MetLife 2011 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2011 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

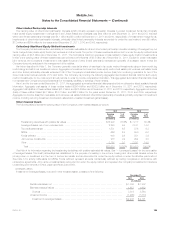

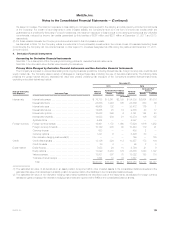

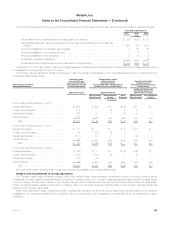

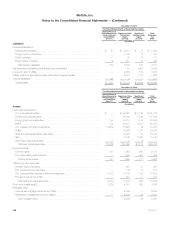

The following table presents the gross notional amount and estimated fair value of derivatives that were not designated or do not qualify as hedging

instruments by derivative type at:

December 31,

2011 2010

Derivatives Not Designated or Not

Qualifying as Hedging Instruments

Estimated

Fair

Value

Estimated

Fair

Value

Notional

Amount Assets Liabilities Notional

Amount Assets Liabilities

(In millions)

Interest rate swaps ............................ $ 71,923 $ 5,410 $2,107 $ 46,133 $1,729 $1,231

Interest rate floors ............................. 23,866 1,246 165 23,866 630 66

Interest rate caps ............................. 49,665 102 — 35,412 176 1

Interest rate futures ............................ 14,965 25 19 9,385 43 17

Interest rate options ........................... 16,988 896 6 8,761 144 23

Interest rate forwards .......................... 13,068 76 91 9,234 106 28

Synthetic GICs ............................... 4,454 — — 4,397 — —

Foreign currency swaps ........................ 6,871 320 656 7,546 496 790

Foreign currency forwards ...................... 6,630 145 38 8,508 110 65

Currency futures .............................. 633 — — 493 2 —

Currency options ............................. 1,321 6 — 5,426 50 —

Credit default swaps ........................... 13,136 326 113 10,957 173 104

Equity futures ................................ 7,053 26 10 8,794 21 9

Equity options ................................ 17,099 3,263 179 33,688 1,843 1,197

Variance swaps .............................. 18,801 397 75 18,022 198 118

Total rate of return swaps ....................... 1,644 10 34 1,547 — —

Total non-designated or non-qualifying

derivatives ............................... $268,117 $12,248 $3,493 $232,169 $5,721 $3,649

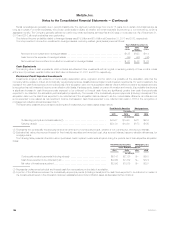

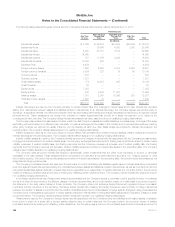

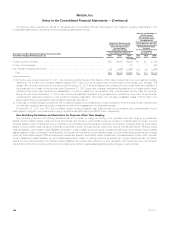

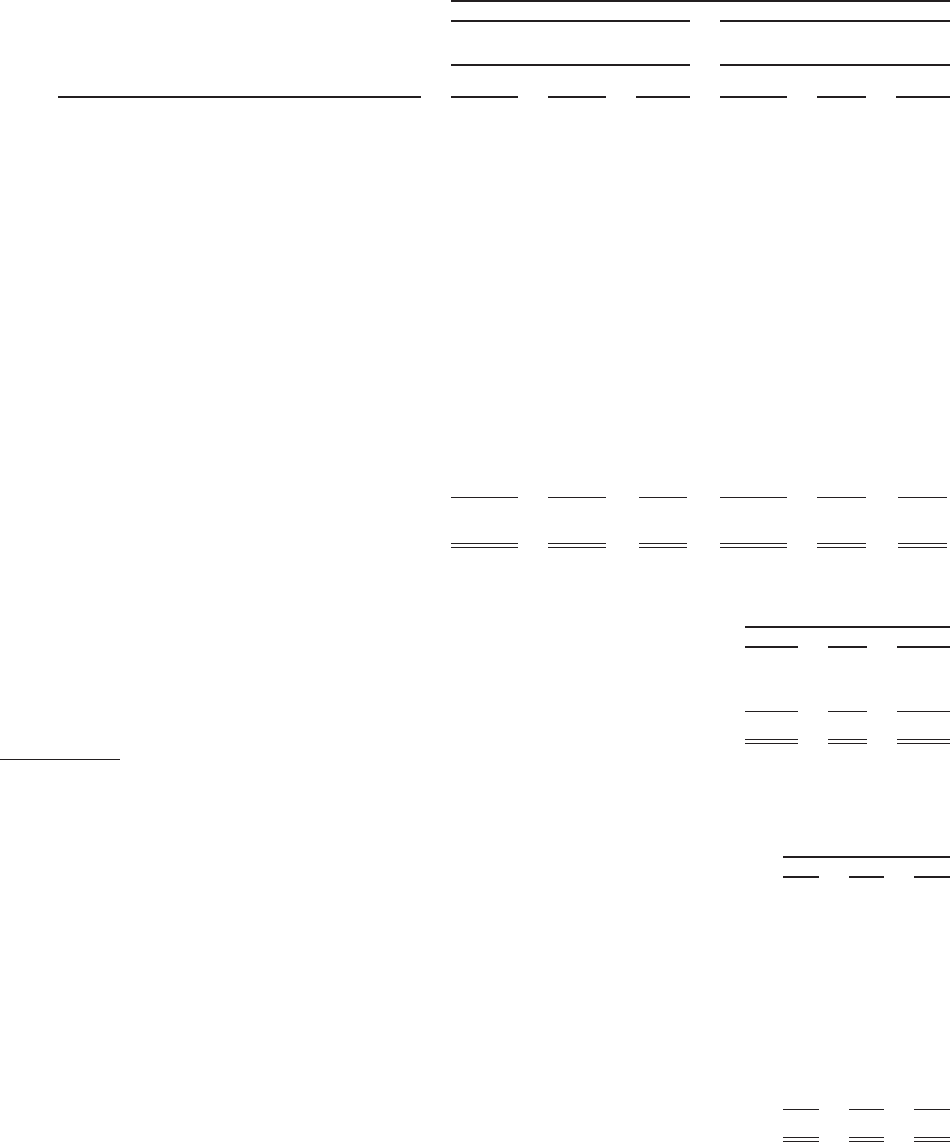

Net Derivative Gains (Losses)

The components of net derivative gains (losses) were as follows:

Years Ended December 31,

2011 2010 2009

(In millions)

Derivatives and hedging gains (losses)(1) .............................................. $6,108 $ 122 $(6,624)

Embedded derivatives ............................................................ (1,284) (387) 1,758

Total net derivative gains (losses) .................................................. $4,824 $(265) $(4,866)

(1) Includes foreign currency transaction gains (losses) on hedged items in cash flow and non-qualifying hedging relationships, which are not presented

elsewhere in this note.

The following table presents earned income on derivatives for the:

Years Ended December 31,

2011 2010 2009

(In millions)

Qualifying hedges:

Net investment income .............................................................. $ 98 $ 83 $ 49

Interest credited to policyholder account balances ......................................... 214 233 220

Other expenses .................................................................... (4) (6) (3)

Non-qualifying hedges:

Net investment income .............................................................. (8) (3) (2)

Other revenues .................................................................... 75 108 77

Net derivative gains (losses) .......................................................... 411 65 91

Policyholder benefits and claims ....................................................... 17 — —

Total ........................................................................... $803 $480 $432

MetLife, Inc. 143