MetLife 2011 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2011 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

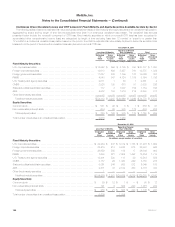

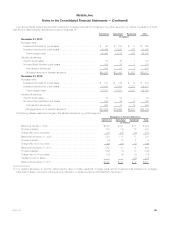

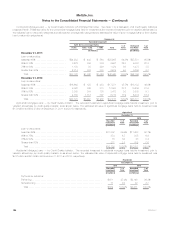

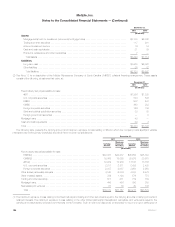

The following tables present the recorded investment in mortgage loans held for investment, by portfolio segment, by method of evaluation of credit

loss, and the related valuation allowances, by type of credit loss, at:

Commercial Agricultural Residential Total

(In millions)

December 31, 2011:

Mortgage loans:

Evaluated individually for credit losses ............................. $ 96 $ 159 $ 13 $ 268

Evaluated collectively for credit losses ............................. 40,344 12,970 676 53,990

Total mortgage loans ........................................ 40,440 13,129 689 54,258

Valuation allowances:

Specific credit losses .......................................... 59 45 1 105

Non-specifically identified credit losses ............................ 339 36 1 376

Total valuation allowances .................................... 398 81 2 481

Mortgage loans, net of valuation allowance ....................... $40,042 $13,048 $ 687 $53,777

December 31, 2010:

Mortgage loans:

Evaluated individually for credit losses ............................. $ 120 $ 146 $ 13 $ 279

Evaluated collectively for credit losses ............................. 37,698 12,605 2,218 52,521

Total mortgage loans ........................................ 37,818 12,751 2,231 52,800

Valuation allowances:

Specific credit losses .......................................... 36 52 — 88

Non-specifically identified credit losses ............................ 526 36 14 576

Total valuation allowances .................................... 562 88 14 664

Mortgage loans, net of valuation allowance ....................... $37,256 $12,663 $2,217 $52,136

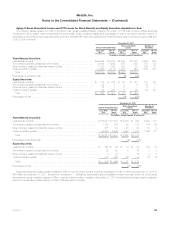

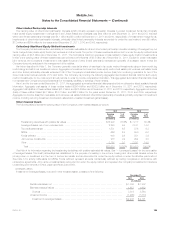

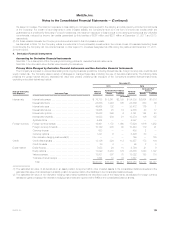

The following tables present the changes in the valuation allowance, by portfolio segment:

Mortgage Loan Valuation Allowances

Commercial Agricultural Residential Total

(In millions)

Balance at January 1, 2009 ......................................... $232 $ 61 $11 $304

Provision (release) ................................................. 384 79 12 475

Charge-offs, net of recoveries ....................................... (27) (25) (6) (58)

Balance at December 31, 2009 ...................................... 589 115 17 721

Provision (release) ................................................. (5) 12 2 9

Charge-offs, net of recoveries ....................................... (22) (39) (5) (66)

Balance at December 31, 2010 ...................................... 562 88 14 664

Provision (release) ................................................. (152) (3) 10 (145)

Charge-offs, net of recoveries ....................................... (12) (4) (3) (19)

Transfer to held-for-sale(1) .......................................... — — (19) (19)

Balance at December 31, 2011 ...................................... $398 $ 81 $ 2 $481

(1) The valuation allowance on and the related carrying value of certain residential mortgage loans held-for-investment was transferred to mortgage

loans held-for-sale in connection with the pending disposition of certain operations of MetLife Bank. See Note 2.

MetLife, Inc. 131