MetLife 2011 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2011 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

(2) On March 8, 2011, MetLife, Inc. repurchased and canceled all of the convertible preferred stock.

(3) The Equity Units include the Debt Securities and the Purchase Contracts that will settle in MetLife, Inc.’s common stock on specified future dates.

See Note 14.

(4) Relates to the cash settlement of intercompany balances prior to the Acquisition for amounts in excess of certain agreed-upon thresholds and

certain other adjustments.

(5) Effective settlement of debt securities issued by MetLife, Inc. that were owned by ALICO on the Acquisition Date and which reduced the total

purchase consideration. Such debt securities were sold to a third party in the second quarter of 2011.

(6) Estimated fair value of potential payments related to the adequacy of reserves for guarantees on the fair value of a fund of assets backing certain

United Kingdom (“U.K.”) unit-linked contracts.

At the Acquisition Date, management expected the aggregate amount of MetLife, Inc.’s common stock to be issued to AM Holdings to be between

214.6 million to 231.5 million shares, consisting of 78.2 million shares issued at closing, 68.6 million shares to be issued upon conversion of the

convertible preferred stock and between 67.8 million and 84.7 million shares of common stock, in total, issuable upon settlement of the Purchase

Contracts forming part of the Equity Units. On March 8, 2011, MetLife, Inc. issued 68.6 million shares of common stock and used the gross proceeds

to repurchase and cancel the convertible preferred stock. On the same date, AM Holdings sold, in a public offering, all the Equity Units it received as

consideration from MetLife in connection with the Acquisition. See Notes 14 and 18.

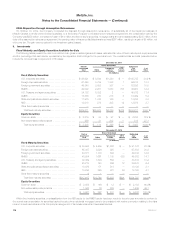

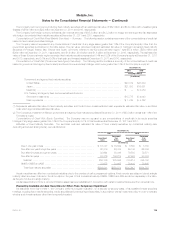

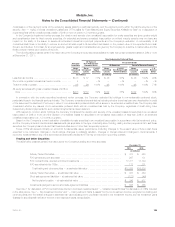

Recording of Assets Acquired and Liabilities Assumed

The following table summarizes the amounts recognized at fair value for each major class of assets acquired and liabilities assumed and the resulting

goodwill as of the Acquisition Date, inclusive of adjustments made in the first year after the Acquisition Date to the amounts initially recorded

(“measurement period adjustments”).

November 1, 2010

(In millions)

Assets acquired:

Total investments .......................................................................... $101,036

Cash and cash equivalents ................................................................... 4,175

Accrued investment income .................................................................. 948

Premiums, reinsurance and other receivables .................................................... 1,971

VOBA ................................................................................... 9,210

Other assets .............................................................................. 1,146

Separate account assets .................................................................... 244

Total assets ............................................................................. $118,730

Liabilities assumed:

Future policy benefits ....................................................................... $ 31,811

Policyholder account balances ................................................................ 66,652

Other policy-related balances ................................................................. 7,306

Current and deferred income tax liability ......................................................... 375

Other liabilities ............................................................................. 2,918

Separate account liabilities ................................................................... 244

Total liabilities ........................................................................... $109,306

Redeemable noncontrolling interests in partially owned consolidated subsidiaries assumed $ 109

Noncontrolling interests ...................................................................... (21)

Goodwill ................................................................................. 6,998

Net assets acquired ........................................................................ $ 16,292

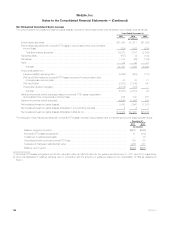

The measurement period adjustments, which related to the finalization of American Life’s current and deferred income tax liability, did not have an

impact on the Company’s earnings or cash flows and, therefore, the financial statements were not retrospectively adjusted. See Note 15.

Goodwill

Goodwill is calculated as the excess of the consideration transferred over the net assets recognized and represents the future economic benefits

arising from other assets acquired and liabilities assumed that could not be individually identified. The goodwill recorded as part of the Acquisition

includes the expected synergies and other benefits that management believes will result from combining the operations of ALICO with the operations of

MetLife, including further diversification in geographic mix and product offerings and an increase in distribution strength.

As of the Acquisition Date, of the $7.0 billion of goodwill, approximately $4.0 billion was estimated to be deductible for tax purposes. Of the

$4.0 billion, approximately $573 million was estimated to be deductible for U.S. tax purposes prior to the completion of the anticipated restructuring of

American Life’s foreign branches. See “—Branch Restructuring.”

Identified Intangibles

VOBA reflects the estimated fair value of in-force contracts acquired and represents the portion of the purchase price that is allocated to the value of

future profits embedded in acquired insurance annuity and investment-type contracts in-force at the Acquisition Date.

MetLife, Inc. 115