MetLife 2011 Annual Report Download - page 13

Download and view the complete annual report

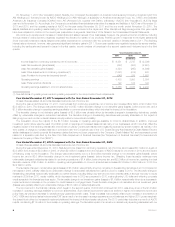

Please find page 13 of the 2011 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.enterprise-wide cost reduction and revenue enhancement initiative was more than offset by an increase in other expenses related to our Other

International Regions segment. This increase primarily stemmed from the impact of a benefit recorded in the prior year related to the pesification in

Argentina, as well as current year business growth in the segment.

Consolidated Company Outlook

In 2012, we expect a solid improvement in the operating earnings of the Company over 2011, driven primarily by the following:

‰Premiums, fees and other revenues growth in 2012 is expected to be driven by:

– Rational pricing strategy in the group insurance marketplace.

– Higher fees earned on separate accounts primarily due to favorable net flows of variable annuities, which are expected to remain strong in

2012, thereby increasing the value of those separate accounts; and

– Increases in our International businesses, notably accident and health, from continuing organic growth throughout our various geographic

regions.

‰Focus on disciplined underwriting. We see no significant changes to the underlying trends that drive underwriting results and continue to anticipate

solid results in 2012; however, unanticipated catastrophes, similar to those that occurred during 2011, could result in a high volume of weather-

related claims.

‰Focus on expense management. We continue to focus on expense control throughout the Company, and managing the costs associated with

the integration of ALICO.

‰Continued disciplined approach to investing and asset/liability management, including significant hedging to protect against low interest rates.

As a result of new financial accounting guidance for DAC which we intend to adopt in the first quarter of 2012, we estimate that, on the date of

adoption, DAC will be reduced by approximately $3.1 billion to $3.6 billion and total equity will be reduced by approximately $2.1 billion to $2.4 billion,

net of income tax. Additionally, we estimate that there will be a negative impact on our 2012 operating earnings primarily in Japan, with no impact on our

on-going cash flows. The Company plans to apply this accounting change retrospectively to all prior periods presented in its consolidated financial

statements for all insurance contracts.

We expect only modest investment losses in 2012, but more difficult to predict is the impact of potential changes in fair value of freestanding and

embedded derivatives as even relatively small movements in market variables, including interest rates, equity levels and volatility, can have a large impact

on the fair value of derivatives and net derivative gains (losses). Additionally, changes in fair value of embedded derivatives within certain insurance

liabilities may have a material impact on net derivative gains (losses) related to the inclusion of an adjustment for nonperformance risk.

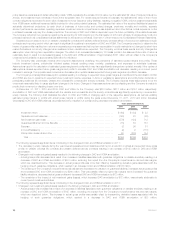

Industry Trends

We continue to be impacted by the unstable global financial and economic environment that has been affecting the industry.

Financial and Economic Environment. Our business and results of operations are materially affected by conditions in the global capital markets and

the economy generally. Stressed conditions, volatility and disruptions in global capital markets, particular markets, or financial asset classes can have an

adverse effect on us, in part because we have a large investment portfolio and our insurance liabilities are sensitive to changing market factors. Global

market factors, including interest rates, credit spreads, equity prices, real estate markets, foreign currency exchange rates, consumer spending,

business investment, government spending, the volatility and strength of the capital markets, deflation and inflation all affect the business and economic

environment and, ultimately, the amount and profitability of our business. Disruptions in one market or asset class can also spread to other markets or

asset classes. Upheavals in the financial markets can also affect our business through their effects on general levels of economic activity, employment

and customer behavior. While our diversified business mix and geographically diverse business operations partially mitigate these risks, correlation

across regions, countries and global market factors may reduce the benefits of diversification.

Beginning in 2010 and continuing throughout 2011, concerns increased about capital markets and the solvency of certain European Union member

states, including Portugal, Ireland, Italy, Greece and Spain (“Europe’s perimeter region”), and of financial institutions that have significant direct or indirect

exposure to their sovereign debt. See “— Investments — Current Environment” for information regarding credit ratings downgrades and support

programs for Europe’s perimeter region. These ratings downgrades and implementation of European Union and private sector support programs have

increased concerns that other European Union member states could experience similar financial troubles, that some countries could default on their

obligation or have to restructure their outstanding debt, that financial institutions with significant holdings of sovereign or private debt issued by borrowers

in peripheral European countries could experience financial stress, or that one or more countries may exit the Euro zone, any of which could have

significant adverse effects on the European and global economies and on financial markets, generally. See “Risk Factors – We Are Exposed to

Significant Financial and Capital Markets Risk Which May Adversely Affect Our Results of Operations, Financial Condition and Liquidity, and May Cause

Our Net Investment Income to Vary from Period to Period” in the 2011 Form 10-K.

Although the downgrade by Standard & Poor’s Ratings Services (“S&P”) of U.S. Treasury securities initially had an adverse effect on financial

markets, the extent of the longer-term impact cannot be predicted. Fitch Ratings (“Fitch”) warned that it may in the future downgrade the U.S. credit

rating unless action is taken to reduce the national debt of the U.S. See “Risk Factors — Concerns Over U.S. Fiscal Policy and the Trajectory of the

National Debt of the U.S., as well as Rating Agency Downgrades of U.S. Treasury Securities, Could Have an Adverse Effect on Our Business, Financial

Condition and Results of Operations” in the 2011 Form 10-K. See also “— Investments — Current Environment” for further information about European

region support programs announced in July 2011 and October 2011, ratings actions and our exposure to obligations of European governments and

private obligors.

All of these factors have had and could continue to have an adverse effect on the financial results of companies in the financial services industry,

including MetLife. Such global economic conditions, as well as the global financial markets, continue to impact our net investment income, our net

investment and net derivative gains (losses), and the demand for and the cost and profitability of certain of our products, including variable annuities and

guarantee benefits. See “— Results of Operations” and “— Liquidity and Capital Resources.”

As a financial holding company with significant operations in the U.S., we are affected by the monetary policy of the Board of Governors of the

Federal Reserve System (the “Federal Reserve Board”) and the Federal Reserve Bank of New York (the “FRB of NY” and, collectively with the Federal

Reserve Board, the “Federal Reserve”). The Federal Reserve Board has taken a number of actions in recent years to spur economic activity by keeping

interest rates low and may take further actions to influence interest rates in the future, which may have an impact on the pricing levels of risk-bearing

investments, and may adversely impact the level of product sales. In January 2012, the Federal Reserve Board announced its plans to keep interest

rates low until at least through late 2014, 18 months longer than previously planned in order to revive the slow recovery from stressed economic

conditions. See “Risk Factors — Governmental and Regulatory Actions for the Purpose of Stabilizing and Revitalizing the Financial Markets and

Protecting Investors and Consumers May Not Achieve the Intended Effect or Could Adversely Affect Our Competitive Position” in the 2011 Form 10-K

and “— Investments — Current Environment.”

MetLife, Inc. 9