MetLife 2011 Annual Report Download - page 193

Download and view the complete annual report

Please find page 193 of the 2011 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

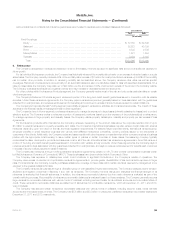

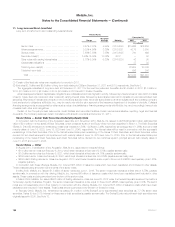

Advances from the Federal Home Loan Bank of New York

MetLife Bank is a member of the FHLB of NY and held $234 million and $187 million of common stock of the FHLB of NY at December 31, 2011

and 2010, respectively, which is included in equity securities. MetLife Bank has also entered into advances agreements with the FHLB of NY whereby

MetLife Bank has received cash advances and under which the FHLB of NY has been granted a blanket lien on certain of MetLife Bank’s residential

mortgage loans held-for-sale, commercial mortgage loans and mortgage-backed securities to collateralize MetLife Bank’s repayment obligations. Upon

any event of default by MetLife Bank, the FHLB of NY’s recovery is limited to the amount of MetLife Bank’s liability under the advances agreements. The

amount of MetLife Bank’s liability for advances from the FHLB of NY was $4.8 billion and $3.8 billion at December 31, 2011 and 2010, respectively,

which is included in long-term debt and short-term debt depending upon the original tenor of the advance. During the years ended December 31,

2011, 2010 and 2009, MetLife Bank received advances related to long-term borrowings totaling $1.3 billion, $2.1 billion and $1.3 billion, respectively,

from the FHLB of NY. MetLife Bank made repayments to the FHLB of NY of $750 million, $349 million and $497 million related to long-term borrowings

for the years ended December 31, 2011, 2010 and 2009, respectively. The advances related to both long-term and short-term debt were collateralized

by residential mortgage loans held-for-sale, commercial mortgage loans and mortgage-backed securities with estimated fair values of $8.7 billion and

$7.8 billion at December 31, 2011 and 2010, respectively.

Collateralized Borrowing from the Federal Reserve Bank of New York

MetLife Bank is a depository institution that is approved to use the Federal Reserve Bank of New York Discount Window borrowing privileges. In

order to utilize these privileges, MetLife Bank has pledged qualifying loans and investment securities to the Federal Reserve Bank of New York as

collateral. MetLife Bank had no liability for advances from the Federal Reserve Bank of New York at both December 31, 2011 and 2010. The estimated

fair value of loan and investment security collateral pledged by MetLife Bank to the Federal Reserve Bank of New York at December 31, 2011 and 2010

was $1.6 billion and $1.8 billion, respectively. There were no such advances during the years ended December 31, 2011 and 2010. During the year

ended December 31, 2009, the weighted average interest rate on these advances was 0.26%. During the year ended December 31, 2009, the

average daily balance of these advances was $1.5 billion and these advances were outstanding for an average of 24 days.

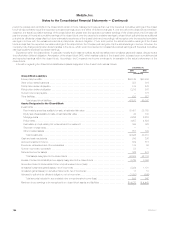

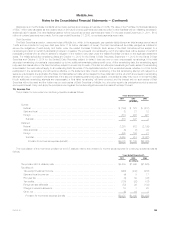

Short-term Debt

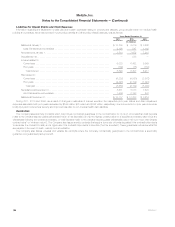

Short-term debt with maturities of one year or less was as follows:

December 31,

2011 2010

(In millions)

Commercial paper ..................................................................... $ 101 $ 102

MetLife Bank, N.A. — Advances agreements with the FHLB of NY ................................ 585 190

Other ............................................................................... — 14

Total short-term debt ................................................................... $ 686 $ 306

Average daily balance .................................................................. $ 447 $ 687

Average days outstanding ............................................................... 19days 21 days

During the years ended December 31, 2011, 2010 and 2009, the weighted average interest rate on short-term debt was 0.33%, 0.35% and

0.42%, respectively.

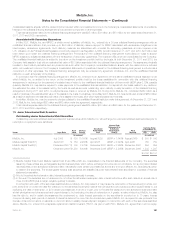

Interest Expense

Interest expense related to the Company’s indebtedness included in other expenses was $975 million, $815 million and $713 million for the years

ended December 31, 2011, 2010 and 2009, respectively, and does not include interest expense on collateral financing arrangements, junior

subordinated debt securities or common equity units. See Notes 12, 13 and 14.

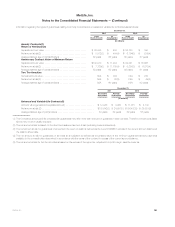

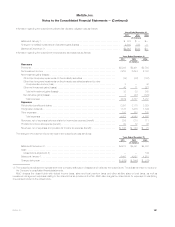

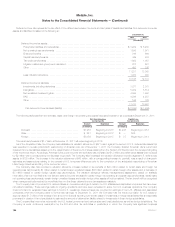

Credit and Committed Facilities

The Company maintains unsecured credit facilities and committed facilities, which aggregated $4.0 billion and $12.4 billion, respectively, at

December 31, 2011. When drawn upon, these facilities bear interest at varying rates in accordance with the respective agreements.

Credit Facilities. The unsecured credit facilities are used for general corporate purposes, to support the borrowers’ commercial paper programs

and for the issuance of letters of credit. Total fees expensed associated with these credit facilities were $35 million, $17 million and $43 million for the

years ended December 31, 2011, 2010 and 2009, respectively. Information on these credit facilities at December 31, 2011 was as follows:

Borrower(s) Expiration Capacity

Letter of

Credit

Issuances Drawdowns Unused

Commitments

(In millions)

MetLife, Inc. and MetLife Funding, Inc. ............ October 2013(1),(2) $1,000 $ 104 $— $896

MetLife, Inc. and MetLife Funding, Inc. ............ August 2016(1) 3,000 2,980 — 20

Total ..................................... $4,000 $3,084 $— $916

(1) In August 2011, the 364-day, $1.0 billion senior unsecured credit agreement entered into in October 2010 by MetLife, Inc. and MetLife Funding,

Inc., a subsidiary, was amended and restated to provide a five-year, $3.0 billion senior unsecured credit facility. Concurrently, MetLife, Inc. and

MetLife Funding, Inc. elected to reduce the outstanding commitments under the three-year, $3.0 billion senior unsecured credit facility entered into

in October 2010 to $1.0 billion with no change to the original maturity of October 2013. The Company incurred costs of $9 million related to the five-

year credit facility, which have been capitalized and included in other assets. These costs will be amortized over the amended terms of the facilities.

MetLife, Inc. 189