MetLife 2011 Annual Report Download - page 229

Download and view the complete annual report

Please find page 229 of the 2011 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

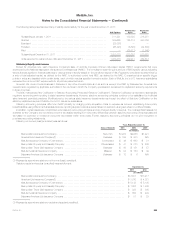

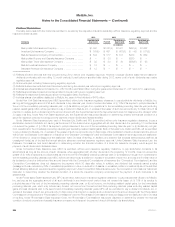

Under Missouri State Insurance Law, MetLife Investors Insurance Company (“MLIIC”) is permitted, without prior insurance regulatory clearance, to

pay a stockholder dividend to its parent as long as the amount of the dividend when aggregated with all other dividends in the preceding 12 months

does not exceed the greater of: (i) 10% of its surplus to policyholders as of the end of the immediately preceding calendar year; or (ii) its statutory net

gain from operations for the immediately preceding calendar year (excluding net realized capital gains). MLIIC will be permitted to pay a cash dividend to

its parent in excess of the greater of such two amounts only if it files notice of the declaration of such a dividend and the amount thereof with the

Missouri Commissioner of Insurance (the “Missouri Commissioner”) and the Missouri Commissioner does not disapprove the distribution within 30 days

of its filing. In addition, any dividend that exceeds earned surplus (defined as unassigned funds) as of the last filed annual statutory statement requires

insurance regulatory approval. Under Missouri State Insurance Law, the Missouri Commissioner has broad discretion in determining whether the

financial condition of a stock life insurance company would support the payment of such dividends to its shareholders.

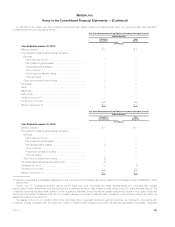

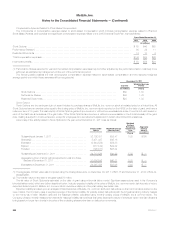

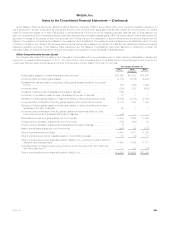

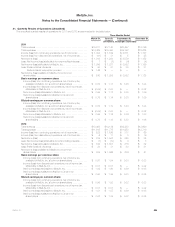

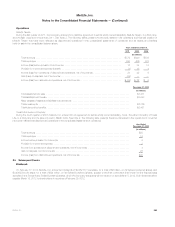

Other Comprehensive Income (Loss)

The following table sets forth the balance and changes in accumulated other comprehensive income (loss) including reclassification adjustments

required for the years ended December 31, 2011, 2010 and 2009 in other comprehensive income (loss) that are included as part of net income for the

current year that have been reported as a part of other comprehensive income (loss) in the current or prior year:

Years Ended December 31,

2011 2010 2009

(In millions)

Holding gains (losses) on investments arising during the year ........................... $13,945 $10,092 $18,548

Income tax effect of holding gains (losses) ......................................... (4,783) (3,516) (6,243)

Reclassification adjustments for recognized holding (gains) losses included in current year

income ................................................................... 755 (733) 1,464

Income tax effect ............................................................. (260) 255 (493)

Unrealized investment loss of subsidiary at the date of disposal ......................... (105) — —

Income tax on unrealized investment loss of subsidiary at the date of disposal ............. 37 — —

Allocation of holding (gains) losses on investments relating to other policyholder amounts ..... (6,339) (2,813) (2,979)

Income tax effect of allocation of holding (gains) losses to other policyholder amounts ....... 2,174 980 1,002

Allocation of holding (gains) losses on investments relating to other policyholder amounts of

subsidiary at the date of disposal .............................................. 93 — —

Income tax effect of allocation of holding (gains) losses on investments relating to other

policyholder amounts of subsidiary at the date of disposal ........................... (33) — —

Net unrealized investment gains (losses), net of income tax ............................ 5,484 4,265 11,299

Foreign currency translation adjustments, net of income tax ............................ (135) (350) 63

Foreign currency translation adjustments of subsidiary at the date of disposal .............. (7) — —

Defined benefit plans adjustment, net of income tax .................................. (494) 96 (102)

Other comprehensive income (loss) .............................................. 4,848 4,011 11,260

Other comprehensive (income) loss attributable to noncontrolling interests ................ 38 (5) 11

Other comprehensive income (loss) attributable to MetLife, Inc., excluding cumulative effect of

change in accounting principle ................................................ 4,886 4,006 11,271

Cumulative effect of change in accounting principle, net of income tax of $0, $27 million and

$40 million (see Note 1) ...................................................... — 52 (76)

Other comprehensive income (loss) attributable to MetLife, Inc. ......................... $ 4,886 $ 4,058 $11,195

MetLife, Inc. 225