MetLife 2011 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2011 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

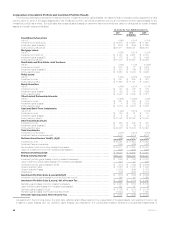

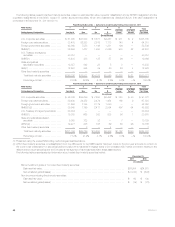

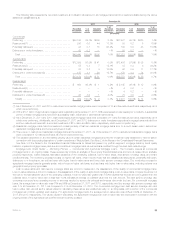

CMBS. The following tables present holdings of CMBS by rating agency designation and by vintage year at:

December 31, 2011

Aaa Aa A Baa

Below

Investment

Grade Total

Amortized

Cost Estimated

Fair Value Amortized

Cost Estimated

Fair Value Amortized

Cost Estimated

Fair Value Amortized

Cost Estimated

Fair Value Amortized

Cost Estimated

Fair Value Amortized

Cost Estimated

Fair Value

(In millions)

2003 & Prior ......... $ 5,574 $ 5,677 $ 176 $ 176 $ 91 $ 88 $ 54 $ 52 $ 29 $ 27 $ 5,924 $ 6,020

2004 ............... 3,586 3,730 430 440 135 129 83 80 32 25 4,266 4,404

2005 ............... 3,081 3,318 427 432 277 269 184 175 31 28 4,000 4,222

2006 ............... 1,712 1,835 245 237 89 83 118 110 123 106 2,287 2,371

2007 ............... 643 665 395 332 163 138 67 71 94 88 1,362 1,294

2008 ............... — — — — — — — — 25 27 25 27

2009 ............... — — — — — — — — — — — —

2010 ............... 3 3 — — — — 60 66 — — 63 69

2011 ............... 536 557 1 1 92 96 — — 9 8 638 662

Total ............. $15,135 $15,785 $1,674 $1,618 $847 $803 $ 566 $ 554 $343 $309 $18,565 $19,069

Ratings Distribution .... 82.8% 8.5% 4.2% 2.9% 1.6% 100.0%

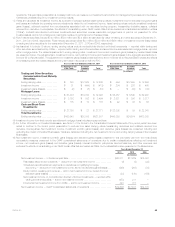

December 31, 2010

Aaa Aa A Baa

Below

Investment

Grade Total

Amortized

Cost Estimated

Fair Value Amortized

Cost Estimated

Fair Value Amortized

Cost Estimated

Fair Value Amortized

Cost Estimated

Fair Value Amortized

Cost Estimated

Fair Value Amortized

Cost Estimated

Fair Value

(In millions)

2003 & Prior ......... $ 7,411 $ 7,640 $ 282 $ 282 $228 $227 $ 74 $ 71 $ 28 $ 24 $ 8,023 $ 8,244

2004 ............... 3,489 3,620 277 273 216 209 181 175 91 68 4,254 4,345

2005 ............... 3,113 3,292 322 324 286 280 263 255 73 66 4,057 4,217

2006 ............... 1,463 1,545 159 160 168 168 385 398 166 156 2,341 2,427

2007 ............... 840 791 344 298 96 95 119 108 122 133 1,521 1,425

2008 ............... 2 2 — — — — — — — — 2 2

2009 ............... 3 3 — — — — — — — — 3 3

2010 ............... 8 8 — — 4 4 — — — — 12 12

Total ............. $16,329 $16,901 $1,384 $1,337 $998 $983 $1,022 $1,007 $480 $447 $20,213 $20,675

Ratings Distribution .... 81.7% 6.4% 4.8% 4.9% 2.2% 100.0%

The tables above reflect rating agency designations assigned by nationally recognized rating agencies including Moody’s, S&P, Fitch and Realpoint,

LLC.

The weighted average credit enhancement of the Company’s CMBS holdings was 27% and 26% at December 31, 2011 and 2010, respectively.

This credit enhancement percentage represents the current weighted average estimated percentage of outstanding capital structure subordinated to the

Company’s investment holding that is available to absorb losses before the security incurs the first dollar of loss of principal. The credit protection does

not include any equity interest or property value in excess of outstanding debt.

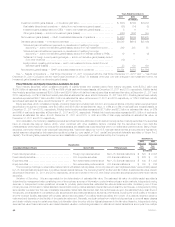

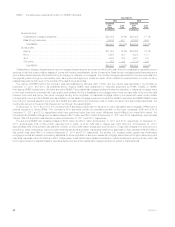

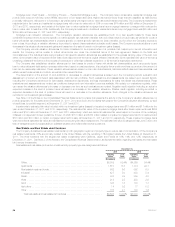

ABS. The Company’s ABS are diversified both by collateral type and by issuer. The following table presents information about ABS held at:

December 31,

2011 2010

Estimated

Fair

Value %of

Total

Estimated

Fair

Value %of

Total

(In millions) (In millions)

By collateral type:

Credit card loans ................................................... $ 4,038 31.1% $ 6,027 45.8%

Collateralized debt obligations ......................................... 2,575 19.8 1,798 13.7

Student loans ...................................................... 2,434 18.8 2,416 18.3

Automobile loans ................................................... 977 7.5 605 4.6

Other loans ....................................................... 2,955 22.8 2,322 17.6

Total ........................................................... $12,979 100.0% $13,168 100.0%

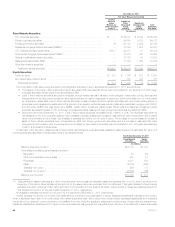

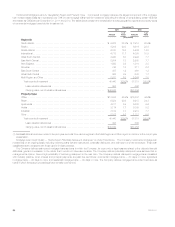

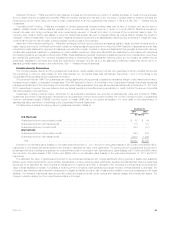

Evaluation of Fixed Maturity Securities and Equity Securities Available-for-Sale for Other-Than-Temporary Impairment

See the following sections within Note 3 of the Notes to the Consolidated Financial Statements for information about the evaluation of fixed maturity

securities and equity securities available-for-sale for OTTI:

‰Evaluating available-for-sale securities for other-than-temporary impairment;

MetLife, Inc. 51