MetLife 2011 Annual Report Download - page 150

Download and view the complete annual report

Please find page 150 of the 2011 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

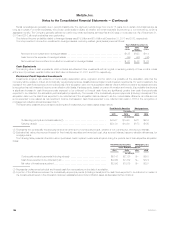

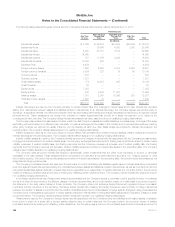

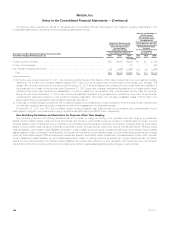

The following table presents the effects of derivatives and non-derivative financial instruments in net investment hedging relationships in the

consolidated statements of operations and the consolidated statements of equity:

Derivatives and Non-Derivative Hedging Instruments in Net

Investment Hedging Relationships(1), (2)

Amount of Gains (Losses)

Deferred in Accumulated

Other Comprehensive

Income (Loss)

(Effective Portion)

Amount and Location of

Gains (Losses)

Reclassified From

Accumulated Other

Comprehensive

Income (Loss) into Income

(Loss) (Effective Portion)

Net Investment Gains

(Losses)

Years Ended December 31, Years Ended

December 31,

2011 2010 2009 2011 2010 2009

(In millions)

Foreign currency forwards ...................................................... $62 $(167) $(244) $— $— $ (59)

Foreign currency swaps ........................................................ — — (18) — — (63)

Non-derivative hedging instruments ............................................... 6 (16) (37) — — (11)

Total ..................................................................... $68 $(183) $(299) $— $— $(133)

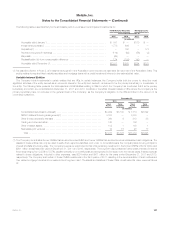

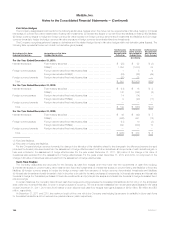

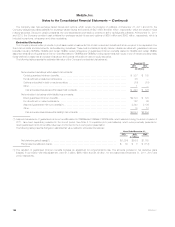

(1) During the year ended December 31, 2011, the Company sold its interest in MSI MetLife, which was a hedged item in a net investment hedging

relationship. As a result, the Company released losses of $71 million from accumulated other comprehensive income (loss) upon the sale. This

release did not impact net income for the year ended December 31, 2011 as such losses were considered in the overall impairment evaluation of

the investment prior to sale. During the year ended December 31, 2010, there were no sales or substantial liquidations of net investments in foreign

operations that would have required the reclassification of gains or losses from accumulated other comprehensive income (loss) into earnings.

During the year ended December 31, 2009, the Company substantially liquidated, through assumption reinsurance, the portion of its Canadian

operations that was being hedged in a net investment hedging relationship. As a result, the Company reclassified losses of $133 million from

accumulated other comprehensive income (loss) into earnings. See Note 2.

(2) There was no ineffectiveness recognized for the Company’s hedges of net investments in foreign operations. All components of each derivative and

non-derivative hedging instrument’s gain or loss were included in the assessment of hedge effectiveness.

At December 31, 2011 and 2010, the cumulative foreign currency translation gain (loss) recorded in accumulated other comprehensive income

(loss) related to hedges of net investments in foreign operations was ($84) million and ($223) million, respectively.

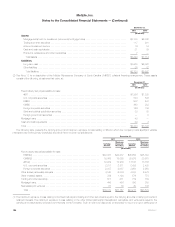

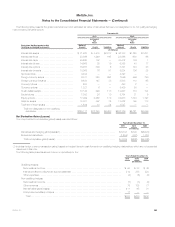

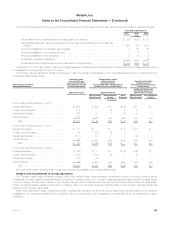

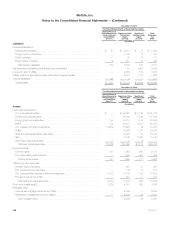

Non-Qualifying Derivatives and Derivatives for Purposes Other Than Hedging

The Company enters into the following derivatives that do not qualify for hedge accounting or for purposes other than hedging: (i) interest rate

swaps, implied volatility swaps, caps and floors and interest rate futures to economically hedge its exposure to interest rates; (ii) foreign currency

forwards, swaps, option contracts and future contracts to economically hedge its exposure to adverse movements in exchange rates; (iii) credit default

swaps to economically hedge exposure to adverse movements in credit; (iv) equity futures, equity index options, interest rate futures, TRRs and equity

variance swaps to economically hedge liabilities embedded in certain variable annuity products; (v) swap spreadlocks to economically hedge invested

assets against the risk of changes in credit spreads; (vi) interest rate forwards to buy and sell securities to economically hedge its exposure to interest

rates; (vii) credit default swaps, TRRs and structured interest rate swaps to synthetically create investments; (viii) basis swaps to better match the cash

flows of assets and related liabilities; (ix) credit default swaps held in relation to trading portfolios; (x) swaptions to hedge interest rate risk; (xi) inflation

swaps to reduce risk generated from inflation-indexed liabilities; (xii) covered call options for income generation; (xiii) interest rate lock commitments;

(xiv) synthetic GICs; and (xv) equity options to economically hedge certain invested assets against adverse changes in equity indices.

146 MetLife, Inc.