MetLife 2011 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2011 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

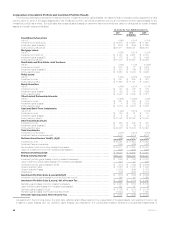

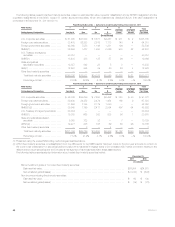

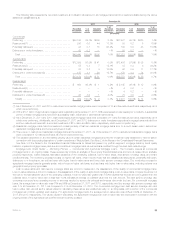

The following tables present total fixed maturity securities, based on estimated fair value, by sector classification and by NRSRO designation and the

equivalent designations of the NAIC, except for certain structured securities, which are presented as described above, that each designation is

comprised of at December 31, 2011and 2010:

Fixed Maturity Securities — by Sector & Credit Quality Rating at December 31, 2011

NAIC Rating: 1 2 3 4 5 6 Total

Estimated

Fair ValueRating Agency Designation: Aaa/Aa/A Baa Ba B Caa and

Lower In or Near

Default

(In millions)

U.S. corporate securities ............. $ 51,045 $41,533 $ 8,677 $4,257 $ 271 $ 2 $105,785

Foreign corporate securities ........... 33,403 26,383 2,915 1,173 140 4 64,018

Foreign government securities ......... 42,360 7,553 1,146 1,281 196 — 52,536

RMBS(1) .......................... 36,699 1,477 1,450 2,026 933 52 42,637

U.S. Treasury and agency

securities ....................... 40,012 — — — — — 40,012

CMBS(1) ......................... 18,403 388 125 57 96 — 19,069

State and political

subdivision securities .............. 12,357 842 23 5 8 — 13,235

ABS(1) ........................... 12,507 355 39 50 24 4 12,979

Other fixed maturity securities ......... — — — — — — —

Total fixed maturity securities ........ $246,786 $78,531 $14,375 $8,849 $1,668 $ 62 $350,271

Percentage of total ................ 70.5% 22.4% 4.1% 2.5% 0.5% —% 100.0%

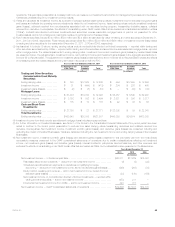

Fixed Maturity Securities — by Sector & Credit Quality Rating at December 31, 2010

NAIC Rating: 1 2 3 4 5 6 Total

Rating Agency Designation: Aaa/Aa/A Baa Ba B Caa and

Lower In or Near

Default Estimated

Fair Value

(In millions)

U.S. corporate securities ............. $ 46,035 $34,259 $ 7,633 $3,452 $ 353 $ 40 $ 91,772

Foreign corporate securities ........... 39,430 24,352 2,474 1,454 169 9 67,888

Foreign government securities ......... 31,559 7,184 2,179 1,080 — — 42,002

RMBS(1)(2) ........................ 39,640 1,196 2,411 2,054 497 54 45,852

U.S. Treasury and agency securities .... 33,304 — — — — — 33,304

CMBS(1) ......................... 19,385 665 363 205 56 1 20,675

State and political subdivision

securities ....................... 9,368 722 32 — 7 — 10,129

ABS(1)(2) ......................... 12,477 348 198 59 60 26 13,168

Other fixed maturity securities ......... — 3 — 4 — — 7

Total fixed maturity securities ........ $231,198 $68,729 $15,290 $8,308 $1,142 $130 $324,797

Percentage of total ................ 71.2% 21.2% 4.7% 2.6% 0.3% —% 100.0%

(1) Presented using the revised NAIC rating methodologies described above.

(2) Within fixed maturity securities, a reclassification from the ABS sector to the RMBS sector has been made to the prior year amounts to conform to

the current year presentation for securities backed by sub-prime residential mortgage loans to be consistent with market convention relating to the

risks inherent in such securities and the Company’s management of its investments within these asset sectors.

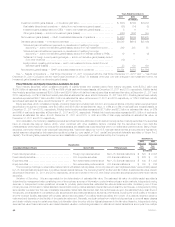

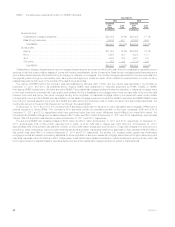

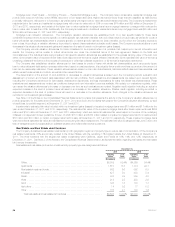

The following table presents selected information about certain fixed maturity securities held at:

December 31,

2011 2010

(In millions)

Below investment grade or non-rated fixed maturity securities:

Estimated fair value .................................................................... $24,954 $24,870

Net unrealized gains (losses) ............................................................ $(1,310) $ (696)

Non-income producing fixed maturity securities:

Estimated fair value .................................................................... $ 62 $ 130

Net unrealized gains (losses) ............................................................ $ (19) $ (23)

48 MetLife, Inc.