MetLife 2011 Annual Report Download - page 173

Download and view the complete annual report

Please find page 173 of the 2011 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

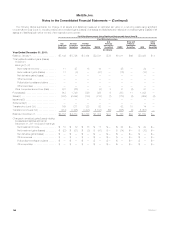

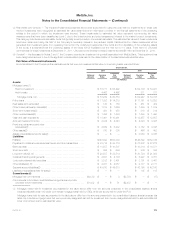

Fair Value Option

Residential Mortgage Loans Held-For-Sale

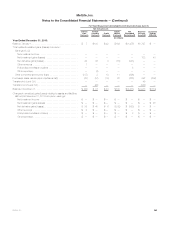

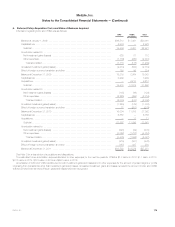

The following table presents residential mortgage loans held-for-sale carried under the FVO at:

December 31,

2011 2010

(In millions)

Unpaid principal balance ................................................................... $2,935 $2,473

Excess of estimated fair value over unpaid principal balance ........................................ 129 37

Carrying value at estimated fair value ........................................................ $3,064 $2,510

Loans in non-accrual status ................................................................. $ 3 $ 2

Loans more than 90 days past due ........................................................... $ 20 $ 3

Loans in non-accrual status or more than 90 days past due, or both — difference between aggregate

estimated fair value and unpaid principal balance ............................................... $ (2) $ (1)

Residential mortgage loans held-for-sale accounted for under the FVO are initially measured at estimated fair value. Interest income on residential

mortgage loans held-for-sale is recorded based on the stated rate of the loan and is recorded in net investment income. Gains and losses from initial

measurement, subsequent changes in estimated fair value and gains or losses on sales are recognized in other revenues. Such changes in estimated

fair value for these loans were due to the following:

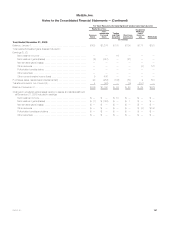

Years Ended December 31,

2011 2010 2009

(In millions)

Instrument-specific credit risk based on changes in credit spreads for non-agency loans and

adjustments in individual loan quality .................................................... $ (3) $ (1) $ (2)

Other changes in estimated fair value ..................................................... 511 487 600

Total gains (losses) recognized in other revenues .......................................... $508 $486 $598

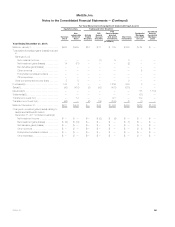

Securitized Reverse Residential Mortgage Loans

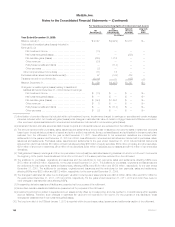

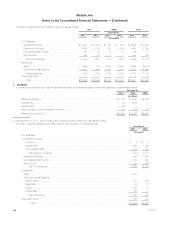

The following table presents securitized reverse residential mortgage loans carried under the FVO at:

December 31, 2011

(In millions)

Unpaid principal balance ..................................................................... $6,914

Excess of estimated fair value over unpaid principal balance .......................................... 738

Carrying value at estimated fair value .......................................................... $7,652

Loans in non-accrual status ................................................................... $ —

Loans more than 90 days past due ............................................................. $ 59

Loans in non-accrual status or more than 90 days past due, or both — difference between aggregate estimated

fair value and unpaid principal balance ......................................................... $ —

Securitized reverse residential mortgage loans accounted for under the FVO are initially measured at estimated fair value. Gains and losses from

initial measurement and subsequent changes in estimated fair value are recognized in other revenues.

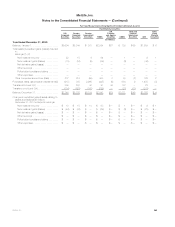

The following table presents the liability related to securitized reverse residential mortgage loans carried under the FVO at:

December 31, 2011

(In millions)

Contractual principal balance .................................................................. $6,914

Excess of estimated fair value over contractual principal balance ...................................... 712

Carrying value at estimated fair value .......................................................... $7,626

The liability related to securitized reverse residential mortgage loans accounted for under the FVO is initially measured at estimated fair value. Gains

and losses from initial measurement and subsequent changes in estimated fair value are recognized in other revenues.

MetLife, Inc. 169