MetLife 2011 Annual Report Download - page 182

Download and view the complete annual report

Please find page 182 of the 2011 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

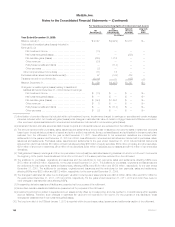

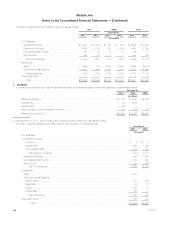

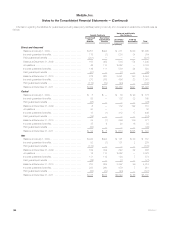

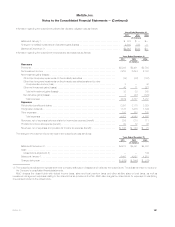

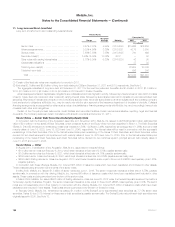

Value of Distribution Agreements and Customer Relationships Acquired

Information regarding VODA and VOCRA, which are reported in other assets, was as follows:

Amount

(In millions)

Balance at January 1, 2009 ........................................................................ $ 822

Acquisitions .................................................................................... —

Amortization .................................................................................... (34)

Effect of foreign currency translation and other .......................................................... 4

Balance at December 31, 2009 ..................................................................... 792

Acquisitions .................................................................................... 356

Amortization .................................................................................... (42)

Effect of foreign currency translation and other .......................................................... (12)

Balance at December 31, 2010 ..................................................................... 1,094

Acquisitions .................................................................................... 213

Amortization .................................................................................... (60)

Effect of foreign currency translation and other .......................................................... 17

Balance at December 31, 2011 ..................................................................... $1,264

The estimated future amortization expense allocated to other expenses for the next five years for VODA and VOCRA is $82 million in 2012,

$89 million in 2013, $94 million in 2014, $92 million in 2015 and $84 million in 2016. See Note 2 for a description of acquisitions and dispositions.

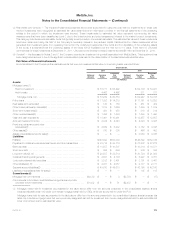

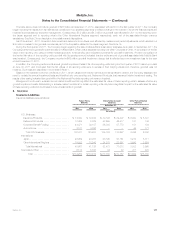

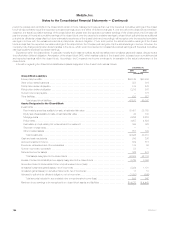

Negative Value of Business Acquired

Information regarding negative VOBA, which is recorded in other policy-related balances, was as follows:

Amount

(In millions)

Balance at January 1, 2010 ........................................................................ $ —

Acquisitions ..................................................................................... 4,422

Amortization ..................................................................................... (64)

Effect of foreign currency translation .................................................................. (71)

Balance at December 31, 2010 ..................................................................... 4,287

Acquisitions ..................................................................................... 7

Amortization ..................................................................................... (697)

Effect of foreign currency translation .................................................................. 60

Balance at December 31, 2011 ..................................................................... $3,657

The weighted average amortization period for negative VOBA was 6.0 years. The estimated future amortization of credit to expenses recorded in

other expenses for the next five years for negative VOBA is $627 million in 2012, $563 million in 2013, $477 million in 2014, $388 million in 2015 and

$298 million in 2016.

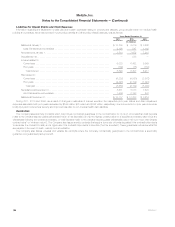

Sales Inducements

Information regarding deferred sales inducements, which are reported in other assets, was as follows:

Amount

(In millions)

Balance at January 1, 2009 ........................................................................ $711

Capitalization .................................................................................... 193

Amortization ..................................................................................... (63)

Balance at December 31, 2009 ..................................................................... 841

Capitalization .................................................................................... 157

Amortization ..................................................................................... (80)

Balance at December 31, 2010 ..................................................................... 918

Capitalization .................................................................................... 140

Amortization ..................................................................................... (132)

Balance at December 31, 2011 ..................................................................... $926

178 MetLife, Inc.