of foreign currency denominated investments and liabilities; and (iv) foreign

currency forwards to hedge the foreign currency fair value exposure of foreign currency denominated fixed rate investments.

The Company recognizes gains and losses on derivatives and the related hedged items in fair value hedges within net derivative gains (losses). The

following table represents the amount of such net derivative gains (losses):

Derivatives in Fair Value

Hedging Relationships Hedged Items in Fair Value

Hedging Relationships

Net Derivative

Gains (Losses)

Recognized for

Derivatives

Net Derivative

Gains (Losses)

Recognized for

Hedged Items

Ineffectiveness

Recognized in

Net Derivative

Gains (Losses)

(In millions)

For the Year Ended December 31, 2011:

Interest rate swaps: Fixed maturity securities .................................... $ (25) $ 22 $ (3)

PABs(1) ................................................. 1,054 (1,030) 24

Foreign currency swaps: Foreign-denominated fixed maturity securities ................... 1 3 4

Foreign-denominated PABs(2) ............................... (24) (25) (49)

Foreign currency forwards: Foreign-denominated fixed maturity securities ................... (25) 25 —

Total ............................................................................ $ 981 $(1,005) $(24)

For the Year Ended December 31, 2010:

Interest rate swaps: Fixed maturity securities .................................... $ (14) $ 16 $ 2

PABs(1) ................................................. 140 (142) (2)

Foreign currency swaps: Foreign-denominated fixed maturity securities ................... 14 (14) —

Foreign-denominated PABs(2) ............................... 9 (20) (11)

Foreign currency forwards: Foreign-denominated fixed maturity securities ................... — — —

Total ............................................................................ $ 149 $ (160) $(11)

For the Year Ended December 31, 2009:

Interest rate swaps: Fixed maturity securities .................................... $ 49 $ (42) $ 7

PABs(1) ................................................. (963) 951 (12)

Foreign currency swaps: Foreign-denominated fixed maturity securities ................... (13) 10 (3)

Foreign-denominated PABs(2) ............................... 462 (449) 13

Foreign currency forwards: Foreign-denominated fixed maturity securities ................... — — —

Total ............................................................................ $ (465) $ 470 $ 5

(1) Fixed rate liabilities.

(2) Fixed rate or floating rate liabilities.

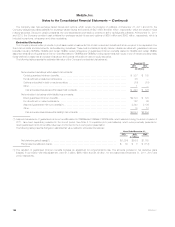

For the Company’s foreign currency forwards, the change in the fair value of the derivative related to the changes in the difference between the spot

price and the forward price is excluded from the assessment of hedge effectiveness. For all other derivatives, all components of each derivative’s gain or

loss were included in the assessment of hedge effectiveness. For the year ended December 31, 2011, ($3) million of the change in fair value of

derivatives was excluded from the assessment of hedge effectiveness. For the years ended December 31, 2010 and 2009, no component of the

change in fair value of derivatives was excluded from the assessment of hedge effectiveness.

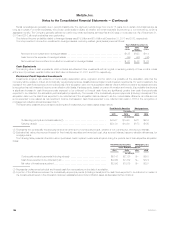

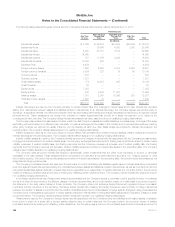

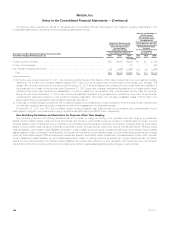

Cash Flow Hedges

The Company designates and accounts for the following as cash flow hedges when they have met the requirements of cash flow hedging:

(i) interest rate swaps to convert floating rate investments to fixed rate investments; (ii) interest rate swaps to convert floating rate liabilities to fixed rate

liabilities; (iii) foreign currency swaps to hedge the foreign currency cash flow exposure of foreign currency denominated investments and liabilities;

(iv) interest rate forwards and credit forwards to lock in the price to be paid for forward purchases of investments; (v) interest rate swaps and interest rate

forwards to hedge the forecasted purchases of fixed-rate investments; and (vi) interest rate swaps and interest rate forwards to hedge forecasted fixed-

rate borrowings.

In certain instances, the Company discontinued cash flow hedge accounting because the forecasted transactions did not occur on the anticipated

date, within two months of that date, or were no longer probable of occurring. The net amounts reclassified into net derivative gains (losses) for the years

ended December 31, 2011, 2010 and 2009 related to such discontinued cash flow hedges were gains (losses) of ($13) million, $9 million and ($7)

million, respectively.

At December 31, 2011 and 2010, the maximum length of time over which the Company was hedging its exposure to variability in future cash flows

for forecasted transactions did not exceed nine years and seven years, respectively.

144 MetLife, Inc.